The FTSE Finish Line - Thursday, March 27

Image Source: Pexels

British shares retreated on Thursday, with luxury carmaker Aston Martin plunging to a record low, following U.S. President Donald Trump's announcement of new tariffs on all imported vehicles and auto components. On Wednesday evening, Trump disclosed plans to impose a 25% tariff on imported cars and light trucks starting next week, intensifying concerns over the global trade tensions he reignited earlier this year after returning to the White House. UK Finance Minister Rachel Reeves stated that Britain is actively negotiating with Washington to secure an exemption for the country—America's second-largest supplier of British-made cars—from the proposed tariffs. She also hinted at the possibility of reassessing subsidies currently benefiting Elon Musk's Tesla in a bid to bolster domestic manufacturers. Meanwhile, industry data revealed a decline in UK vehicle production, including electric and hybrid models, in February, underscoring the persistent challenges facing the automotive sector amid mounting global economic uncertainties.

Single Stock Stories & Broker Updates:

- Aston Martin shares fell 8.9% to a record low, making it the biggest loser on the FTSE 250 index. This drop follows U.S. President Trump's announcement of a 25% tariff on imported vehicles, increasing trade tensions, with the U.S. being the second-largest importer of British cars. Currently, the stock is down 5.7%, marking a YTD loss of approximately 35%.

- Shares of British retailer Next rose 7.9%, the top gainers in the FTSE 100 index, after raising its pretax profit outlook by 5.4% to £1.066 billion. Next's annual profit surpassed £1 billion for the first time with a rise of 10.1%. The company reported that full-price sales in the first eight weeks of 2025/26 exceeded expectations and upgraded its outlook for annual full-price sales growth to 5.0% from 3.5%. Peer Marks & Spencer is up 3.9%, while Tesco rises 0.6%. NXT has gained about 5% so far this year.

- Sage shares drop 3.2% to 1171.5p as new CFO Jacqui Cartin is announced, effective January 1, 2026. Current CFO Jonathan Howell plans to step down for non-executive work. The stock has declined ~4.94% this year.

- Shares of Compass rose 1.8%, among top gainers on FTSE100. The CFO expressed confidence in achieving 4%-5% net new wins for FY and noted no consumer softness in key sectors. There are no significant risks from the U.S. DOGE program or federal funding cuts. Jefferies analysts found the CFO's reassurances positive amid recent share pullback. The stock is down 6.3% year-to-date as of Wednesday's close.

- Capricorn Energy shares fell 5.05% to 244p, among the top losers on the FTSE small-cap index. The company expects 2025 production to be between 17,000-21,000 boepd, down from 20,000-24,000 in 2024. Jefferies expects FY production to be down 23% y-o-y due to lower drilling activity before Egypt's concession terms are approved. The company is also exploring M&A opportunities in the UK North Sea and MENA region.

Technical & Trade View

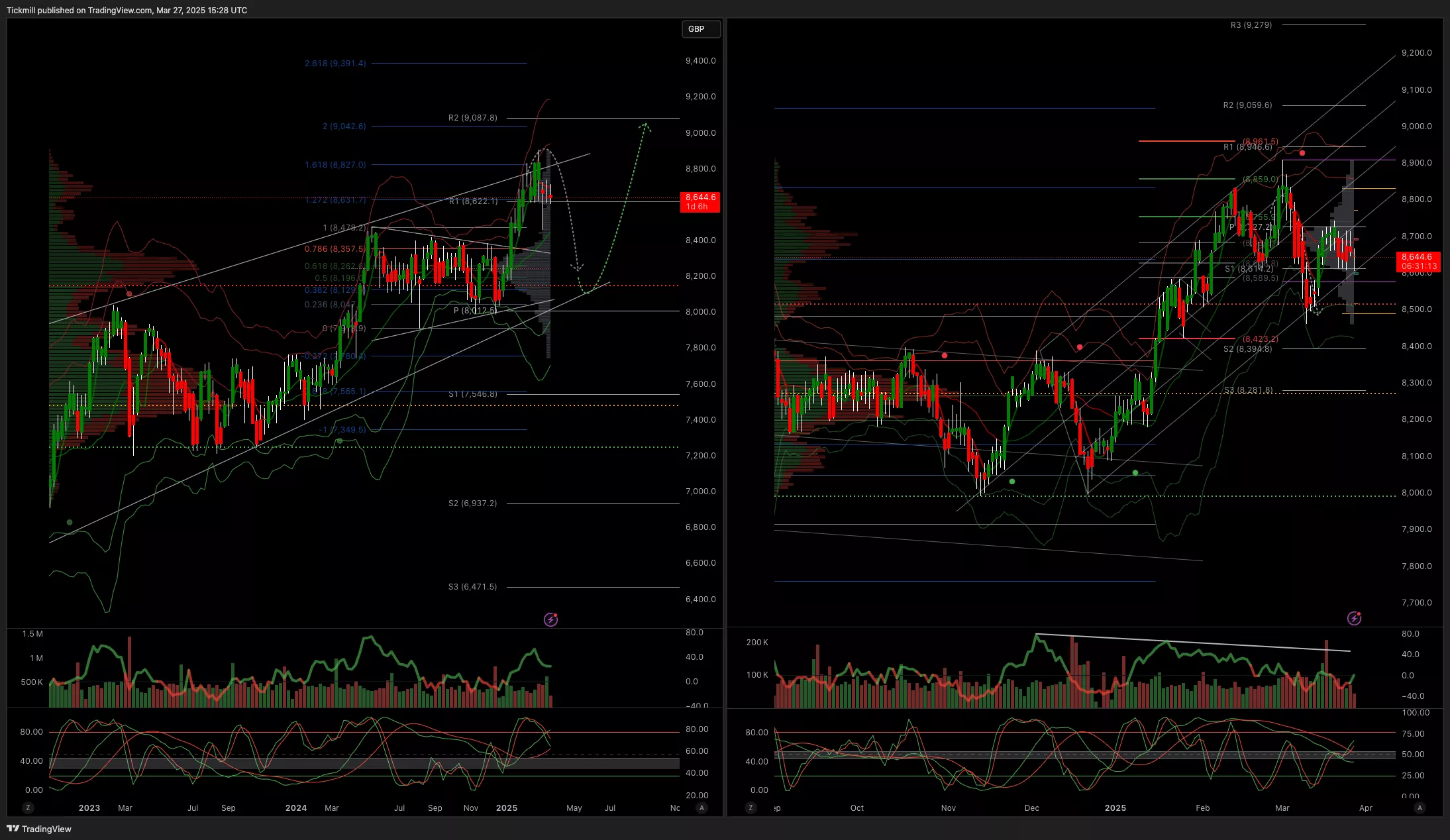

FTSE Bias: Bullish Above Bearish below 8950

- Primary support 8700

- Below 8700 opens 8600

- Primary objective 9050

- Daily VWAP Bearish

- Weekly VWAP Bearish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Thursday, March 27The FTSE Finish Line - Wednesday, March 26

Daily Market Outlook - Wednesday, March 26