The China Outlook From The WEO

July WEO update:

In China, further lockdowns and the deepening real estate crisis have led growth to be revised down by 1.1 percentage points, with major global spillovers.

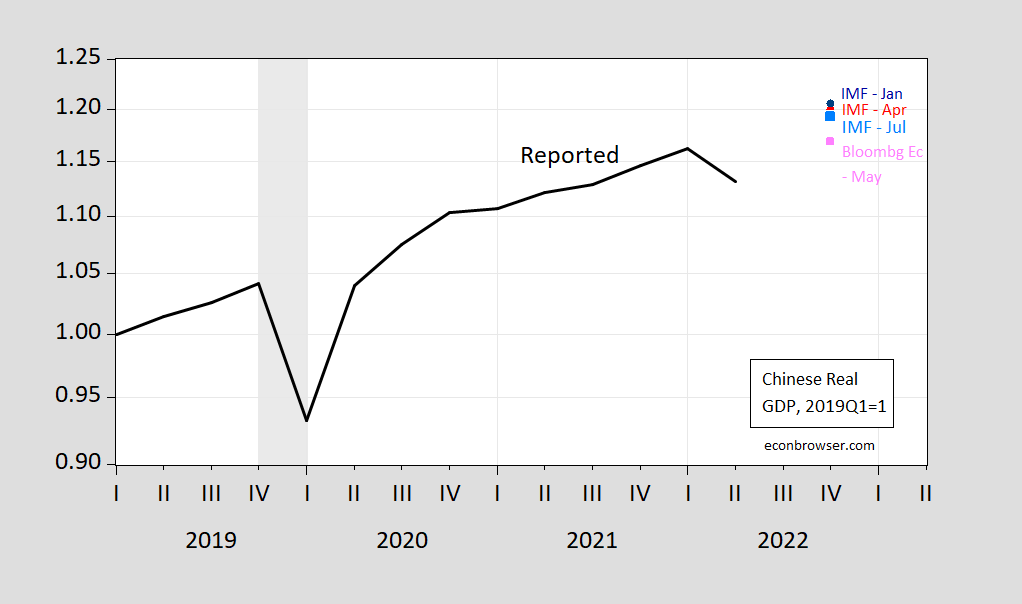

This shows up in the following graph as the most recent in markdowns in forecasted growth rates and implied levels of GDP:

Figure 1: China real GDP, 2019=1 (black), and forecasts from IMF World Economic Outlook, January (blue circle) April (red triangle), July (sky blue square), and Bloomberg Economics (pink square). GDP calculated by cumulating q/q reported growth rates. ECRI defined peak-to-trough recession dates shaded gray. Source: NBS, IMF WEO (various issues), Bloomberg Economics, ECRI, and author’s calculations.

The latest WEO forecast implies the same end-2022 level as in the Deutsche Bank and Goldman Sachs May forecast (see this post).

Further details:

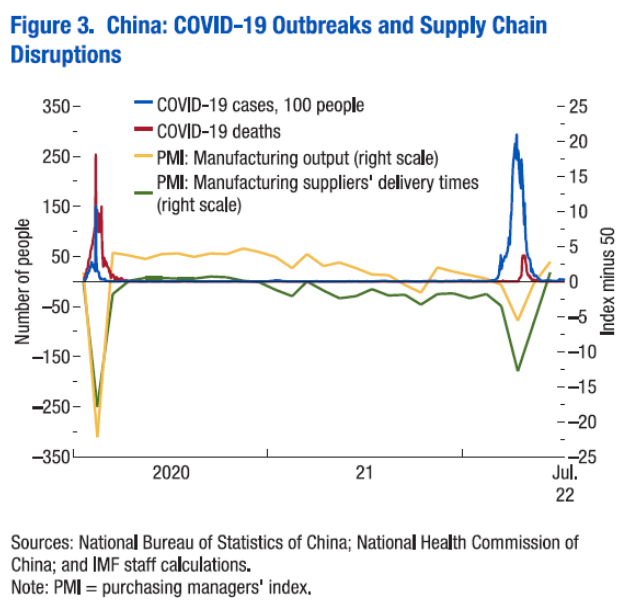

COVID-19 outbreaks and mobility restrictions as part of the authorities’ zero-COVID strategy have disrupted economic activity widely and severely (Figure 3). Shanghai, a major global supply chain hub, entered a strict lockdown in April 2022, forcing citywide economic activity to halt for about eight weeks. In the second quarter, real GDP contracted significantly by 2.6 percent on a sequential basis, driven by lower consumption—the sharpest decline since the first quarter of 2020, at the onset of the pandemic, when it declined by 10.3 percent. Since then, more contagious variants have driven a worrisome surge in COVID-19 cases. The worsening crisis in China’s property sector is also dragging down sales and real estate investment. The slowdown in China has global consequences: lockdowns added to global supply chain disruptions and the decline in domestic spending are reducing demand for goods and services from China’s trade partners.

Figure 3 shows the impact on manufacturing activity of the pandemic and the government’s response.

More By This Author:

IMF Downgrades Growth OutlookNowcast Errors – Atlanta vs. St. Louis

Does A Downturn In Household Survey Employment Presage A Recession?

Disclosure: None.