Negative Mortgage Rates In Europe Are The Ultimate Liquidity Trap

As the bogeyman of inflation dominates the North American bond markets, Europeans are contending with financial markets that are firmly expecting more deflation. In a world gone upside, the European mortgage borrowers are not charged any interest or, in many instances, are actually paid small monthly amounts to take and retain mortgages. To North Americans, this seems like something out of an Alice in Wonderland, but in the Eurozone “free “money is very common place. Denmark’s largest mortgage lender reports that nearly half of its outstanding loans offer negative rates ( there can be some administrative charges). ( Danish Mortgages). How did the European mortgage market trip over and land on its head?

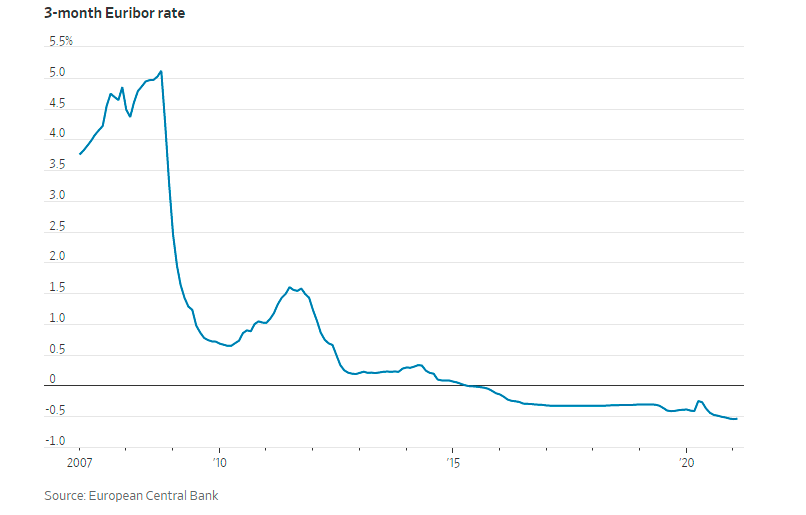

The key to understanding interest rates is to consider the rates banks charge each other for very short-term lending. Individual banks periodically need additional cash overnight to maintain their reserve requirements, while other banks possess excess cash reserves which can be made available for short-term lending. In Eurozone, the “Euribor” rate, short for the Euro Interbank Offered Rate, is determined by a group of banks who borrow funds from one another. More importantly, the Euribor rate provides the basis for interest rates on a host of financial products, especially savings accounts and mortgages. As the accompanying chart dramatically points out, the Euribor rate plunged right after the 2008 crisis and then dipped lower in 2016 and now seems to rest comfortably at just about minus 0.05%. Mortgages are frequently adjusted to the movements in Euribor and have steadily dropped as that rate continues to fall.

(Click on image to enlarge)

The drive to push interest rates in Europe ever lower started as early as 2012 when the European Central Bank (ECB) introduced negative rates for commercial banks wishing to deposit excess reserves with the central bank. This discourages banks from depositing reserves with the ECB in the expectation that banks would make more loans available to businesses and consumers. Interest rates in Europe never recovered from the ECB’s rate cuts and remain negative. Now, the impact of negative rates is well-embedded in the European banking system as banks have started to charge customers who wish to place deposits. No longer able to absorb negative rates, banks are turning away depositors, unless they are willing to pay the bank to accept their money----another case of Alice in Wonderland?

But the real issue is simple, but deeply concerning. European banks have no good loan opportunities and hence have no need of more deposits. Europe continues to suffer greatly from the pandemic. Banks have made it more difficult for business to borrow, as concern over debt repayment remains very high while the economy continues to limp along. France and Italy continue various degrees of restrictive lockdowns, threatening the summer opening for the tourist season. With tourism accounting for as much 15% of national income, another summer lost would likely result in permanent damage to the industry and the economy at large. Already, forecasts anticipate further economic contraction into the third quarter of 2021.

Certainly this article is interesting, informative, and rather disturbing.

It is difficult to imagine interest-free borrowing, even among friends. It sounds more like the Kingdom of Utopia, or perhaps the land of OZ, as discovered by Timothy O'Leary years ago. At one point banks were known to invest in bonds and real-estate. so it is difficult to imagine that there is nothing profitable that banks can do with those excess funds. So it does seem to be quite insane!

One fact is certain, though, and that is that there is no such thing a free money, nor really free anything. There is always a cost, although certainly it is sometimes very well hidden.

In the US the hidden cost is the irresponsible accumulation of debt, which will need to be repaid by somebody in the future. And the result of a bunch of that borrowing is the creation of very large, rather expensive, houses, at least in my area. that is, in turn, altering the very nature of the community, and not for the better.

But the worst part is that it keeps blowing the bubble up bigger and bigger. Bubbles are not forever, they always burst. When the current bubble bursts, certainly there will be pain, probably a whole lot of pain, for quite a while. And certainly there will be scars that stay for a very long time. Those scars will be ugly and disfiguring.

How can a bubble be deflated without bursting???

The Fed thinks it can let the air out of the bubble very slowly. It believes it can just change its QE program to let the air out. It remains to be seen that that is true

Great article Norman.

You are of course right that it is a liquidity trap, except based on negative central bank rates.

Shows how difficult it is for the ECB to stimulate the economy with its monetary policy. As Keynes argued many years ago (i.e. the 1930s), you need to use an aggressive fiscal policy in a liquidity trap. The Biden Administration seems to understand this better than the Europeans.

Europe continues to be very tight fisted when it comes to government spending. There appears to be no change in that direction at all.

Given that every cent of government income is from taxes on those who are not the government, it does make some sense to at least be wise in spending money. Of course, printing lots more, and diluting the value of everybody's assets is another option for some. And I have heard the explanations that Mister Keynes had a different, hidden, agenda at the time.

And certainly the irresponsible creation of huge amounts of debt based on theories that do not seem to perform as desired is quite probably not a best choice for aggressive action.