Key Events In Developed Markets And EMEA For The Week Of June 26

Image Source: Pixabay

Expect hawkish messaging from the Fed to continue over the coming week as the case for another 25p hike in July continues to gather momentum. While we remain hopeful on the inflation front for Canada, key data releases are still unlikely to deter the BoC from a similar move next month. In Poland, keep an eye out for a decline in June's CPI inflation figures.

US: The Fed likely to hike 25bp in July

Hawkish messaging from the Fed continued last week, and we'll likely see more of the same over the coming week with several officials scheduled to speak. The no-change interest rate decision has been characterized as a slowdown in the policy tightening path rather than a “pause” and as such, we would likely need to see weakness in job creation and a sub 0.2% month-on-month increase in inflation to deter the Fed from hiking rates by 25bp in July.

The data calendar includes durable goods orders and housing numbers, which are likely to remain relatively firm. The highlight, however, will be the Fed’s favored measure of inflation, the core personal consumer expenditure deflator. Unfortunately, we don’t expect to see any real slowdown and the pricing for a July hike is likely to build.

Canada: Bank of Canada restarted rate hikes this month

In Canada, we will see inflation and GDP numbers. The Bank of Canada restarted its rate hikes this month having paused since January. We remain hopeful that inflation will moderate to some extent, with core CPI potentially dropping below 4%. However, as with the Fed, this probably won’t be enough to prevent a final 25bp hike in July.

Poland: CPI (June flash): 12.2% YoY

Our initial estimate – which may be slightly fine-tuned in the coming days – points to a decline in CPI inflation to 12.2% year-on-year in June from 13.0% YoY in May. We expect the annual growth of food prices will be similar to that observed in May, with core inflation close to the May reading of 11.5% YoY. A further sharp decline was observed in gasoline prices in year-on-year terms, and energy for housing also posted lower annual growth this month.

We are still on track for single-digit CPI inflation in September, which the National Bank of Poland signals as a precondition for a potential rate cut this year. At the end of 2023, we see consumer inflation slightly above 8% YoY. In August, headline inflation may fall below core inflation, which in our view will be moderating visibly slower than the headline rate.

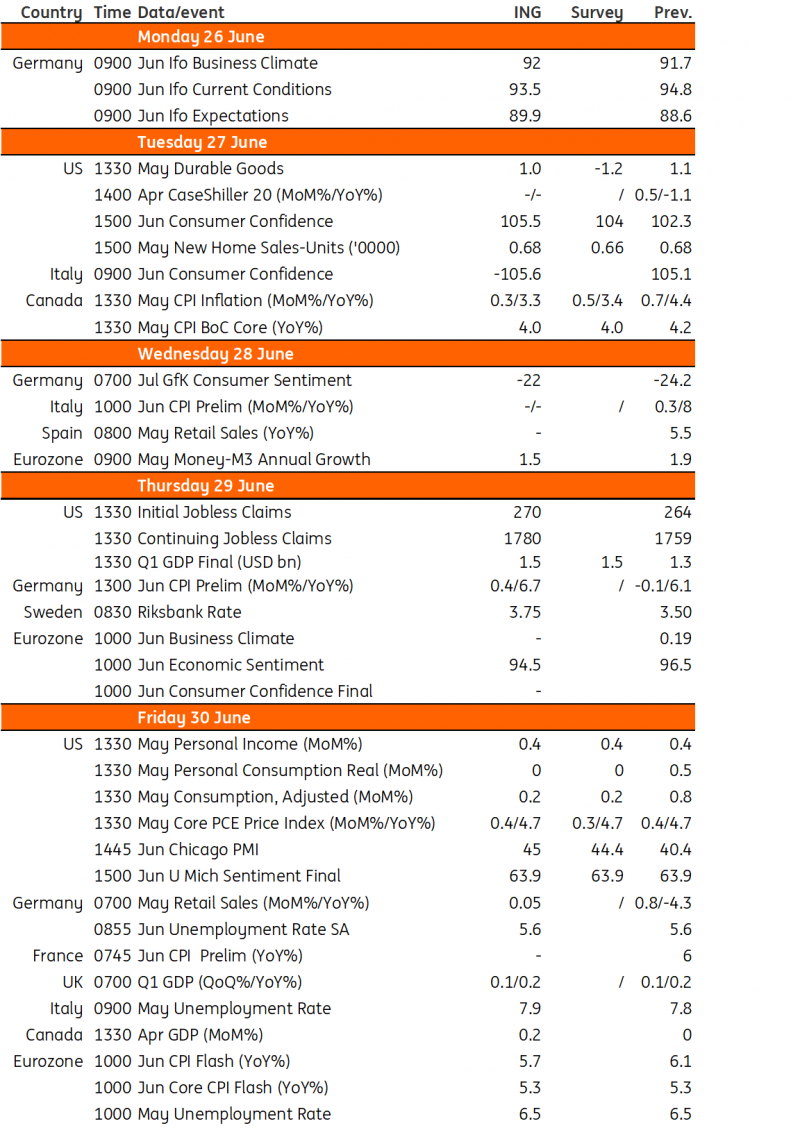

Key events in developed markets next week

Image Source: Refinitiv, ING

Key events in EMEA next week

Image Source: Refinitiv, ING

More By This Author:

Eurozone PMI Drops Again In June, Confirming Weakness In Economy

FX Daily: The Perks Of An Inverted Yield Curve

U.S.: Dearth Of Housing Supply Keeps Prices And Construction Supported

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more