U.S.: Dearth Of Housing Supply Keeps Prices And Construction Supported

US housing demand may have collapsed, but so too has the supply of homes for sale. This means prices are holding up and in some areas continue to rise, despite mortgage rates sitting at a 20-year high. This is good news for home builders as new home sales continue to defy the downturn.

Shutterstock

Transactions are on the floor, but prices are holding

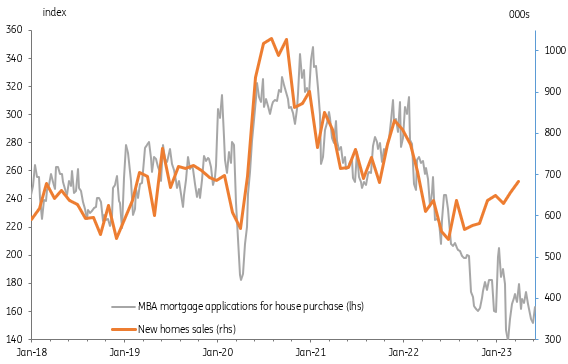

US existing home sales rose to 4.3mn in May from an upwardly revised April reading of 4.29mn. The consensus forecast was 4.25mn, so it's broadly in line with expectations. Nonetheless, sales are still 20.4% lower year-on-year with the median price down 3.1% YoY. The fact that mortgage applications for home purchase are 50% down from the peak would ordinarily imply that prices should be falling much faster, but supply of existing homes for sale is falling nearly as fast – down around 45% from pre-pandemic levels. This is similar to the 39% figure reported by real estate broker Redfin yesterday based on its own in-house data.

Mortgage applications and existing home sales

Macrobond, ING

The combination of weaker demand and weak supply means that transactions are the lowest since the housing bubble burst – yet in some local markets, homes continue to sell for above asking price. This dearth of supply is unlikely to change soon, given the strong jobs market and a high proportion of borrowers who are not exposed to higher borrowing costs as a result of having taken out fixed-rate mortgages at much lower rates than we're seeing today.

New home sales defying the downturn

Macrobond, ING

New sales continue to rise

This lack of supply in existing homes for sale is providing a boost for the new home market, as sales outperform what mortgage applications would typically be consistent with. With prices not collapsing as feared, we are seeing home builder sentiment and housing starts strengthen again. As a result, residential construction should contribute positively to economic growth over the next couple of quarters, after having been a sizeable drag over the past year.

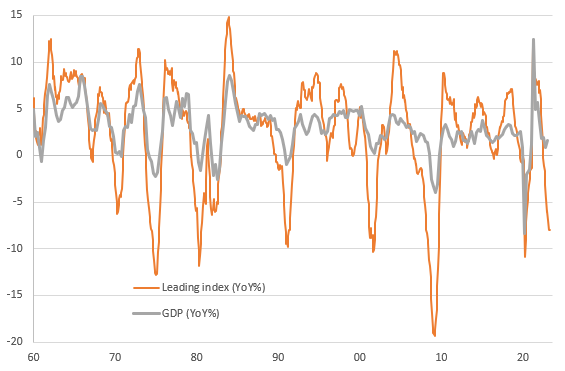

Leading indicators point to recession

Macrobond, ING

Leading index flashes bright recession warning

The other data point of note is the leading index, which fell a further 0.7% month-on-month in a 14th consecutive monthly decline. While this flashes clear recession signals, both the market and the Federal Reserve appear focused purely on jobs and inflation data – and it will therefore be ignored as the Fed looks likely to raise rates at least once more.

More By This Author:

Turkey: Gradual Approach In Policy NormalisationBank Of England Hikes More Aggressively Following Shock Inflation Data

Rates Spark: No Pushback

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more