Japan’s Unemployment Rate Has Plunged Even Though The Economy Is Performing Poorly

According to conventional economic theory, a historically low unemployment rate should be associated with higher inflation, rising household spending, and strong GDP growth. However, this normally expected outcome has not occurred in Japan.

Indeed, most of the macroeconomic data for Japan are quite discouraging, even though in July the unemployment rate slipped down to 3%, down from 3.1% in June.

This represented the lowest jobless rate in 16 years and even suggests that there probably are labor shortages in Japan.

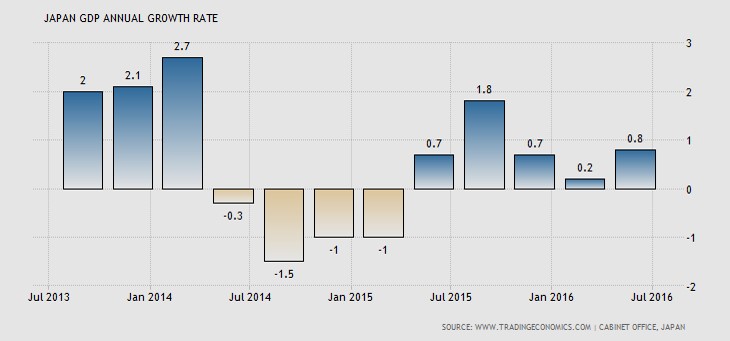

Japan’s real GDP expanded only 0.8% in the first quarter of 2016 over the same quarter of the previous year. At an annual rate, real GDP increased only 0.7% in Q2. As well, Japan has experienced considerable “stop-go” growth since the Great Recession ended in 2009.

The yen’s escalation against the US dollar since the start of 2016 has been hurting Japan’s exports and has been making firms more reluctant to invest. Meanwhile, consumers are also quite wary of spending because wages are barely rising. This is putting pressure on the Bank of Japan to consider even more monetary stimulus at its September meeting.

There is also a strange parallel with the U.S. situation, where the American unemployment rate has been plunging even though the economy has been growing extremely slowly.

Maybe their method of calculation has changed. Just like in the US unemployment rate is sub 5% but the labor participation rate is dropping steadily for years.

independenttrader.org/...n-against-the-crisis.html

LOL, perhaps if we can get to zero or negative population growth we too can lower unemployment after decades and even more massive government debt.