Is The Canadian Economy Vulnerable To Higher Interest Rates

Image Source: Pexels

With each successive increase in the Bank of Canada’s overnight rate, the financial media anticipate dire consequences for the consumer and especially, homeowners. The pessimists now lump all household debt into one pool and ring the alarm bell that we are headed to a major, if not “historic correction underway” not seen in 40 years (RBC). Today, the CIBC released its sobering analysis of the impact of rate hikes on the consumer. The results are far from what the headlines are saying about the consumers in general and homeowners in particular (CIBC). No, the sky is not about to fall.

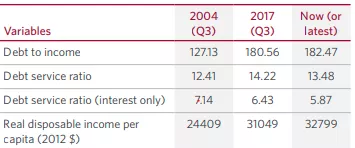

To begin, the CIBC report compares today's debt level and servicing costs with those that existed in 2004 and in 2017, years in which the Bank of Canada raised its rate by 200bps. The debt service-to-income ratio is 13.5 today, slightly lower than the 14.2 in 2017. And, just looking at interest costs alone, today’s interest costs are just 5.9% of disposal income, whereas in prior rate hike cycles, the ratio was 6.4% (2017) and 7.1% (2004). The report argues that “the policy rate will have to be miles above what’s reasonable at this point for this factor to have any notable macro implications”. We know that the world economies are slowing and every central bank runs the risk of overshooting and contributing to an economic slump with each rate hike.

A very important variable that is often overlooked is the national savings rate. Historically, the Canadian savings rate has been in the 2-3% range. Today, the rate stands at 8% of national income, a legacy of the past three years of restraint during the pandemic. The CIBC argues that huge savings will continue to support pent-up demand. From a completely different perspective, however, this unusually high savings rate strongly suggests that Canadians are deeply concerned with economic uncertainty and are more inclined to save than in the past.

Key Variables Affecting Consumers

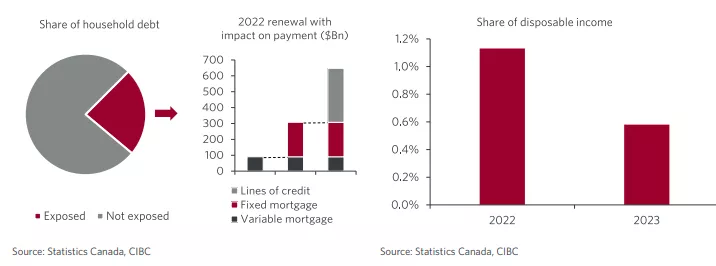

So, how much of the Canadian economy is vulnerable to rate increases? Broadly speaking, only about 25% of all household debt is subject to an immediate renewal at higher rates. The bulk of mortgages are fixed terms; the remaining variable rate mortgages are a long way from any “trigger point”, the mortgage market is no way near a stress level that would necessitate a dramatic drop in home values. Furthermore, the share of disposable income devoted to interest costs will decline next year, further easing credit conditions. This is not an economy that is under stress from interest rate hikes. While some individual groups will pay more to maintain current debt levels, candidly, the CIBC emphasizes that “from a macro perspective, the sting is hardly fatal —".

Interest Costs as a Share of Debt and of Disposable Income

By far, the most important aspect of this report relates to the outlook for mortgage rates. In a previous blog, I argued that it is not a foregone conclusion that mortgages will continue to climb. The yield curve has inverted, signaling that rates are more likely to be cut within a year or less to combat a recession (Mortgage rates). The CIBC report anticipates that “based on our expectation that the overnight rate will rise to 3.25% in September and stay at that level for the duration of 2023, and that the 5-year bond rate will average 2.45% in 2022 and 2.3% in 2023”. The fall in the 5-year rate sets up for a decline in mortgage rates sooner than later. All

More By This Author:

What Are The Canadian Banks Going To Do With All These Deposits?

Comparing The 1970s Stagnation To Today’s Economic Conditions

Mortgage Rates in Canada are Not Destined to Increase

Disclosure: None.