Comparing The 1970s Stagnation To Today’s Economic Conditions

Image Source: Pexels

Those of a certain age vividly recall the stagflation of the 1970s and how an entire decade seemed lost to rising energy prices, wage-price spirals, labour market strife, and general social unrest. Today’s inflation and anticipated economic slowdown is now inviting unenviable comparisons with the 1970s. The perennial question concerns whether ‘is this time is different?’.A recent World Bank Group report (Global Prospects) on the prospects for global growth compares the conditions prevailing in the 1970s to those of today in an effort to answer this question.

Let’s look at the parallels between current conditions and the 1970s. Both periods featured:

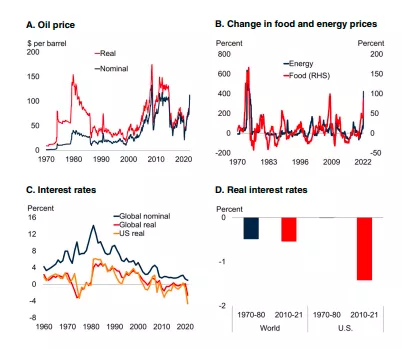

- Supply shocks, especially in energy costs; the Russian invasion of Ukraine has set off a series of energy disruptions that now permeate world oil and natural gas markets;

- A long period featuring very accommodative monetary policy; central banks did not tackle the issue of inflation until it was well entrenched; then as now, negative real interest rates was an outstanding feature of monetary policy, encouraging greater risk-taking;

- Worldwide, both actual and potential growth steadily weakened; productivity growth slowed dramatically, hence contributing to inflationary pressures;

- Emerging markets, then and now, suffer from high debt levels relative to income; these economies are highly vulnerable to a rising USD and worldwide inflation.

Source: World Bank Group, Global Prospects, June 2022

The overriding difference between the 1970s and the 2020s relates to the magnitude of the supply shocks.

- The 1973 oil shock resulted in the price jumping from $3 bbl to $10 bbl in a matter of days; a subsequent oil supply shock took place after the Iranian revolution in 1979 when oil hit $40bbl; throughout the 1970s, economies had a very difficult time implementing efficiencies designed to reduce energy consumption per unit of output;

- Although oil prices have doubled since their lows of early 2021, the negative impact on economic performance has been much smaller than in the 1970s. Technological advances in the use of fossil fuels and the introduction in alternative energy sources have resulted in lower energy consumption per unit of output, hence the oil shock has had a much more muted impact throughout the economy;

- So far, global inflation in 2022 is still less broad-based than it was in the 1970s; and core inflation has remained relatively, especially in Asia;

- There is no evidence of a wage-price spiral taking hold in the advanced economies; the growth in nominal wages continue to fall behind consumer price increases; today, labour unions do not hold the same sway over employers as they did in the 1970s, a period which featured constant labour disruptions throughout the industrialized world;

- Longer-term inflation expectations remained relatively well anchored; investors in long- term bonds consider this current bout of inflation will moderate considerably towards the central banks target of 2% over the next 12 -18 months.

Thus, the 2020s experience with inflation is very different from that of the 1970s both in scope and magnitude. It was much worse then than now. While inflation seems likely to remain high a little longer, there is growing evidence that the world is coping with the supply shocks and that peak inflation rates have been reached. The World Bank Group report concludes on somewhat optimistic tone by pointing out:

As central banks tighten monetary policy and pandemic-related fiscal stimulus is unwound, demand pressures will moderate; as the supply disruptions caused by Russia’s invasion of Ukraine are priced in, commodity prices will stabilize, albeit at high levels; and as global production lines and logistics adjust, supply bottlenecks will ease.

More By This Author:

Mortgage Rates in Canada are Not Destined to Increase

The Federal Reserve is whistling by the graveyard

Does the Fed Read its Own Research Findings?

Disclosure: None.