Central Bankers Are Always On Their Back Foot

Image source: Pixabay

A central banker’s lot is never a happy. So often they are caught wrong footed, yet they remain stubborn to change in time in response to changes in inflation and unemployment. This appears to be one of those cases where the Federal Reserve remains adamant in its belief that there is not sufficient evidence to loosen monetary conditions. They still insist that they have not yet seen the whites of their eyes when it comes to defeating inflation.

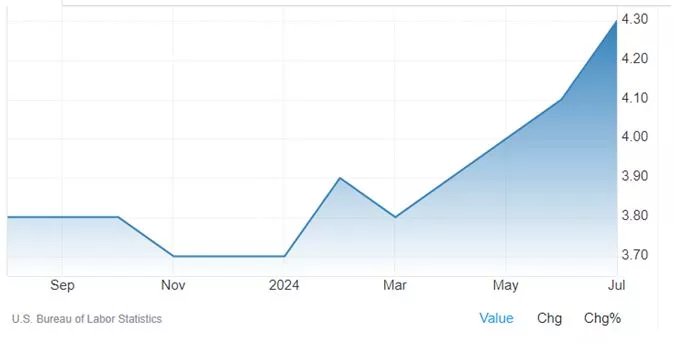

The US job numbers for July no longer support a claim that the economy remains robust and the need for any monetary relief is still not evident. US unemployment has steadily risen from a recent low of 3.7% in November 2023 to 4.3% last month. Economists are debating whether this weakening 3-month moving average rise in the jobless numbers signals the start of a recession. Regardless of the outcome of that debate, the Fed is now looking as if it is behind the curve. Ironically, during the pandemic years when the Fed was criticized for failing to raise rates fast enough to stem the tide of rising consumer prices, it now faces a similar degree of criticism that it holding the reigns too tight in the face of a weakening economy. Today’s data comes on the heels of a decision by the Fed against lowering its benchmark rate which is set at 23-year high of 5.25%-5.5%.

Figure 1 US Unemployment Rate

So, now all eyes are on the Fed’s September meeting, given that Powell has signalled that a rate cut is on the table then. But that just pushes the effectiveness of any rate cut further into the future and introduces the possibility that it will be too late to deal with further labour market weakness. Given that the normal lag time following a rate cut is up to 9 months, a cut in September will not be effective until mid-2025. And future rate cuts go beyond that point. More disconcerting is the likelihood that a rate cut of just 0.25% will be insufficient. The Fed may have to be more aggressive to make up for lost time. Traders share a concern that the Fed needs to act more aggressively and have staked out positions that the central bank will do two half-point cuts before the year’s end.

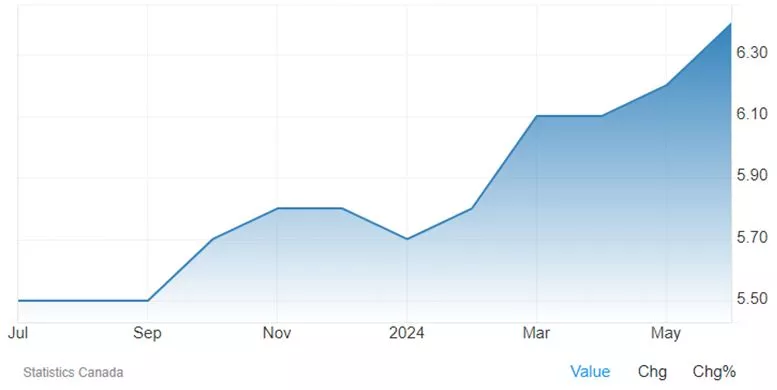

Shifting to the Bank of Canada, we see that it has already responded with a 0.25% rate cut in June and a similar one in July. The Canadian economy has never been robust since the recovery from the pandemic years. The unemployment rate in Canada has risen from 5.5% in July 2023 to 6.4% in June. Moreover, overall economic growth has virtually stagnated, bouncing around the 1.5 % mark, but definitely showing no signs of strength. As in the case of the US, it is not so much the level of unemployment that is of greatest concern, it is the slow, but steady, increase in the unemployment rate that signals trouble ahead. Observers anticipate that, once the Bank has changed course, it is most likely to continue to move the bank rate down. Signs of weakness in the US economy will ensure that the Bank has no choice but to continue to ease. The question is how fast should the easing take place to sustain growth and reverse the unemployment rate.

Figure 2 Canadian Unemployment Rate

More By This Author:

What Underlies The Pessimism Regarding The Outlook In Canada

The Bank Of Canada Is Now Behind The Curve As The Unemployment Rate Rises

The Nexus Between Immigration Flows And Employment Growth In Canada