Buckle Up, The Bond Market Is About To Break A Major Central Bank

The situation in Japan is worsening.

As I’ve outlined before, Japan is the grandfather of monetary policy insanity. The Fed first introduced Zero Interest Rate Policy (ZIRP) and Quantitative Easing (QE) in 2008.

The central bank of Japan, the Bank of Japan, or BoJ introduced them in 1999 and 2001, respectively. And since that time, it’s NEVER been able to normalize monetary policy. Indeed, the longest the BoJ has even managed to tighten monetary conditions in 20+ years is a mere 14 months.

Put simply, Japan has been dealing with extraordinary monetary policy for an entire generation: 25 years. Along the way, the BoJ has launched:

1) Negative interest rate policy (NIRP), through which it charges lenders to lend it money.

2) A single QE program equal to 25% of Japan’s GDP (in 2013).

3) Unlimited QE in the form of yield control, through which it prints money and buys Japanese Government Bonds any time said bonds’ yields begin to rise above a certain level.

We are in the process of watching #3 blow up today.

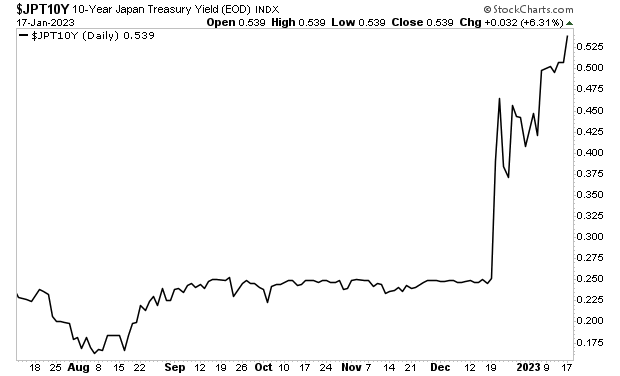

Initially, the BoJ, wanted 10-Year Japanese Government Bond yields to remain at 0%. However, once inflation arrived, the BoJ found itself printing so much money to defend that level, that it was forced to raise its yield target to 0.5%.

And that’s when all hell broke loose. The bond market is repeatedly testing the BoJ’s resolve, with yields rising above 0.5% time and again. To counter this, the BoJ is being forced to launch previously unscheduled QE programs on a near daily basis.

Friday and Monday alone, the BoJ spent $78 BILLION. And bond yields STILL rose above its desired level of 0.5%.

Something is about to break here. The BoJ just announced that it won’t be changing its policy despite the obvious signs that it is losing control of its bond market.

Put another way: we’re about to find out what happens when a bond market breaks a major central bank. Think of the 2023 crisis for Italy and Spain… only with the world’s THIRD largest economy and third most used currency.

As I keep stating, the Great Crisis… the one to which 2008 was a warm-up, has finally arrived. In 2008 entire banks went bust. In 2023, entire countries will do so.

More By This Author:

Why Japan’s Bond Market Could Make Or Break Your 2023 Returns

Is the Worst Over For This Bear Market?

The Everything Bubble Has Burst