Is The Worst Over For This Bear Market?

In 2022, the Everything Bubble burst courtesy of the inflation created by over $8 trillion in Fed and Federal government money printing.

As I outlined in my best-selling book, The Everything Bubble: the Endgame for Central Bank Policy, the Fed created the Everything Bubble when it attempted to corner the U.S. Treasury market in the aftermath of the Great Financial Crisis.

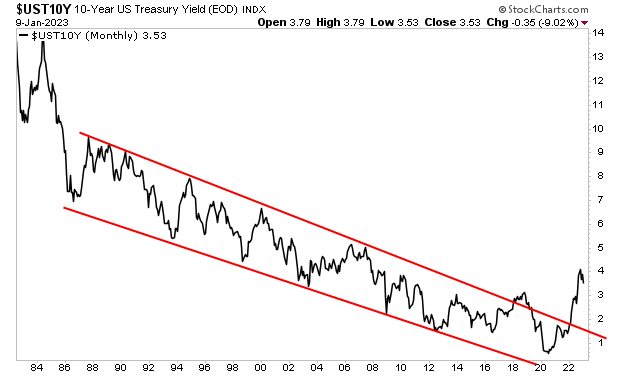

Treasuries are the bedrock of our current financial system, and their yields represent the “risk free” rate of return against which all risk assets (stocks, bonds, real estate, etc.) are priced. So, when the Fed created a bubble in Treasuries via Zero Interest rate Policy (ZIRP) Quantitative Easing (QE), it ended up creating a bubble in EVERYTHING.

So, it’s no small irony that the Fed and its absurd money printing from 2020-2021 was what unleashed inflation, which burst this bubble. You see, Treasury yields don’t just trade based on Fed intervention. They also trade based on economic growth as well as inflation.

So once inflation ignited in 2021, U.S. treasury yields broke out of their 35+ year downtrend.

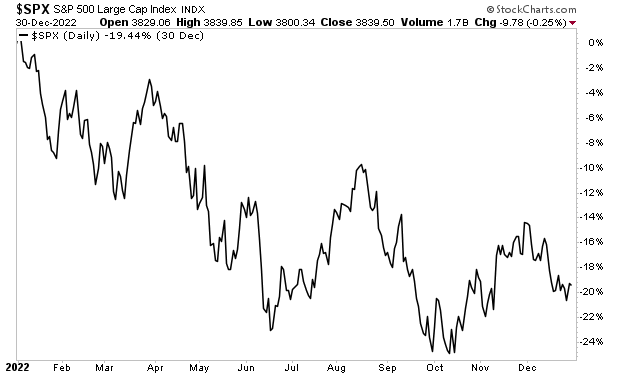

Remember, when I wrote that the yields on these bonds represent the “risk free” rate of return against which all risk assets, including stocks, are valued? Once Treasury yields started rising, stocks were soon repriced much lower to account for this. The S&P 500 ended 2022 DOWN 19%, making it the seventh worst year for stocks since 1920.

Which brings us to today.

The single most common question my clients are asking is if “the worst is over” for this bear market.

To answer that, we need to determine the answers to two other questions:

1) Has the Fed managed to kill inflation?

2) Will the U.S. economy experience a soft landing as opposed to a severe recession?

I’ll delve into those tomorrow.

More By This Author:

The Everything Bubble Has Burst

If Stocks Don’t Hold This Line… They Could Lose Another 44%-55% Easily

The Fed Believes Inflation Will Be 2% In 2023… Good Luck With That!