BoE Preview: 25 Bps Hike And Done?

Image Source: Pexels

We think the BoE will go ahead with a 25-bps hike and then pause to assess the impact of the previous hikes.

The Bank of England’s interest rate decision on Thursday is a coin flip between a 25-basis hike or no change in monetary policy. But knowing that the BoE has the option to use targeted measures to address financial stability risks – like it did during the mini-budget crisis of last year – and can use more traditional measures – i.e., changing the Bank Rate – to continue its fight against inflation, we lean towards a rate hike.

MPC doves will be vocal

The recent turmoil in financial markets means the doves among the BoE’s rate-setters will be more inclined to vote for a no change this time. This group of Monetary Policy Committee (MPC) will also point to the fact that the impact of past hikes is yet to filter through to the economy and that inflation should be on a downward spiral from here anyway. The cost of hiking too much may outweigh any benefits additional tightening might achieve. The likes of Silvana Tenreyro and Swati Dhingra will undoubtedly push for a no-change.

Is the UK better insulated from banking problems?

The more hawkish members of the MPC, meanwhile, will point to the still-very high inflation rate in the UK. This camp will want to avoid a premature pause in the hiking cycle so as to ensure inflation has a good chance to return to target quicker.

The hawks will also argue that price action in Gilts has been comparably more stable than US Treasuries and German Bunds, and a lot less volatile than during the mini-budget debacle last year. This is because the market perceives the UK to be better insulated from banking problems seen in Europe and the US.

This, therefore, implies that the split among the BoE’s monetary policy committee members may widen further. However, the BoE had already set a much lower bar for pausing its rate hikes, compared to the likes of the ECB and Fed. So, if it decides against a rate hike because of financial stability concerns, this will not come as a major shock to the market – for as long as it leaves the door open to a hike in one of the upcoming policy meetings if inflation does not come down sharply enough.

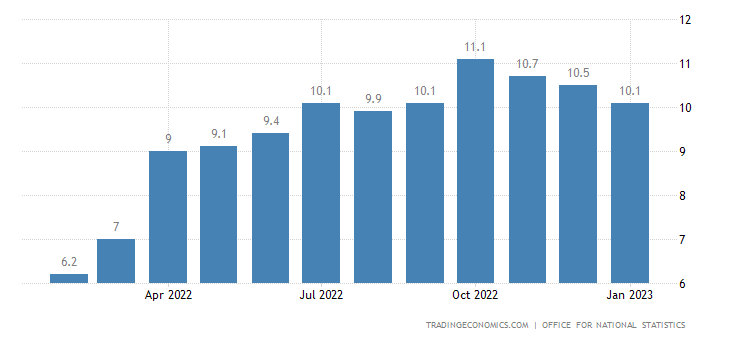

Inflation is still far too high

Speaking of inflation, the latest CPI data from the UK will be published on Wednesday, the same day as the Fed’s meeting. These two events will have at least some implication in the BoE’s decision to hike or to hold.

There have been signs inflation has peaked but the BoE will want to see more evidence that it is heading toward its 2% target in the not-too-distant future. Wage growth, for one, has started to weaken – albeit it is far too early to say it will continue trending lower and pull price inflation lower with it. We have also seen inflation in the services sector drop a little thanks to the easing of supply chain issues, lower energy prices, and, obviously, lower consumer demand amid the cost-of-living crisis.

In as far as the February CPI is concerned, well analysts expect a modest drop in the headline annual rate from the 10.1% recorded in January, to 9.9%. Core CPI is seen falling to 5.7% from 5.8%.

What do we think the BoE will decide?

All told I do think that the BoE will go ahead with a 25-bps hike at this meeting and then pause to assess the impact of the previous hikes. As we saw around the time of the mini-budget crisis last year, the BoE separated its inflation fight from the financial stability risks, by temporarily purchasing bonds while simultaneously hiking interest rates. With the BoE joining several other central banks in announcing a coordinated action to enhance the provision of liquidity this weekend, there is no need to announce any bond buying again. So, it can go ahead with a rate hike to try and tame inflationary pressures.

How will the pound react to the BoE’s decision?

A 25-basis point rate hike will in itself be considered a hawkish surprise now because market pricing is leaning more in favor of a hold amid the recent turmoil in the banking sector. So, if the BoE decides to go for a hike, this should provide the GBP/USD a bit of a helping hand. However, if the BoE also makes it clear that it will pause its hiking then this should keep the upside limited.

The bigger risk event for the cable is the FOMC rate decision taking place a day earlier, on Wednesday. So, it may be best to concentrate on a GBP cross instead.

Assuming that the GBP/USD will maintain its bullish trend post the FOMC meeting, then an eventual rally towards 1.25 should not be ruled out.

After all, the cable bulls have been putting in a decent effort to lift rates above 1.2250 considering all the financial stability concerns. By bidding the cable up so much, they must have taken into account at least partially the implications of the Fed and BoE rate decisions. After all, the market should, in theory, price the impact of future events.

From a base of around 1.18, the cable has now risen by more than 450 pips in the space of just under two weeks. So, ahead of this week’s key events, the path of least resistance remains to the upside, and we think 1.2500 may not be too out of reach – especially given the technical breakout from the falling wedge pattern.

(Click on image to enlarge)

More By This Author:

Currency Pair Of The Week: GBP/USDCrude Plummets Will OPEC Come To Rescue

Gold Analysis

Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such ...

more