Currency Pair Of The Week: GBP/USD

Image Source: Unsplash

Welcome to another edition of the Currency Pair of the Week. With the Fed and BoE rate decisions to come, along with some key economic data from both the UK and the US, the GBP/USD has to be the currency pair of the week.

- Will the Fed hike interest rates at all?

- Attention will also be on UK CPI and BoE meeting

- GBP/USD could be heading to 1.2500

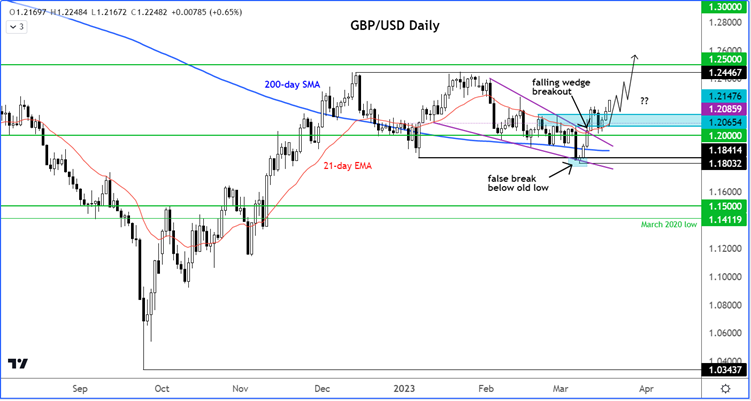

Before we discuss the macro events in greater detail, let’s have a quick look at the chart of the GBP/USD first.

Can GBP/USD head to 1.25?

The cable bulls have been putting in a decent effort to lift rates above 1.2250 considering all the financial stability concerns. The events of the past week or so would have supported the US dollar on haven flows had it not been for collapsing interest rate expectations. From a base of around 1.18, the cable has now risen by more than 450 pips in the space of just under two weeks. Impressive stuff indeed. So, ahead of this week’s key events, the path of least resistance remains to the upside, and we think 1.2500 may not be too out of reach – especially given the technical breakout breakout from the falling wedge pattern – unless something fundamental changes dramatically.

GBP/USD faces several risk events this week

Whether or not more gains could be on the way will depend on a number of factors this week, including 1) whether US bond yields are going to fall further, 2) the Fed’s rate decision, 3) BoE’s rate decision and tone and 4) economic data. Let’s take a look at these events in turn.

1. Will US bond yields fall further?

Global yields have fallen sharply in recent days, mainly because of heightened uncertainty over the banking system causing investors to reduce central bank rate hike expectations. Though they rebounded on Thursday of last week, the recovery was short-lived despite the rescue efforts by the SNB and other central banks. Indeed, the bond market rally continued at the start of this week, which saw yields fall as a result. The benchmark US 10-year debt saw it yield fall to 3.291%, its weakest point since September, before bouncing back a touch.

Investors have been pricing out expectations over further central bank tightening despite inflation remaining stubbornly high. The ECB last week went ahead with a 50-bps hike it had pre-committed to since its previous meeting, but it balanced that decision by providing no forward guidance, suggesting that they may pause going forward. This was a dovish rate hike, something which the market expects other central banks to replicate. The FOMC, BoE and SNB will be in focus this week. Expectations over tightening have been slashed for all three. So, we may well see global bond yields fall further or remain near current levels. If so, the dollar should remain undermined, which should keep the GBP/USD underpinned.

2. FOMC policy decision

Wednesday March 22

The US Federal Reserve was previously expected to hike interest rates by 50 basis points at the conclusion of Wednesday’s FOMC meeting. But that was before the SVB’s collapse, when the market was also projecting a terminal rate as high as 5.66% around August. That forecast has come down sharply. It now stands at 4.25% for around the same period, meaning to get there would require a rate CUT from the current range of 4.50 – 4.75 percent. Still, the market sees a good chance the Fed will hike by 25bp at this week’s meeting. Indeed, according to a Reuters poll, the majority of the respondents reported that the Fed will raise interest rates by 25 bps, not 50 bps as had been priced in just a week ago. Some 76 of the 82 surveyed economists agreed, while 5 said the Fed will pause. Whether the dollar will find support or come under further pressure will also depend on the update to the dot plots of officials’ rate forecasts and Chairman Powell’s remarks at the press conference. The less hawkish the overall message, the further the dollar is likely to fall. And vice versa.

3. Bank of England rate decision

Thursday March 23

A few weeks ago, the market was certain the BOE would raise rates by a quarter point to 4.25% on March 23. This would have been the continuation of the quickest tightening cycle in about three decades. But the recent banking turmoil has caused investors to cut BOE rate expectations. However, will the BoE follow the footsteps of the ECB and hike anyway? After all, UK inflation is simply too high at above 10%. If so, this should keep the pound supported. However, it is not as simple as that. There is a good chance the BoE may also announce a pause in hiking to assess the full impact of its tightening, especially given the financial rumblings in the US and Europe – although UK banks have not been impacted yet. That being said, the market has priced in a dovish rate hike. So, the BoE will need to be super dovish to cause a big drop in the pound. Otherwise, the GBP/USD may continue its upward drift towards 1.25 handle.

4. Key data impacting GBP/USD

UK CPI

Wednesday March 22

The BoE policy makers are looking at signs that inflation is proving more persistent than it expected, with UK CPI remaining above 10% and threatening a wage-price spiral. A big miss could influence the BoE’s decision whether to hike or not on Thursday, in light of the recent turmoil concerning banks. However, if we see another print above 10%, this should almost certainly seal the deal for another rate increase.

Economists expect UK inflation to have fallen back below 10% in February – only just. Headline CPI is expected to print 9.9% on a year-over-year basis, while core CPI is seen edging down to 5.7% from 5.8%.

Global flash PMIs & UK retail sales

Friday March 24

The latest PMI figures will give us a snapshot of the state of the global economy, providing us with leading indication of whether the recovery has held or whether things have started to change for the worse. The PMIs may determine how central banks might proceed with future rate decisions.

For GBP/USD traders, the PMIs from the UK and US will be of particular interest. UK manufacturing PMI is expected to have improved to 50.0 from 49.3, while services PMI is seen edging lower to 53.1 from 53.5. For the US, no change is expected in the manufacturing PMI from the last reading of 47.3, while the services PMI is seen falling to 50.3 from 50.6.

We will also have UK retail sales on Friday, which should provide even more volatility for the cable. This is expected to show a 0.2% month-on-month increase in February following a 0.5% rise the month before.

More By This Author:

Crude Plummets Will OPEC Come To Rescue

Gold Analysis

ECB Preview: 50bps Hike May Still Be On The Cards

Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such ...

more