BoC Choses To Raise Rates Despite Acknowledging That Inflation Is Due To Worldwide Supply Constraints

Economists have long argued regarding the sources leading up to an inflationary cycle. The usual suspect is excess liquidity that stokes excess aggregate demand, ultimately requiring that the central banks tame demand with higher interest rates. Today, the suspect list has been expanded and is mostly centered on nearly two years of constant supply shortages due to the pandemic, now worsened by the lockdowns in China. So, when the Bank of Canada announces its most recent rate hike, a full 50bps, it is important to understand what lies behind that decision. According to the Bank ( BoC April 13th),

“Supply disruptions resulting from the war are also exacerbating ongoing supply constraints and weighing on activity. These factors are the primary drivers of a substantial upward revision to the Bank’s outlook for inflation in Canada” (bold italics added).

The statement goes on to cite price spikes in energy and basic commodities generating a worldwide wave of inflation. Furthermore, the Ukrainian invasion adds to disruptions in important supply chains involving oil and gas and basic foodstuffs. Now, one wonders how raising domestic interest rates will do anything to moderate those sources of inflation emanating from overseas. The inelasticity of supply prevents any price reductions related to higher interest rates and as long as the war continues and sanction remain in place the supple chain will continue to be great pressure.

Nonetheless, the Bank then continues its reasoning by claiming there is excess demand in the economy, when it states: “Businesses increasingly report they are having difficulty meeting demand, and are able to pass on higher input costs by increasing prices”

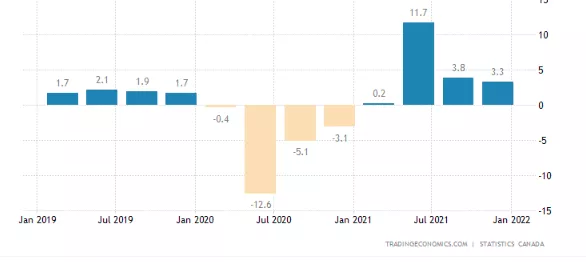

Canada’s GDP growth rates are far from ‘excessive’, especially given the severe drop in output experienced during the lockdowns of 2020-21. It is relatively easy to generate a rate of growth of more than 4%, having experienced a huge decline in output in the previous year. (Figure 1). Indeed, the Bank does anticipate a steady deceleration in economic growth, starting in 2022 (4.25%),fallingin2023 (3.25%), and declining further into 2024 (2.25%). Put differently, the growth anticipated is more in line with a recovery process than with a view that demand needs to be tamed.

Figure 1 Canadian Annual Growth Rates, Quarterly

Disclosure: None.