Tuesday Talk: Market Mash-Up

After a relatively robust week, markets started this one with a stumble. With Q2 financial sector earnings reporting this week, US CPI numbers coming out on Wednesday, and US Dollar - Euro parity being reached or broaching lower today, there is a lot on the plate for investors to digest.

At the close of trading on Monday the S&P 500 had lost 45 points to close at 3,854, the Dow was down 164 points, closing at 31,174 and the Nasdaq Composite lost 263 points to close at 11,373.

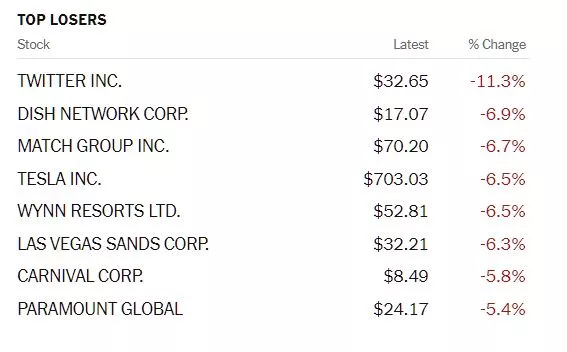

Twitter was the day's biggest loser, followed by Dish Networks, Match Group and Tesla.

Chart: The New York Times

In morning futures action S&P 500 market futures are trading down 19 points, Dow market futures are trading down 181 points and Nasdaq 100 market futures are trading down 42 points.

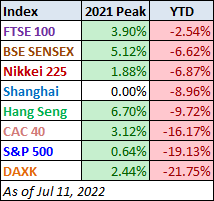

Kicking off 2H22, contributor Jill Mislinski provides readers with a World Markets Update.

"All eight indexes on our world watch list posted losses through July 11, 2022. The top performer is London's FTSE 100 with a YTD loss of 2.54%. India's BSE SENSEX is in second with a loss of 6.62% and Tokyo's Nikkei 225 is in third with a loss of 6.87%. Coming in last is Germany's DAXK with a loss of 21.75% YTD."

To put things in perspective, Mislinski includes several historical charts of various timelines, going back as far as the turn of the century. Here is one of them.

"The chart below illustrates the comparative performance of World Markets since March 9, 2009. The start date is arbitrary: The S&P 500, CAC 40 and BSE SENSEX hit their lows on March 9th, the Nikkei 225 on March 10th, the DAXK on March 6th, the FTSE on March 3rd, the Shanghai Composite on November 4, 2008, and the Hang Seng even earlier on October 27, 2008. However, by aligning on the same day and using a log scale vertical axis, we get an excellent visualization of the relative performance. We've indexed each of the eight to 800 on the March 9th start date. The callout in the upper left corner shows the percent change from the start date to the latest weekly close."

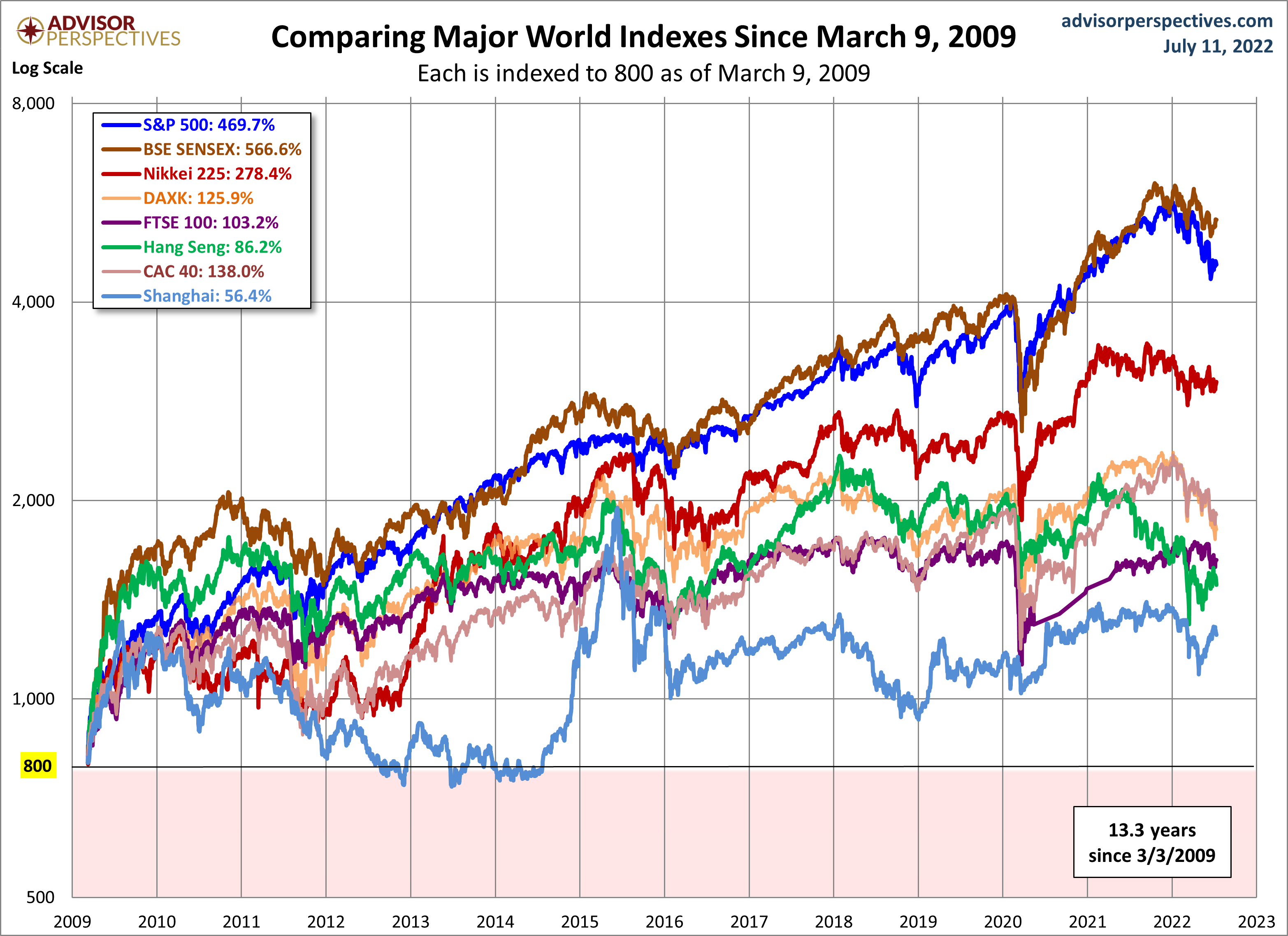

In a TM Editors Choice feature, contributor Sheraz Mian assists investors' digestion by Previewing JPMorgan And The Big Banks To Kick Off Q2 Earnings Season.

"Bank stocks have been big-time laggards in the ongoing market pullback. This is despite the fact that core features of the economy have been stable and rising interest rates are generally expected to benefit banks since they help expand their margins.

It will be interesting to see if the group’s stock market fortunes will change in any meaningful way when they start coming out with June-quarter results this week. We have JPMorgan (JPM) and Citigroup (C) kicking off the Q2 reporting cycle for the group on Thursday (7/14) and Friday (7/15) this week, respectively."

"The chart below shows the year-to-date performance of JPMorgan (blue line; down -27.5%) and Citigroup (green line; -22.3%), relative to the S&P 500 index (orange line; -18.2%), the Zacks Finance sector (red line; -17.1%) and the Zacks Tech sector (purple line; -27.6%)."

The full article provides an in depth look at the banking industry and though the chart ends in the bottom right of the plot area Mian provides the following insights as well:

"If we look at a money-center bank like JPMorgan, we find that commercial banking is doing just fine, with modest improvements in margins and loan volumes offset by weakness in the mortgage business and rising expenses."

"Estimates for JPMorgan have modestly edged up in recent days, which suggests the strong likelihood of a positive surprise from the industry leader. Jamie Dimon’s earlier ‘hurricane’ comment notwithstanding, it is likely that JPMorgan did better than expected in the core commercial banking side of the business."

"As is typically the case, the sentiment shift on banks has likely overshot to the downside, as the economy still remains strong even though recessionary risks have increased from very depressed levels."

The Staff at contributor Bespoke Investment Group observes that Consumers Run From Stocks.

"The New York Fed runs a monthly survey of consumer expectations (SCE) which covers topics ranging from inflation, the labor market, and household finances, and while its history is limited (starts in 2013), it provides a great look at where US consumers see the state of the economy and financial markets...As the equity market has weakened this year amid higher inflation and the Fed’s rate hike cycle, consumer sentiment towards the stock market has been declining, but the pace has really picked up in the last two months taking the total percentage of consumers expecting higher stock prices to its lowest level (33.8%) in the history of the survey. Put another way, just about two-thirds of US consumers expect stock prices to remain flat or decline over the next 12 months."

With investors sour on stocks TM contributor Tom Roseen finds Year To Date, Investors Plow Into ETFs While Being Net Redeemers Of Conventional Funds.

"Fund investors were net purchasers of short-term assets for the Refinitiv Lipper fund-flows week ended July 6, 2022, injecting a net $20.4 billion into money market funds. However, for the same period, fund and ETF investors were net redeemers of equity funds (-$7.9 billion), municipal bond funds (-$313 million), and taxable bond funds (-$111 million)."

"The carnage witnessed on the conventional equity funds side was not replicated by ETFs, which attracted a net $168.0 billion year to date. The primary attractors of investor assets were large-cap ETFs (+$90.9 billion), equity income ETFs (+$45.3 billion), international equity funds (+$32.7 billion), and health/biotechnology ETFs (+$7.4 billion)."

That is interesting, as well as are the other investing and redemption statistics Roseen presents in the full article, some of which are summarized in the graph below:

Following-up on Roseen's article TalkMarkets contributor Sweta Killa notes Tech ETFs At The Forefront Of The Rally Last Week.

"After logging its worst first-half performance in decades on Russia’s invasion of Ukraine, tightening monetary policy and surging prices, the U.S. stock market was off to a strong start in July. A strong jobs report and drop in commodity prices brought back the lure for riskier assets. All the three main indexes logged gains in the winning week."

Image: Bigstock

"While the rally was broad-based, the technology sector led the way higher, with most ETFs gaining in double digits. These include First Trust SkyBridge Crypto Industry & Digital Economy ETF (CRPT), iShares Blockchain and Tech ETF (IBLC), VanEck Digital Assets Mining ETF (DAM), VanEck Vectors Digital Transformation ETF (DAPP) and Bitwise Crypto Industry Innovators ETF (BITQ)."

Killa is striking a positive analyst's note here. Consult the full article for the specifics on the ETFs mentioned above.

Caveat Emptor.

With Twitter (TWTR) closing yesterday at $32.65, well below Elon Musk's offer of $54.20, contributor Brad Thomas takes a look at some of the havoc the Tesla CEO (TSLA) has caused and is continuing to cause in Elon Musk Made A Twit Out Of Someone (It’s Just A Matter Of Who).

"For months now, the world watched as the world’s wealthiest man went to bat with social media giant Twitter...In the beginning, Musk promised to unlock Twitter’s full potential to promote free speech and profits. But the tech titan has apparently given up on that intent and is now in the process of terminating the deal."

"In a regulatory filing last Friday, Elon claimed Twitter hadn’t delivered the crucial data necessary to assess fake account occurrences. Plus, the filing accused it of making material changes to Twitter without Musk’s consent, such as cutting staff and freezing new hires.

He clearly wasn’t playing around about wanting to verify the authenticity of Twitter’s user base. And I tend to agree with him there.

Investing in any company should always be based on sound fundamentals. So I applaud Musk for demanding a full spectrum account of what his money is really purchasing.

Twitter does not share that opinion, however. It says it will sue if Musk does indeed back out. And it’s “confident we will prevail in the Delaware Court of Chancery,” as Bret Taylor, chairman of the board, tweeted."

Whether Twitter's stock price will fall further on the way to the courtroom door remains to be seen, though continuing drama will ensue in or out of court, for sure.

Such are the perils of making something out of nothing...

I'll be back on Thursday.

More By This Author:

Thoughts For Thursday: Bounce Cat, Bounce!

Tuesday Talk: Fireworks and Rollercoasters - The Day After