Too Late To Sell, Too Soon To Buy

No one knows when the market will turn up (or down) no matter how confidently - or stridently - they state their opinion.

I wrote exclusively for Investor's Edge subscribers "What Will Happen Tomorrow?" on Sunday, January 30th: I answered:

"I don't know.

You don't know.

All the quants, techies, fundamentalists, Pollyannas and Cassandras don't know.

Enjoy the time with your families rather than reading everyone's opinion, only to end up where you started.

We don't care what the market does tomorrow.

We care where the market is 3 months, 6 months, or a year from now.

Assuming you are mostly long -- I am and my clients are -- we would very much like to see it higher by then. I am looking at the Big Picture and coming to believe that this may not yet be the correction I am expecting, but earnings still beat the contradictory mumblings from the Fed.

…the futures are pointing to a down opening of the market tomorrow, but the futures fluctuate wildly based mostly upon super-short term option orders placed after-market and pre-market. [Those hugely-down DJI futures that weekend actually resulted in a 400-point uptick the next day.]"

I went on to describe what steps we were taking in our Growth & Value portfolio at the beginning of February - none of which involved panic-selling but only our usual monthly adjustments based upon where we were finding the best value.

Where Do We Stand Today?

The Dow, the S&P 500, and the Nasdaq 100, after a splendid 2021, which almost every prognosticator "predicted" would continue into 2022, fell like a stone. I use the index ETFs for the index themselves since you can buy the ETF but not the index:

The Dow, as measured by the ETF DIA:

Source: Seeking Alpha

The S&P 500, as measured by the ETF SPY:

Source: Seeking Alpha

The Nasdaq 100, as measured by the ETF QQQ:

Source: Seeking Alpha

"Where we stand today" is that the Nasdaq 100 are already in a serious correction and the rest of the market might join them in the short term, or might not.

However, who cares? The more important question is, "Where will your stocks be in 3 months, 6 months or a year?"

As one of my Investor's Edge blog commenters said, paraphrasing Benjamin Graham, "Is xyz company that you own a piece of any different today than it was yesterday? Did sales suddenly plummet? Is there a new massive lawsuit filed? Did management invest poorly in new plants and equipment? If the answer to any of these is "no" - then who cares what Mr. Market does hour to hour or day by day?"

Amen to that.

There are three fears about in the land today. #3 used to be #1: the new Covid variants will bring the world to a dead stop. That one has now abated somewhat as the virologists and messenger RNA scientists said it would. All things want to live, be they human, animal, plant or virus. Historically, however, viruses that have fewer and fewer targets, either because their host is now either dead or vaccinated, mutate in ever-more haphazard, and thus less virile, ways.

#1, which was #2 a couple of weeks ago, is "Will Russia attack Ukraine?" In some way or another, yes, even if it is only cyberattacks or false "Ukrainian" resistance (read: Russian thugs replacing the Russian-speaking Ukrainians who have fled the Russian-inflicted chaos, poverty, and desperation in Donbas.) Please refer to the paraphrase of Ben Graham's questions two paragraphs above to answer how this will affect your portfolio.

Finally, the #1 real concern: Inflation.

Is Inflation "Out of Control"?

Before you say yes, this is what I have been saying for many articles (and months) in a row: "Covid-induced supply chain bottlenecks."

The supply of goods, consumers in the nations most successful in reducing Covid deaths and hospitalizations are clamoring for is simply not reaching the consumers.

Yet pent-up demand for almost every consumer product (even beyond toilet paper) is strong.

Result? Demand-induced inflation.

I imagine we will still see high inflation simply from a seasonal lag factor for this month - and possibly a scary March. That gives those of us with a longer view of market success a more likelihood of profiting from others' selling. I believe we will see inflation slack off beginning in about 8 weeks - shortly after the Fed raises rates in March.

The reason for the decline in the rate of inflation will have "absolutely nothing" to do with the Fed's action, however! (Seriously, a few weeks after a single rate rise?)

The reason will be that Covid-induced supply chain bottlenecks will begin to clear. Same demand + more supply = lowered inflation. Hence, my belief is we will see volatility over the coming days and a few weeks. But volatility can be our friend.

Keeping in mind the crazy notion that short term does not mean next Thursday and long term does not mean we need to wait 10 years, here is what I believe/think/guess will most likely happen in the coming weeks:

Barring a virulent evolution of the Covid virus that prevents global workers from returning to work, millions more people will be vaccinated or naturally immunized by surviving rather than dying. The more people vaccinated globally, the less likelihood "any" new variant will find receptive targets.

That will immediately lead to…

…more supplies reaching the consumers who want or need them and are willing to pay for the privilege. This will re-ignite the growth of the US economy while simultaneously lowering the rate of real inflation. Inventories are so low today that it will take time to re-stock, but re-stock we will. This goes for everything from imported cheese to luxury automobiles.

With governments now curtailing their helicopter money, more people will have to return to work. Some would rather stay home and play video games. But when the do-re-mi runs out, the wolf at the door insists you demean yourself to make a living. All that money chasing too few available goods drove prices higher. That, too, will begin to reduce inflation.

Because of the shortage of labor worldwide, companies have been forced to accelerate their use of automation in factories, workplaces and even fast-food outlets. Heightened productivity is the inevitable result. First, it requires fewer workers on the payroll, but it also gives those workers a shot at getting more training to find more satisfying and/or higher-paying jobs.

Inflation will be higher a year from now than it was a year ago. But that does not mean it will be too high. Interest rates will rise as well. For some business sectors, this will be a good thing, for others not as much. For some stock sectors, this will be a good thing; for others, not as much.

But as someone who entered this business in the super-inflation and stagflation of the 1970s, my best experience/thinking/belief guess is that real inflation will return to its historic 2-3% range.

What Am I Doing Today?

Not much.

I had been moving into energy, natural resources, industrial, and real estate companies as I watched the fireworks of late 2021. Today, our subscribers' Growth & Value portfolio currently has about 40% of assets in those categories, with value a far greater percentage than growth.

I have not abandoned growth or tech, however. More than 10% is in semiconductor and other tech companies that I recently added to in this decline. If it continues, I will add more here. But I will also add more international companies, mostly value-oriented, that have gone nowhere over the past couple of years.

FYI, I have also placed trailing stops on some companies I previously suggested for SA readers' due diligence, so it is worth mentioning them here. This includes ZIM Integrated Shipping Services (ZIM) and the Global X Lithium & Battery Tech ETF (LIT).

My article on ZIM can be found here: Put Some ZIP In Your Portfolio With Maritime Shipper ZIM

The Battery Revolution - Pole Position And Favorites is here: The Battery Revolution - Pole Position And Favorites

I am selling even though both are up nicely only because I want to free up more cash in case the slide continues. The idea is to buy cheap and sell dear. These will be sold high, others bought low, so this strategy works for me.

Finally, I will share one of the "international" value ETFs I recently alerted our Investor's Edge subscribers to - and placed in both their Growth & Value portfolio and one of my own accounts as well.

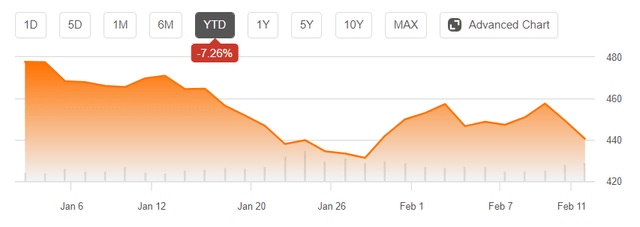

Why do I place "international" in quotes? Because the Invesco International Dividend Achievers ETF (PID) is really a lot closer to home. Yes, it is international, but take a look at the names of its top 10 holdings:

Source: Fidelity.com

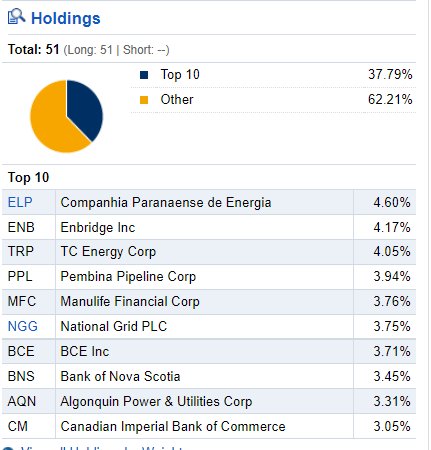

If that doesn't leap out at you immediately, here is a breakdown of where its holdings are domiciled and the distribution by market capitalization:

Source: Fidelity.com

Even if the market weakness we have seen since the first of the year were to end tomorrow, I still want to have greater diversification going forward, greater income via dividends and greater stability.

PID offers significant exposure to both the energy and the metals/mining/materials sectors. That makes sense. Canada is a major energy and mining nation. Better, it is also a nation with stringent environmental standards and enforcement. We are unlikely to see any of the Canadian holdings in this ETF blow up as some others have done in places with less regulation.

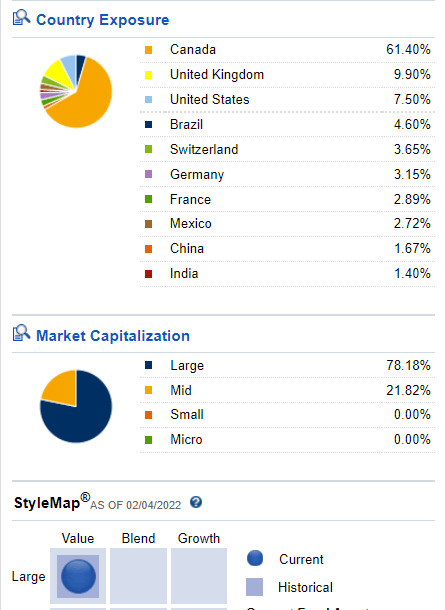

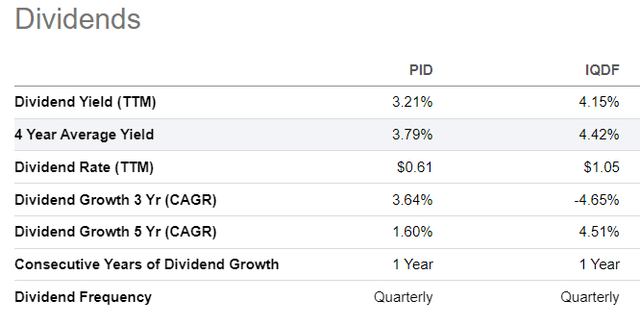

Comparing PID with a comparable international fund of similar size, I find the ETF Dividend Grade the only area in which the FlexShares International Quality Dividend Index Fund (IQDF) rated higher is in the expense ratio. I think this is an insignificant issue since the difference between 47 basis points and 56 is likely to amount to mere decimal dust if PID performs as well as I think it will going forward.

Source: Seeking Alpha

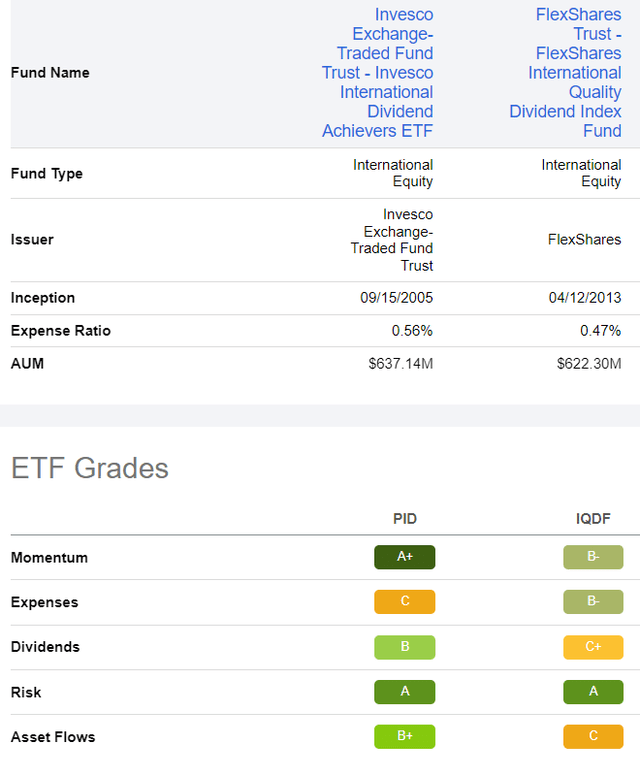

Please note that while IQDF's dividend rate is higher…

Source: Seeking Alpha

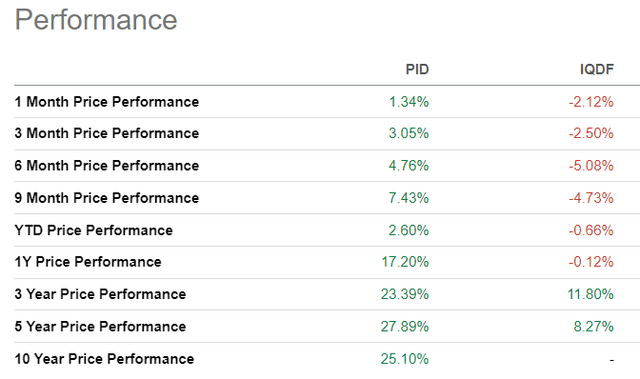

…I'll take the combination of capital gains and dividends over a mere dividend benefit any day!

Source: Seeking Alpha

In the current market environment, which is likely to contain more volatility than the previous 18 months, I like the relative calm, safety, earnings stability, and proximity of the holdings in Invesco International Dividend Achievers. Calm? On Friday, as the Dow plunged 504 points, PID was unchanged.

In parting, I offer the following reminder from Warren Buffett:

"The stock market is a device which transfers money from the impatient to the patient."

Disclosure: I/we have a beneficial long position in the shares of PID, ZIM, LIT either through stock ownership, options, or other derivatives.

Disclaimer: I do not know your personal financial ...

more

Great read, highly recommended.