The Defiance 5G NextGen Connectivity ETF Is The Smart Way To Play 5G

If you are not familiar with the term, here is a quick primer: Fifth generation wireless (5G) is a wireless networking architecture that plans to increase data communication speeds by up to three times compared to its predecessor, 4G, which most consumers use today. The idea is to create speeds of up to 1.5 gigabytes per second and cover a wider distance area from its source, as well.

According to PC Magazine, quoting HighSpeedInternet.com, consumers will save as much as 23 hours of loading time per month while browsing social media, gaming online, streaming music, and downloading TV shows and movies.

With 5G, movie downloads will decrease from 7 minutes to just 6 seconds. Songs will download in the blink of an eye. That second benefit above, covering a wider distance, is also an amazing feature.

"With 4G, the cell towers (network nodes) are designed to reach as broad of an area as possible," HighSpeedInternet.com says. "In the simplest terms, 5G is like having high-powered Wi-Fi routers dispersed all over the city to function as the network nodes. So, your internet provider's network will function more like your home network, but much faster."

I suggest for your due diligence the Defiance 5G Next Gen Connectivity ETF (FIVG) as a way to gain good exposure to the major players and major trends within the 5G world. I like that it is laser-focused on this particular area. FIVG is a brand-new ETF. It launched on March 4th in the wake of Goldman Sachs’ barrage of five “future economic trends” ETFs that same week. While I surveyed all five of the Goldman offerings, I find them too broad-brush in their approach.

Why am I buying this fund and not the better-known Goldman offerings? The Goldman funds are all passively-managed, all carry the same 0.5% expense fee, and all are “custom-weighted,” the two largest components of which seem to be factoring for size. Any security that does not have a total market cap of $500,000,000 or greater was not considered for the passive portfolio, and any company whose stock did not trade at least $1,000,000 in the prior 30 days was not considered.

My biggest concern with the Goldman funds is that they are simply too all-encompassing (which is why Amazon (AMZN) can appear in the Top 10 in three of the five offerings.) AMZN is #1, of course, in the Goldman Sachs Motif New Age Consumer ETF (GBUY) but in addition to e-commerce, Goldman adds social media, health & wellness, and online gaming to this ETF.

Contrasting this approach stated so broadly that the same few companies can appear in many of the different-titled ETFs, in seeking ETFs in specific industries I want to find those that are much closer to a pure play. I think I have found it in FIVG.

I have a number of clients who like to buy the individual 5G firms. However, for most of my clients, and my own family portfolios, I prefer to take less risk. By analogy, betting on one favorite pays a better reward at the racetrack. The win-place ticket also pays well – but it is also all-or-nothing. If your horse doesn’t come in at #1 or #2, you lose.

Better to bet on some favorites and some long shots because, in the market if not in horse-racing, you never know which firm today or one not even in existence today is going to come up with a massive breakthrough that invalidates much of what has been done by others!

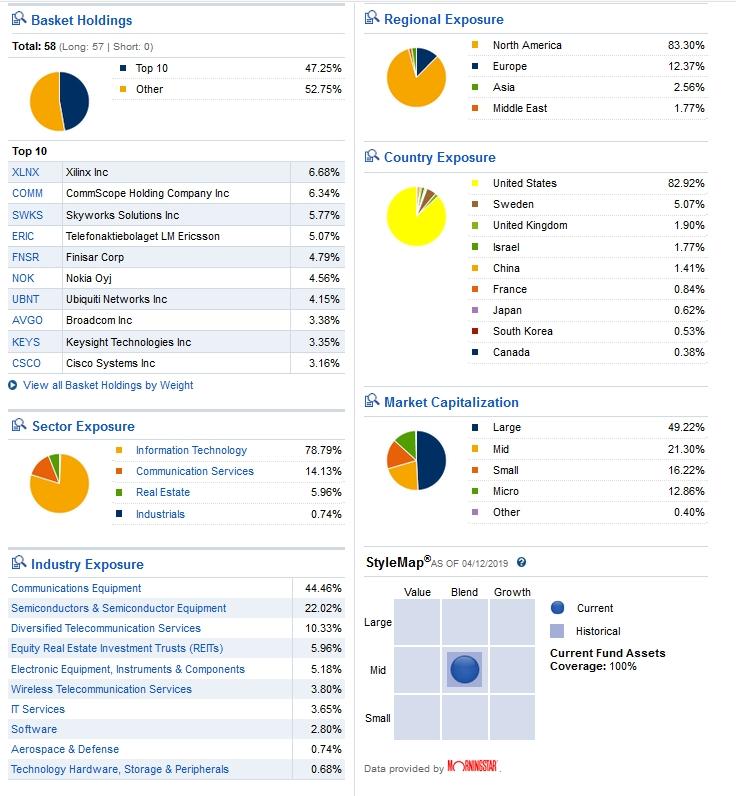

Looking at the chart below, there are a couple of things that leap out about FIVG:

(Click on image to enlarge)

Sources: Fidelity Research/Morningstar

One is the quality of the holdings. These are among the creme de la creme of global (but mostly US) firms directly engaged in, and likely to profit from, the spread of 5G communications technology.

Two, please note the market cap shows a bias toward the most well-established firms with the deepest pockets – but still saves roughly half the portfolio assets for “two guys in a garage” possibility and the rest of the 5G community.

Three, communications equipment manufacturers and semiconductor firms take center stage in the portfolio. This is as it should be – none of the innovations and benefits of 5G happen without these firms! I have expanded the Top 10 to the Top 22 here so you can see what I mean:

(Click on image to enlarge)

Sources: Fidelity Research/Morningstar

And, four, take a look in the bottom left-hand side of the first chart to see how well the ETF is diversified across the various industries that will come together to make 5G happen: in addition to communications equipment and semiconductors, the industry also needs real estate (cell towers and cloud services), ever-evolving software, telecom services. Regarding this last, it is interesting that fallen angels (at least in US markets) LM Ericsson (Nasdaq: ERIC) of Sweden and Nokia (NYSE: NOK) of Finland have both reinvented themselves and are today key 5G participants with more than $30 billion each in market cap.

It is sometimes easier to predict a trend than it is to predict a particular company’s success within that trend. I believe this is one of those times. I am buying the Defiance 5G Next Gen Connectivity ETF.

Disclosure: Do your due diligence. If I can help, you are welcome to contact me directly about a subscription to Investors Edge® or about our portfolio management services. e-mail ...

more

What about $QCOM?