SPHQ: An ETF Whose Holdings Pass Three "Quality" Tests

Image Source: Pixabay

Quality is a metric that applies to many things: The making of a piece of furniture or a new car, the beauty and technique of a piece of artwork, and, of course, the soundness of one’s investments. In the case of exchange-traded funds (ETFs), few ETF managers know this better than those who lead the Invesco S&P 500 Quality ETF (SPHQ), counsels Jim Woods, editor of The Deep Woods.

Formed in 2005 by Invesco, SPHQ’s mission is to provide exposure to S&P 500 firms with sound fundamentals. To accomplish this goal, SPHQ focuses on three quality metrics.

The first metric is return on equity (ROE), which measures overall profitability. The second is lower accruals, which is the change in net operating assets scaled by the average net operating assets over the past two years. This metric is used to potentially signal higher earnings quality. Finally, there’s financial leverage, which measures risk and earnings stability.

These metrics are then equally weighted to produce a quality score. SPHQ takes only the top quintile and scales them based on this quality score. Its exposure to any one specific market sector is capped at 40%, making it a particularly diverse ETF.

The index it bases its investments on is rebalanced semi-annually. Currently, SPHQ has $7.32 billion in assets under management, and the fund’s expense ratio is 0.15%.

Almost all SPHQ’s holdings are US-based. Its primary market sector is technology, which makes up over 54% of its portfolio after combining its various submarkets, such as health technology. SPHQ is diversified, however, with additional allocations in sectors such as commercial services and energy minerals. Its current top holdings include NVIDIA (NVDA), Microsoft (MSFT), Alphabet (GOOG), Apple (AAPL), Visa (V), and Exxon Mobil (XOM).

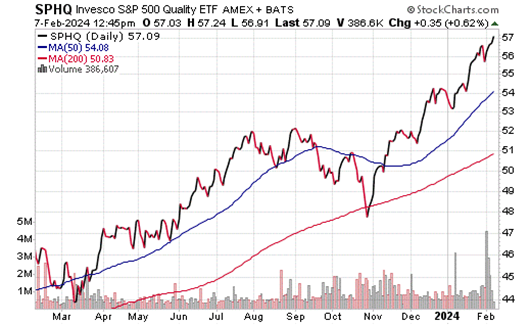

As of the close of trading on Feb. 6, the fund was up 6.6% in the last month, 13.1% in the past three months, 4.9% year-to-date, and 23.8% in the last 12 months.

Quality isn’t just about picking the best products at the best price. It’s also about knowing what’s best for you. And making wise investment decisions is no different. So, keep an eye towards quality by considering your investment goals and doing your due diligence before adding any stock or ETF to your portfolio.

My recommended action would be to consider buying SPHQ.

About the Author

Jim Woods is a 20-plus-year veteran of the markets with varied experience as a broker, hedge fund trader, financial writer, author and newsletter editor. He is the editor and investment director of Intelligence Report, Successful Investing, Bullseye Stock Trader, High Velocity Options, and The Deep Woods e-Letter (Mr. Woods also co-directs the Fast Money Alert trading service, alongside Dr. Mark Skousen.)

The independent firm TipRanks has rated Mr. Woods the #1 financial blogger in the world (out of more than 6,000 competing analysts), and he has been ranked inside the Top 12 globally for more than a decade. His books include co-authoring, Billion Dollar Green: Profit from the Eco Revolution, and The Wealth Shield: How to Invest and Protect Your Money from Another Stock Market Crash, Financial Crisis or Global Economic Collapse.

Mr. Woods formerly worked with Investor's Business Daily founder William J. O'Neil, helping to author training courses in the CANSLIM stock-picking methodology. He is known in professional and personal circles as "The Renaissance Man," because his expertise includes such varied fields as composing and performing music, western horsemanship, combat marksmanship, martial arts, auto racing, and bodybuilding.

Mr. Woods holds a BA in philosophy from the University of California, Los Angeles, and is a former U.S. Army paratrooper. A self-described "radical for capitalism," he celebrates the virtue of making money from his Southern California horse ranch.

More By This Author:

Apple: Services, Vision Pro Growth Should Offset China Sales Concerns

Arch Capital: A 5-Star Buy In Insurance

Intapp: A "Best-In-Breed" Software Provider

Disclaimer: © 2023 MoneyShow.com, LLC. All Rights Reserved.