Apple: Services, Vision Pro Growth Should Offset China Sales Concerns

Image Source: Unsplash

Apple Inc. (AAPL) recently reported December quarter results above expectations, although analysts focused on Chinese sales reporting below expectations. Meanwhile, Apple also announced 600 new spatial computing apps built for the Vision Pro headset. I expect Apple services and the Vision Pro to provide plenty of growth, notes Michael Murphy, editor of New World Investor.

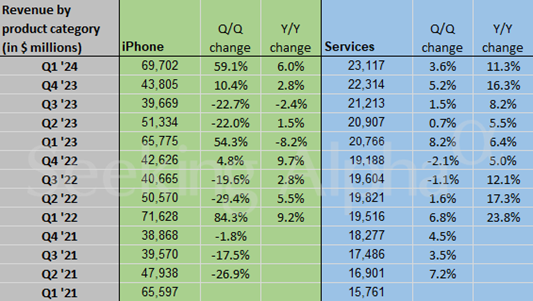

Revenues grew 2% from last year to $119.58 billion despite one less week in the quarter, above the $117.97 billion estimate. Earnings per share hit $2.18, also topping expectations for $2.11. China sales of $20.82 billion were below the $23.5 billion estimate.

Market research firm IDC said that although iPhone shipments in the quarter declined 2.1% year-over-year, for the full year, Apple overtook Vivo to take first place as the top smartphone seller with a 17.3% market share. This was the first time Apple became the top seller in China.

On the conference call, CEO Tim Cook said the installed base (to buy services) is more than 2.2 billion active devices. The iPhone active installed base grew to a new all-time high, and the company had an all-time record number of iPhone upgraders during the quarter. Services grew 11.3% year-over-year to another new record.

Widely-read TF International Securities analyst Ming-Chi Kuo, best known for gathering intelligence from his contacts in Apple’s Asian supply chain, reported that Apple has lowered its 2024 iPhone shipments of key upstream semiconductor components to about 200 million units. That correspondents to a decline of 15% year-on-year.

As a result, he expects iPhone 15 shipments to decline by 10% year-over-year in the first half of 2024 compared to iPhone 14 shipments in 2023. He also expects the coming iPhone 16 series shipments to drop 15% year-over-year in the second half, compared to iPhone 15 series shipments in 2023.

He pointed to the new high-end mobile phone design paradigm that includes Generative AI and foldable phones. He doesn’t expect Apple to launch new iPhone models with those design changes until 2025 at the earliest.

My recommended action would be to consider buying shares of AAPL.

About the Author

Michael Murphy, CFA, has been writing technology investment newsletters for 38 years. He has been a security analyst on the buy-side and sell-side, director of research, mutual fund manager, hedge fund manager, venture capitalist, and CEO of a software company. For the very difficult market in the five years 2008-2012, Mr. Murphy's New World Investor newsletter was rated #1 by The Hulbert Financial Digest.

More By This Author:

Arch Capital: A 5-Star Buy In InsuranceIntapp: A "Best-In-Breed" Software Provider

ET: A Solid Midstream Play In A Sector Ripe For More M&A

Disclaimer: © 2023 MoneyShow.com, LLC. All Rights Reserved.