GDX Short Term View

SPX Monitoring purposes; Sold SPX on 8/19/24 at 5608.25 = Gain 8.14%gain; Long SPX on 8/5/24 at 5186.33.

Covered short 8/2/24 at 5346.56 = gain 3.18%; Short SPX on 7/31/24 at 5522.30.

Our Gain 1/1/23 to 12/31/23 SPX= 28.12%; SPX gain 23.38%

Monitoring purposes GOLD: Long GDX on 10/9/20 at 40.78.

We are up over 26% this year so far; SPX up around 16%. Above is the daily SPY. The bottom window is the SPY/VIX ratio, which is starting to roll over and a bearish sign. Today’s makes eight days up in a row and extended. SPY may find resistance at the gap off of the mid July high near the SPY 560. We expect at some point the open gap near 520 SPY that formed on 8/7 will be tested, possibly in October. Sold long SPX on 8/19/24 at 5608.25= gain 8.14%; Long SPX on 8/5/24 at 5186.33.

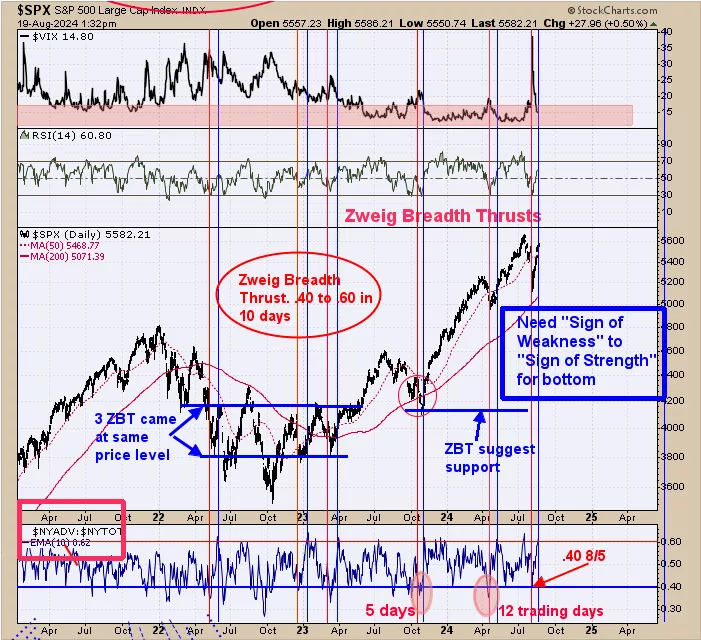

Above is the Zweig Breadth Thrust (ZBT) indicator (bottom window). This indicator helps to define the bigger trend for the market. We noted previous ZBT in the past with red and blue lines. In a nutshell this indicator needs to touch .40 or lower (reached .40 on 8/5) and than rally to .60 or higher in 10 days or less. Ten trading days form August 5 is August 19 (today). Current reading is .62 (Friday’s close) and has met the parameters to trigger the ZBT. These ZBT triggers only show up in bull markets.

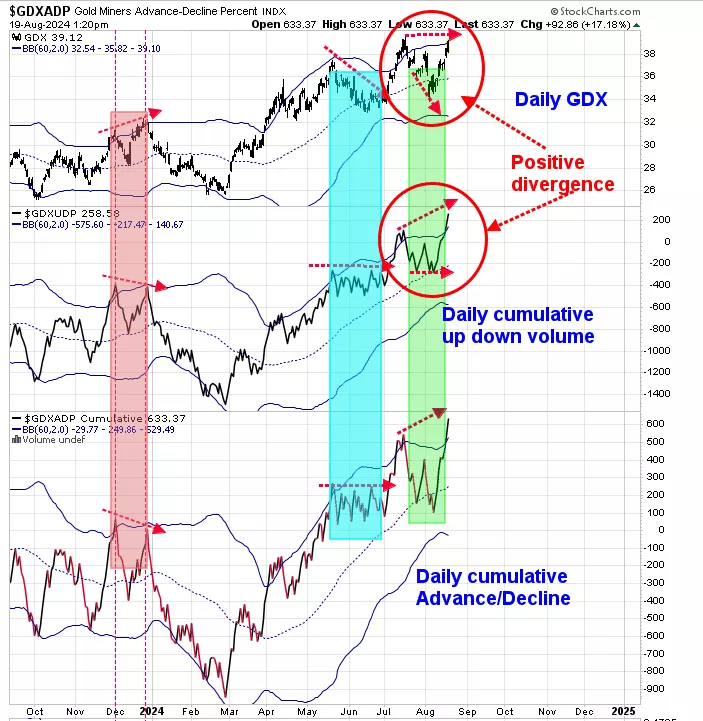

Above is a short term view of what the GDX may do next. The top window is the GDX which is testing its previous high of early August. Next lower window is the daily cumulative GDX up down volume which has made a higher high compared to the previous high of early August. Its common for the cumulative GDX up down volume to lead GDX; which suggests GDX will rally above its previous high of early August and continue higher. The weekly and monthly charts remain on buy signal, and the daily chart is showing positive divergences using the GDX cumulative up down volume indicator.

More By This Author:

Positive Divergence For Gold And a Pullback For SPY

Large Trading Range

Potential Seasonality Gold Rally

Signals are provided as general information only and are not investment recommendations. You are responsible for your own investment decisions. Past performance does not guarantee future performance. ...

more