Another Strong Week For Stocks

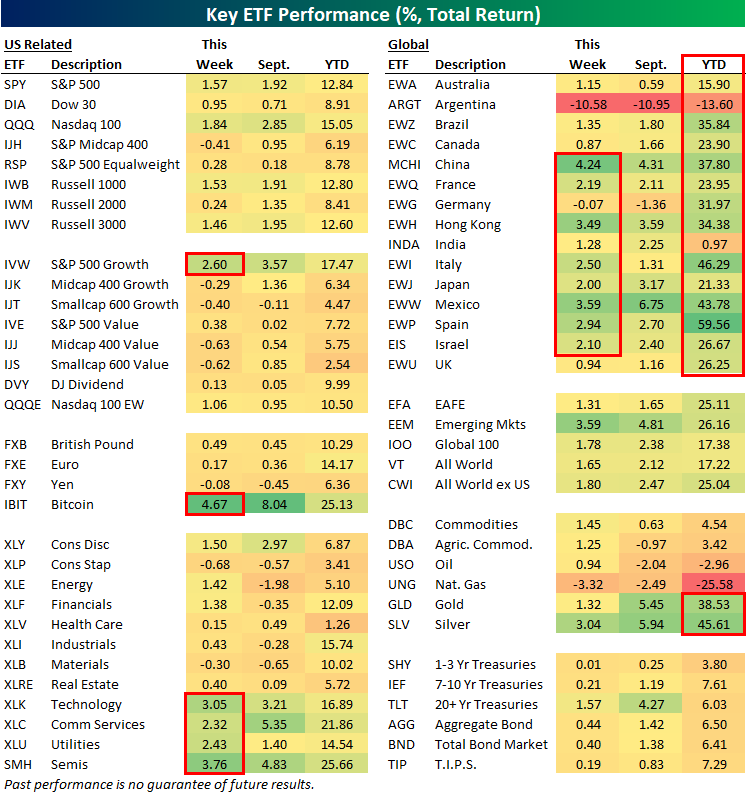

With the week complete, here is a helpful look at the recent performance of various asset classes using key ETFs traded in the US.

Large-cap growth (IVW) was up 2.6% on the week, while mid-caps and small-caps actually fell. Technology (XLK) was the best performing sector due to Oracle's (ORCL) massive gain, while Consumer Staples (XLP) and Materials (XLB) were the worst.

Outside of the US, there are a dozen country ETFs now up 20%+ on the year, which easily beats out SPY's year-to-date gain of 12.8%. Spain (EWP) is up the most in 2025 with a huge gain of 59.6%.

Argentina (ARGT) and natural gas (UNG) were the two worst performing ETFs in our matrix this week.

Sticking with commodities, agriculture (DBA), gold (GLD), and silver (SLV) all rallied more than 1%, with GLD and SLV extending huge year-to-date gains.

Finally, Treasury ETFs were also up across the board this week as rates fell, especially at the long-end.

If you like this snapshot, we update it daily for Bespoke subscribers. Sign up now with our September Special to gain access.

More By This Author:

Highs Keep Adding Up

Back To Reality

US ETF Growth Easily Outpaces Market Gains Since 2020

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more