US ETF Growth Easily Outpaces Market Gains Since 2020

Image Source: Pixabay

With the recent news that there are now more ETFs than stocks in the US, we wanted to provide an update on the dollar amounts that have flowed into ETFs so far this decade.

Since the end of 2019, exchange-traded products (ETPs) in the U.S. -- primarily ETFs -- have exploded in size, outpacing even the impressive rise of the S&P 500.

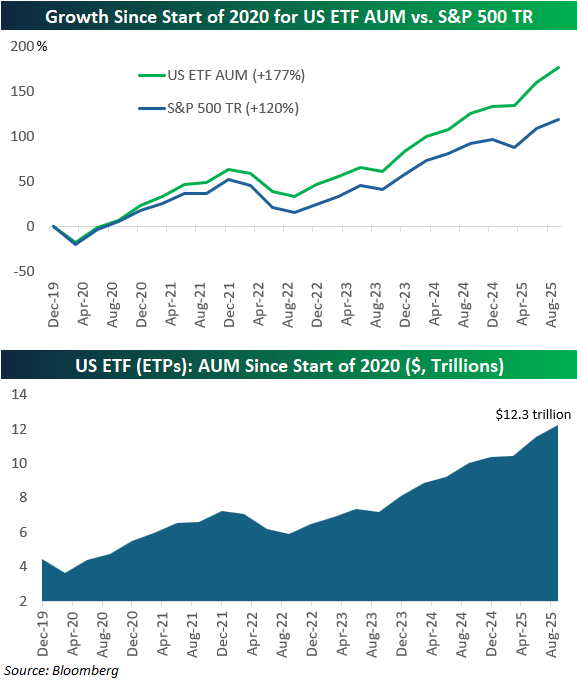

The first chart below highlights just how powerful the trend has been: while the S&P 500’s total return has surged about +120% since the start of 2020, US ETF assets under management (AUM) have climbed an even steeper +177%. That gap shows that ETFs have not just grown alongside the market; they’ve attracted a massive wave of fresh capital from investors seeking low-cost, diversified, and flexible investment vehicles.

The second chart below underscores this growth in dollar terms. According to Bloomberg, U.S. ETF assets have ballooned from around $4 trillion at the start of 2020 to a record $12.3 trillion today. While markets have had their ups and downs over the past five years, the long-term trajectory of ETF adoption has been relentlessly upward.

This expansion is being fueled not only by equity gains, but also by the sheer volume of new inflows, as investors of all sizes, retail to institutional, continue to shift from mutual funds and other structures into ETFs.

Put simply, ETFs are no longer a niche product. -- they are the market. With their assets now equal to more than half of U.S. GDP, their influence on trading flows, liquidity, and even market structure will only grow. And with ETF growth running far ahead of the broader equity market, this wave of adoption shows no sign of slowing down.

More By This Author:

Nvidia Is How Big??AI Earnings Lead To Record Gains

A Small Cap In A Big Cap's Clothing

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more