Highs Keep Adding Up

Well, the market can’t go up every day. Equity futures are on pace to close out the week on a modestly weaker note as the Dow and S&P 500 are indicated to open the session modestly lower. For its part, the Nasdaq is looking at modest gains following strong earnings from Adobe (ADBE), which has that stock trading up 3%. The 10-year yield is two bps higher, but at less than 4.04%, it’s been a good week for longer-term treasuries. Crude oil is up fractionally, along with most precious metals, but silver is up closer to 2%. In crypto, Bitcoin is looking at modest gain as it flirts with $115K, but Ethereum is back above $4,500 with a gain of over 2%, while Solana, the newest flavor of the month in the space, has surged over 5% to $239 and its highest levels since January.

The uneventful tone in the US follows what was mostly a positive session in Asia as Japan and South Korea rallied to new all-time highs. Outside of Australia, all the major averages in the region finished the week with gains of at least 1%, and in most cases more.

In Europe, the tone has been more subdued as the STOXX is trading slightly lower along with most major country benchmarks. For the week, though, returns have also been positive with gains of roughly 1%. One negative item has been growth in the UK, where GDP was unchanged in July, versus forecasts for an increase of 0.4%. Meanwhile, Industrial Production, which was forecast to be unchanged versus June, dropped by 0.9%.

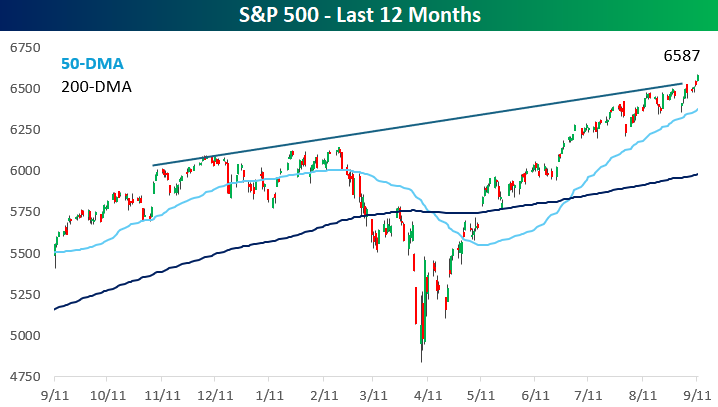

Yesterday’s weaker-than-expected jobless claims report and mostly in-line CPI solidified the case for multiple FOMC rate cuts in the months ahead. The market responded with a very broad-based rally as over 85% of S&P 500 stocks traded higher on the session, and small caps outperformed large caps. The S&P 500’s 0.85% rally took it to another record closing high as the index now pushes up against a trendline that has been in place for the last year. As shown in the chart below, while stocks sold off sharply after the index bumped up against this rising ceiling early in the year, most times it has encountered this trendline, the pullbacks were modest.

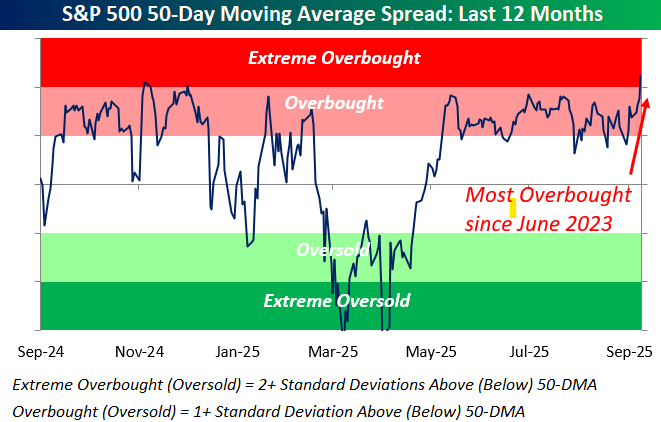

Following yesterday’s rally, the S&P 500 has now moved into ‘extreme’ overbought territory on a short-term basis, which we define as more than two standard deviations above its 50-day moving average (DMA). The last time it traded at more overbought levels was back in June 2023. We’ll have more on these ‘extreme’ overbought readings in tonight’s Bespoke Report.

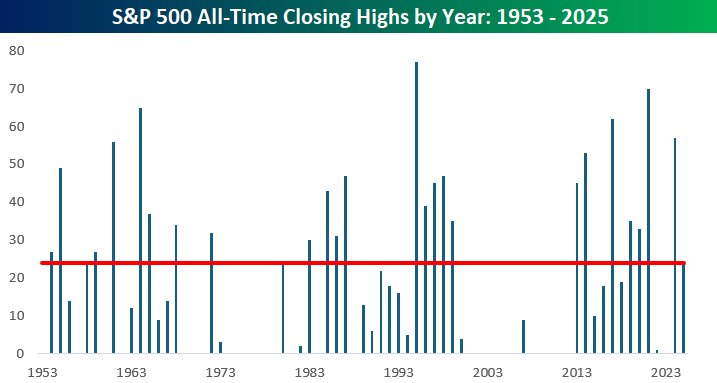

With yesterday’s new high, the S&P 500 has now had 24 record closing highs this year. While it’s above the historical average of 18 per year, 24 is hardly extreme by any stretch of the imagination, and it’s less than half of last year’s total of 57. On the other hand, back in early April, was anyone thinking we’d be anywhere close to new highs later this year, let alone hitting them multiple times? Be honest!

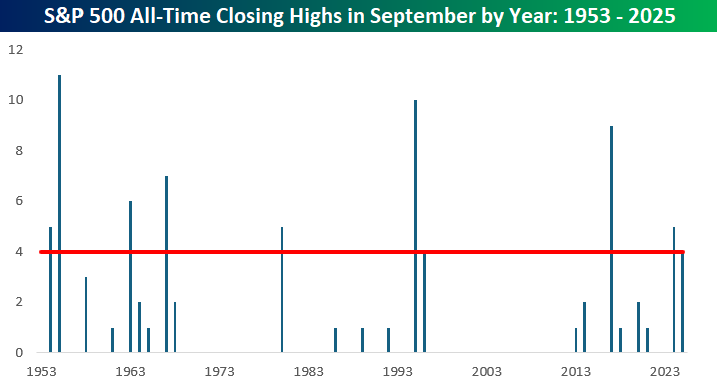

While September is historically known for its weakness, the S&P 500 has already had four record closing highs in eight trading days this month. That may be short of last year’s total of five, but there’s still another 13 trading days left in the month! The record for closing highs in September was 11 in 1955, followed by 10 in 1995, and 9 in 2017. If your memory is good (and long), you’ll remember that those were all good years, and some people reading this may have even been around for all of them!

More By This Author:

Back To RealityUS ETF Growth Easily Outpaces Market Gains Since 2020

Nvidia Is How Big??

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more