Does The Fed Care About What’s Going On In The Rest Of The World?

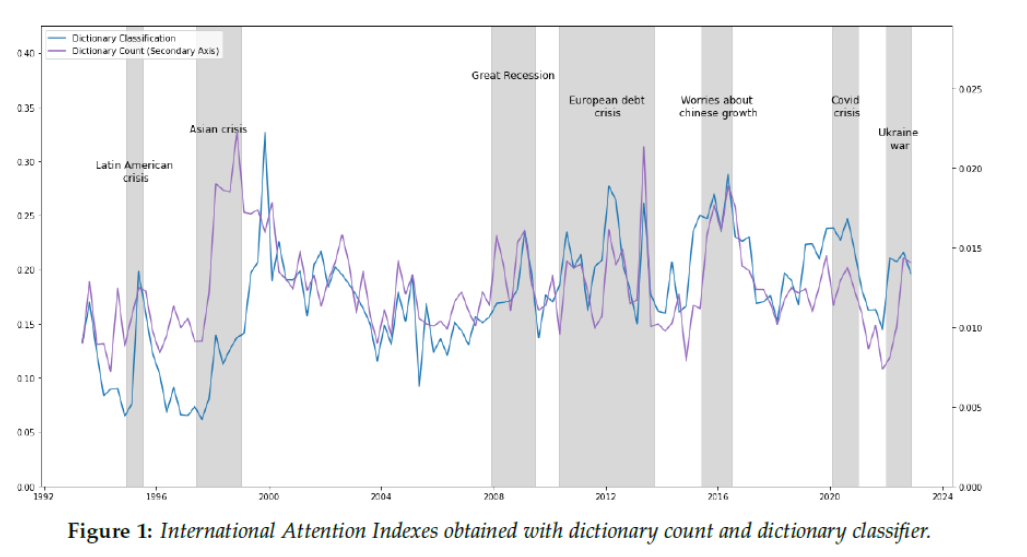

Ferrara and De Roux actually pose the question more tactfully, in their paper (Capturing international influences in U.S. monetary policy through a NLP approach) presented at the ISF meetings here in Charlottesville. They look to see if, in the FOMC minutes, international economic issues are mentioned in a way that, when converted to an index, shows up as statistically significant in a Taylor equation, and provide the answer “yes”.

First the “International Attention Index”:

(Click on image to enlarge)

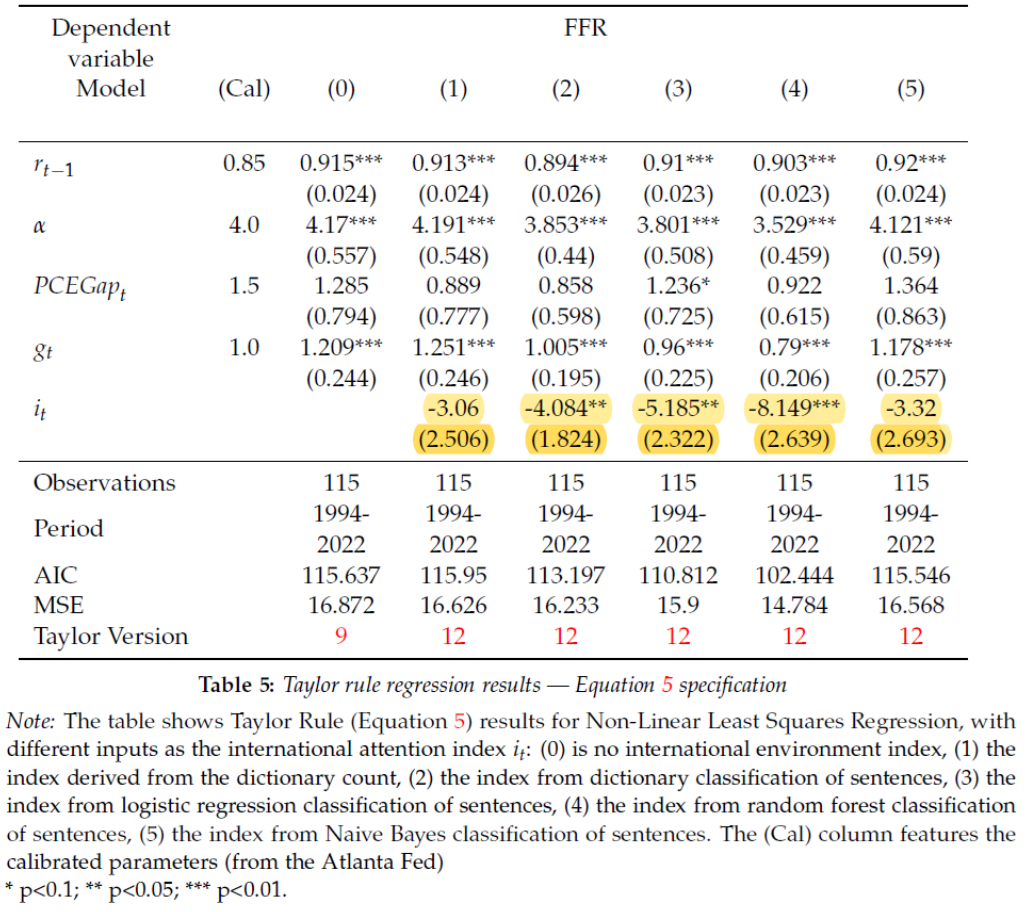

Next, the regression of fed funds rate on lag, nominal interest rate, PCE gap, and output gap, augmented with the International Attention Index.

(Click on image to enlarge)

The index is normalized to 0 to 1, so a 0.10 increase in the index results in an 80 bps reduction in the fed funds rate relative to what it otherwise would be. For context, the increase in the index during the expansion of the Russian invasion of Ukraine was about 0.10.

From the abstract:

Our results show that when there is a focus on international topics within the FOMC, the Fed’s monetary policy generally tends to be more accommodative than expected by a standard Taylor rule. This result is robust to various alternatives that includes a time-varying neutral interest rate or a shadow central bank interest rate.

More By This Author:

Inflation Across Some Countries

Recession Probabilities Based On Multiple Financial Measures

The Term Spread, 1970-2023M06