Disinflation / Deflation Sentiments Are Hard To Disregard

The severe facts of the end of the cheap money period are starting to emerge in 2023, which is quickly becoming that year. Although there was previously evidence that lending was being reduced, the latest banking turbulence has made the situation worse.

(Click on image to enlarge)

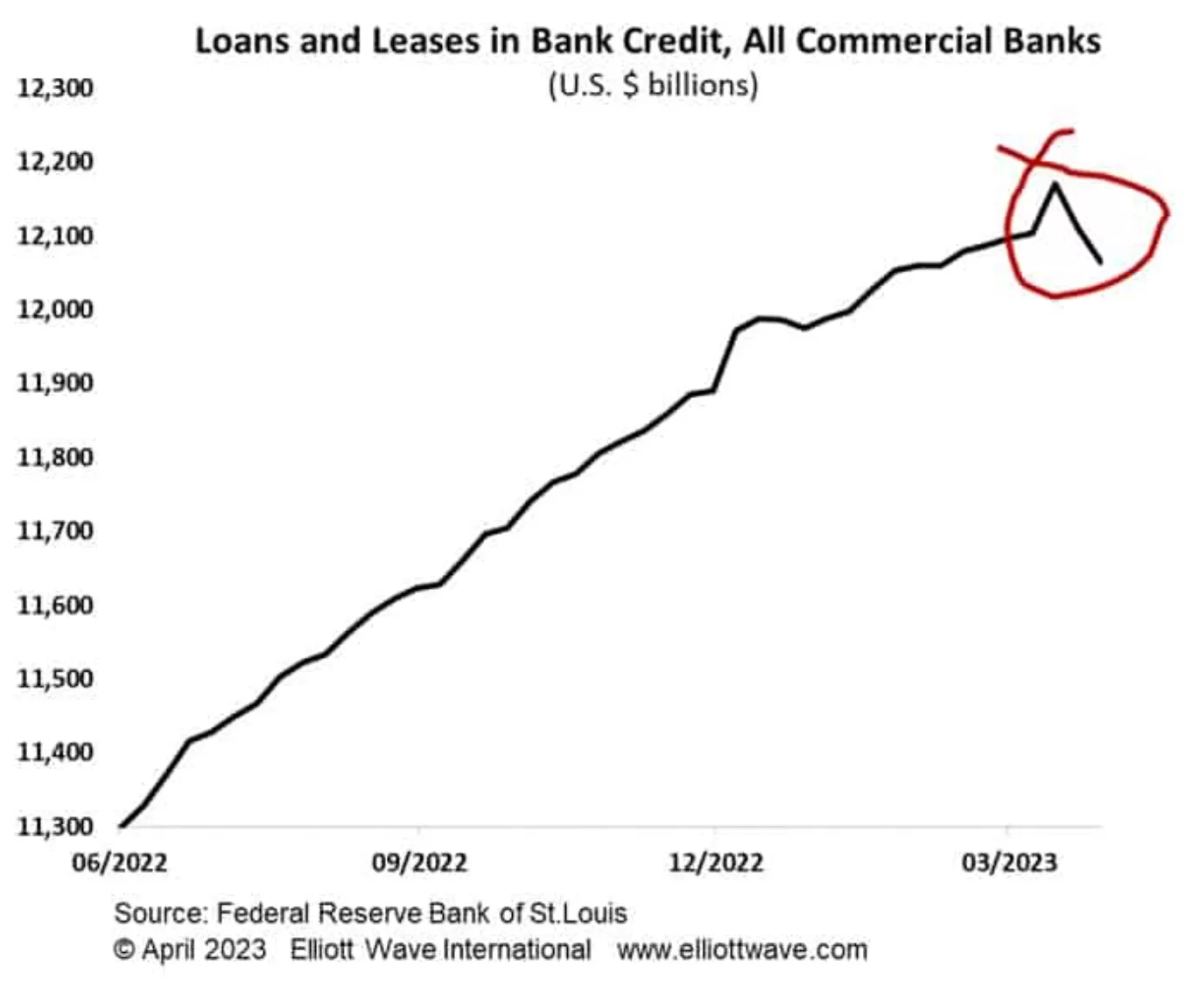

The amount of loans and leases from U.S. commercial banks are depicted in the graph below. The most significant two-week decrease in the history of the series dating back to 1973 has now occurred. Credit was reduced in all industries, including real estate, business, and industrial loans.

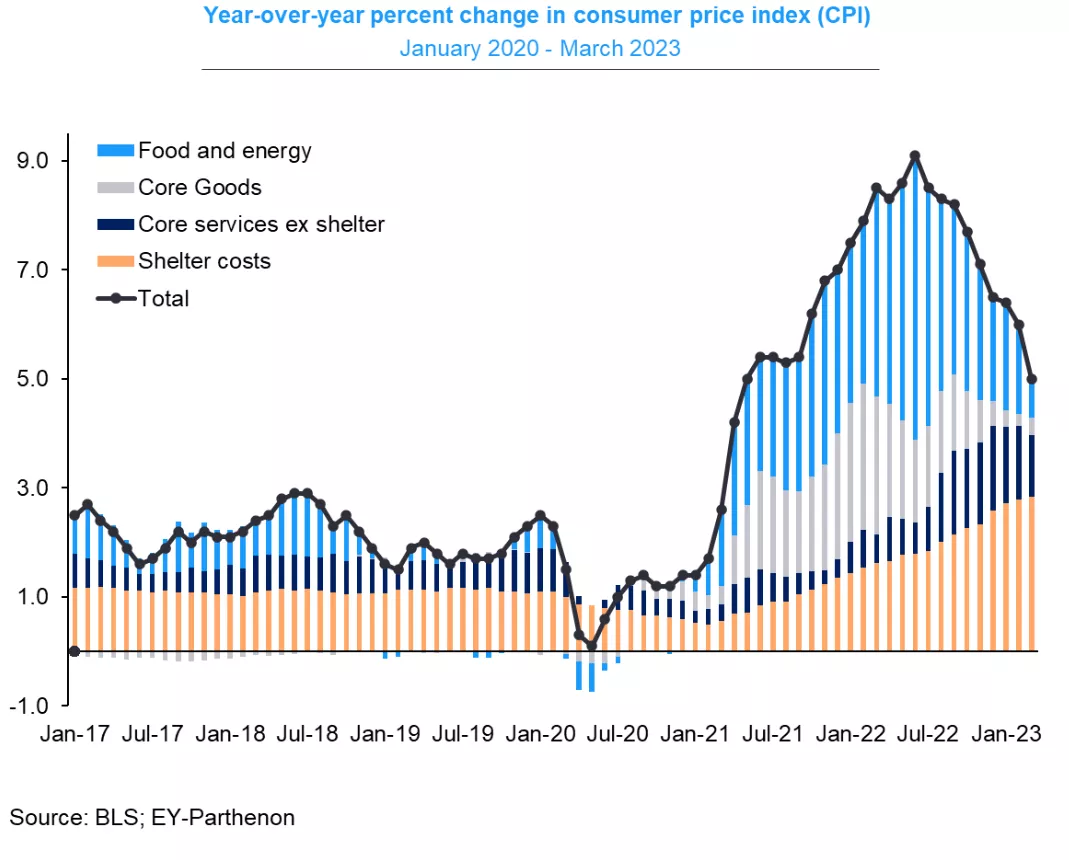

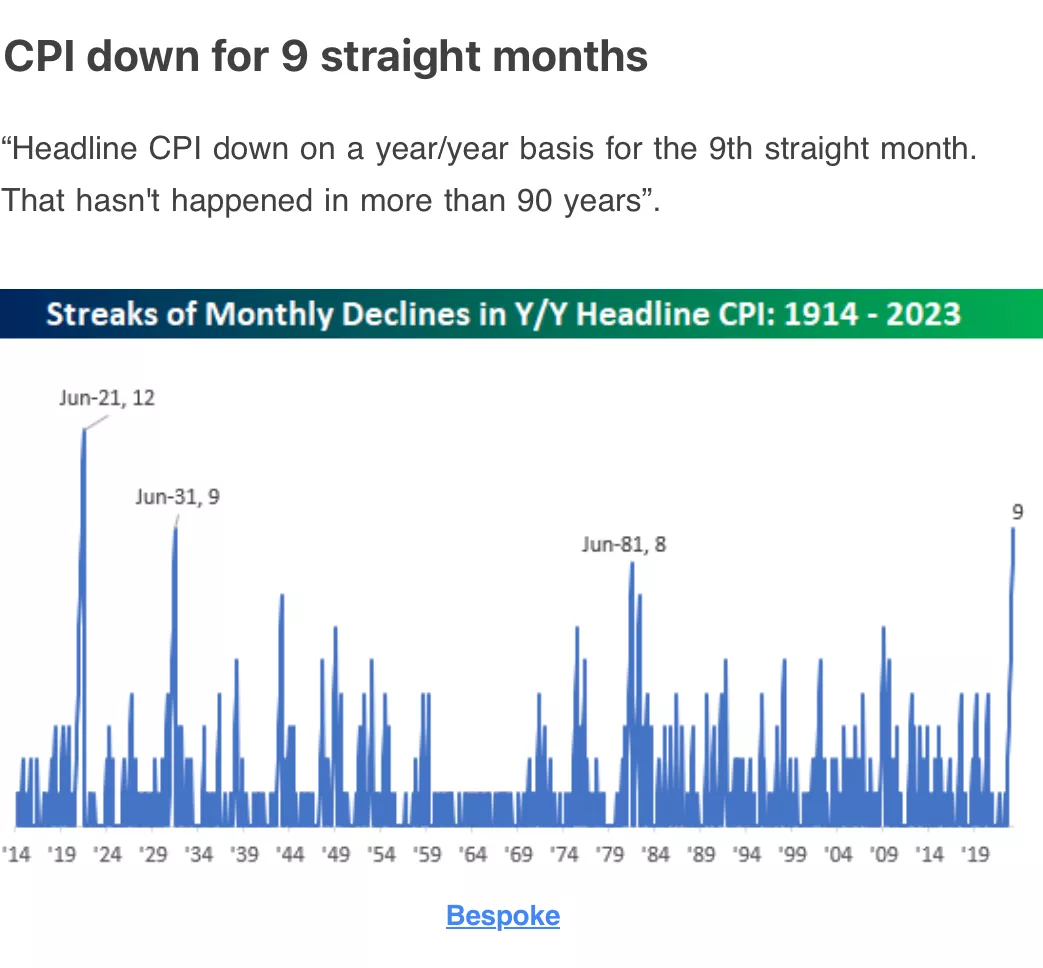

There is little doubt that the disinflationary process is well under way given this CPI figure. In the upcoming month, slower final demand growth for goods and services, declining home price inflation, and moderate wage growth should all work in concert to cause faster disinflation than anticipated.

(Click on image to enlarge)

(Click on image to enlarge)

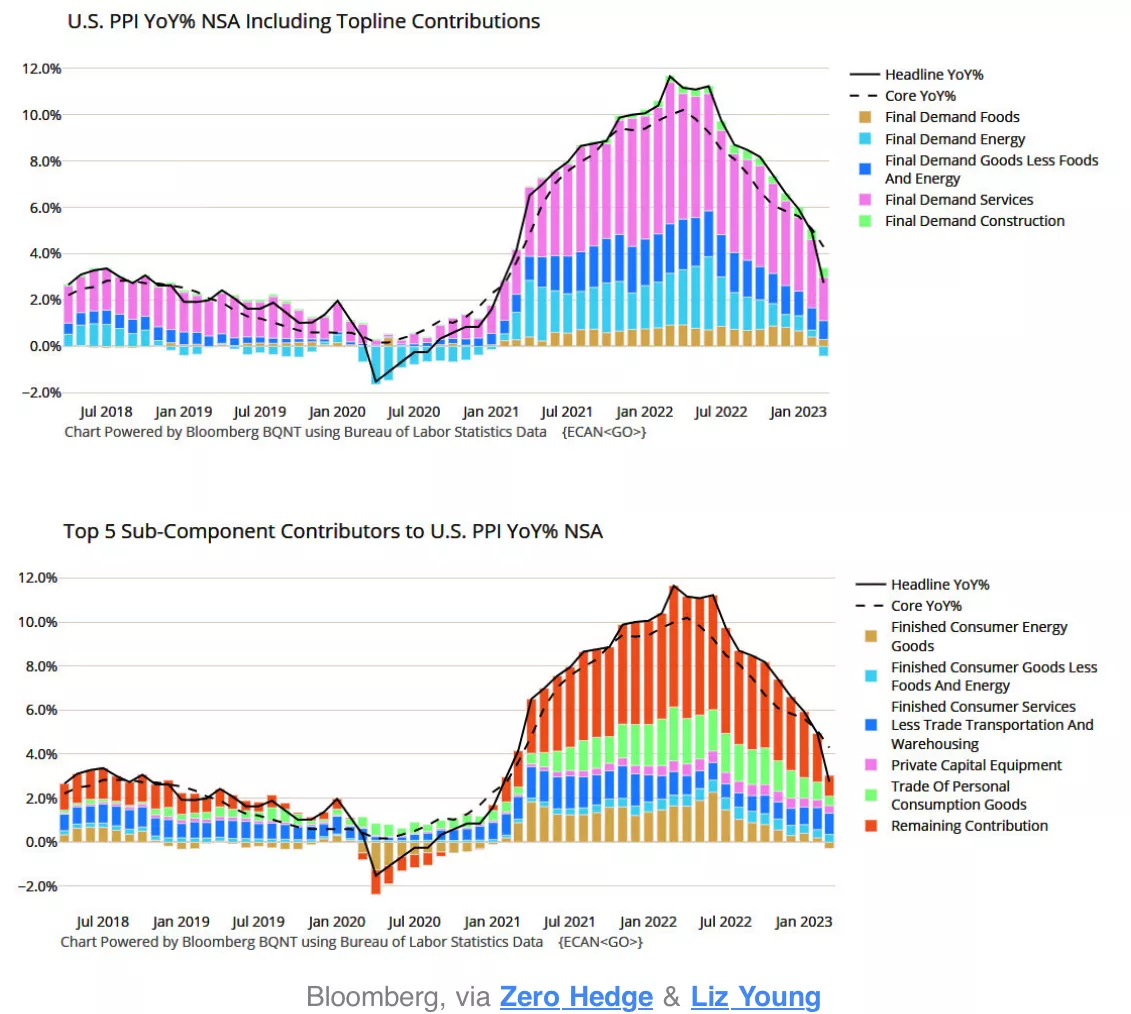

Significantly below expectations, March PPI came in at -0.5% m/m vs. 0% est. and 2.7% y/y vs. 3% est. This data indicates more disinflation demand.

(Click on image to enlarge)

More By This Author:

The Clean Energy Stocks That Outperformed Their Dirty Peers

Emerging Markets Presents Healthy Fundamentals

Capitalization, Style - Wave-Trend Summary, Week Ending April 6

Disclaimer: These illustrations are not a solicitation to buy or sell any ETF.