Emerging Markets Presents Healthy Fundamentals

Photo by Wance Paleri on Unsplash

Investors may be looking for yields as U.S. fixed income securities like corporate and Treasury bonds offer reduced returns. The appealing emerging market local currency bond market, which offers capital appreciation, a reliable return, and gains from emerging market currency appreciation, is one location where they can quench their thirst.

Given sufficient levels of foreign exchange reserves, better fiscal health, and comparatively lower debt levels, the currencies of developing countries are likely to outperform the U.S. dollar in the long run. Additionally, bonds denominated in local currencies would result in gains when the currencies of developing markets increase. When compared to comparable bonds for developed market countries, the returns for many of these countries appear to be higher because they are below investment grade.

The US currency is now almost 50% stronger than it was five years ago, though it is still slightly lower than its peak of late 2022. Much of the globe grew slowly or not at all during this time, and negative interest rates were frequently used.

However, international bonds should be included in a portfolio in 2023 and possibly even into the following year for the following reasons: Europe's apparent victory over the Russian gas embargo; the absence of the predicated global recession; the decline in the value of the dollar; China's reopening; expectations for better European growth; and, perhaps most persuasively, the end of negative interest rates.

Three choices come to mind:

WisdomTree Emerging Markets Local Debt Fund (ELD)

iShares Emerging Markets Local Currency Bond ETF (LEMB)

SPDR Barclays Capital Emerging Market Local Bond ETF (EBND)

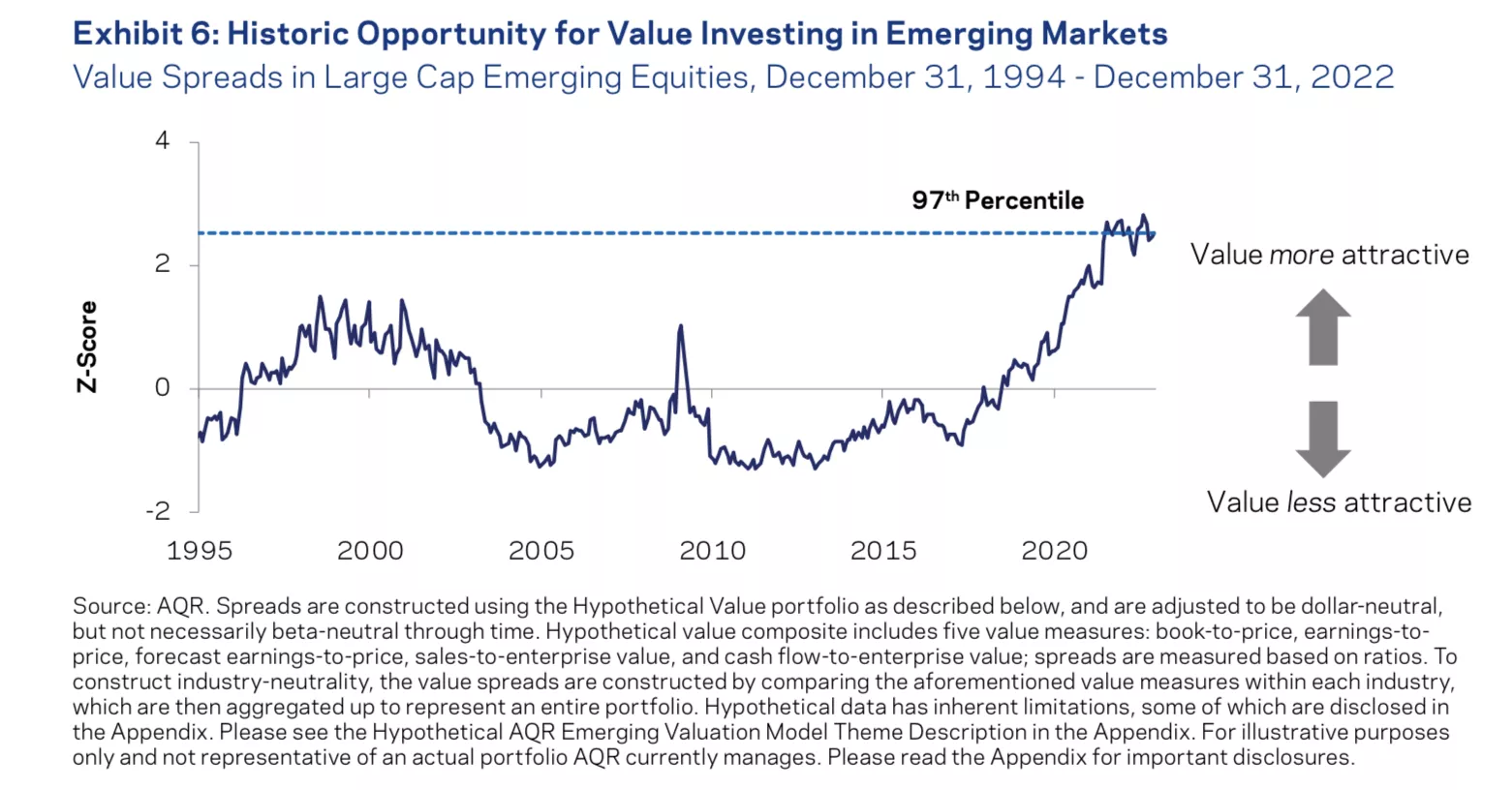

Additionally, whether strategically, tactically, or even through their investment managers, many investors are likely underinvesting in emerging economies. Despite the fact that these markets have traditionally lagged behind developed ones since the GFC, current values indicate an emerging market premium that hasn't been seen in a while, one that may be about to increase.

be particularly helpful in the low projected return environment of today. "Value spreads" represent a historically appealing possibility for investors with value-oriented portfolios who are looking for even more opportunities within emerging economies.

Options:

iShares Edge MSCI EM Value Factor UCITS ETF (EMVL)

Dimensional International Value ETF (DFIV)

More By This Author:

Capitalization, Style - Wave-Trend Summary, Week Ending April 6

Equities, Fixed, Commodities - Wave-Trend Summary, Week Ending April 6

The Investment Opportunities That Address The Plastics Dilemma

Disclaimer: These illustrations are not a solicitation to buy or sell any ETF.