Up With The Escalator, Down With The Elevator...

The stock market once again confirmed an old stock market adage: ‘up with the escalator, down with the elevator’. For investors, who in their recent state of intoxication expected further interest rate cuts, the relatively aggressive message from Fed Chairman Jay Powell came as a ‘surprise’. We mentioned in Thoughts 46, 48, 49 and again in issue 54 that this interest rate fantasy may not correspond to reality. Jay Powell justified the more cautious outlook with a potential increase in inflation in 2025, caused by Donald Trump's tariff policy. We last discussed the issue of higher inflation in issue 59, and there are many indications that it will rise. But what about Trump's tariff policy: is it possible that it is just a negotiating tactic? He had already imposed the threat on Mexico in 2019. Since Mexico reacted very quickly in line with his demands, it was taken off the table within a month...

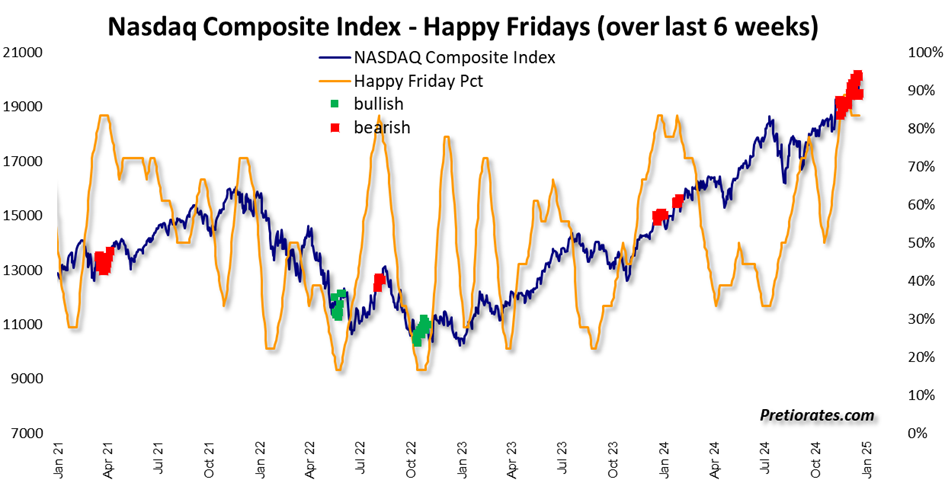

Now the question is whether Jay Powell has just dampened the party or crashed it. We have many sentiment indicators and are happy to publish selected ones via Pretiorates. Perhaps the best statement at the moment is made by the ‘Friday indicator’. This shows when sentiment is particularly good on a Friday. This is how the investor goes into the weekend, looking forward (with bullish sentiment) to the coming week.

During the last few days and weeks, however, it has issued (bearish) warnings almost daily that the mood is too positive...

(Click on image to enlarge)

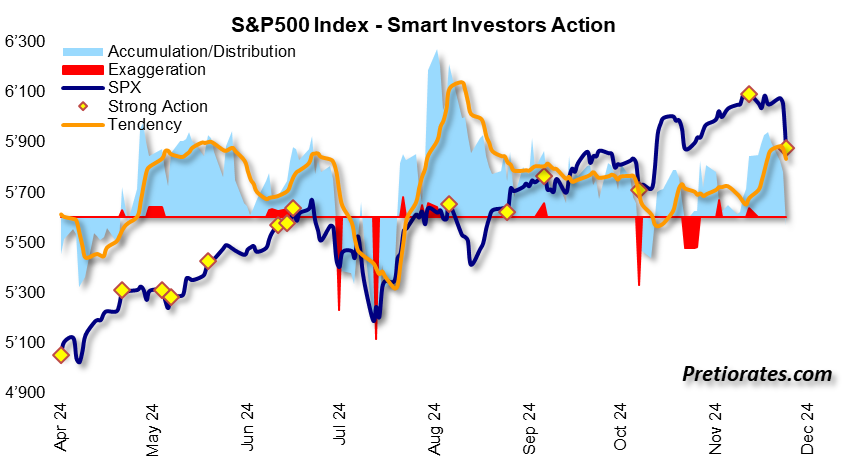

Even the 'smart investors' in the S&P500 index were surprised when they continued to accumulate during the last few weeks, albeit only slightly. However, yesterday's 'strong action' suggests that there should at least be a short countermovement...

(Click on image to enlarge)

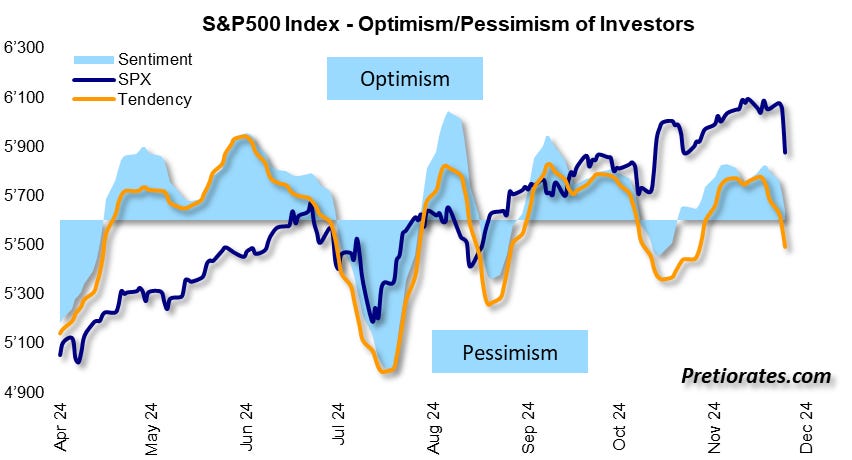

The good sentiment has already started to decline a few days ago and has now fallen into slight pessimism. We repeat: 'slight pessimism'...

(Click on image to enlarge)

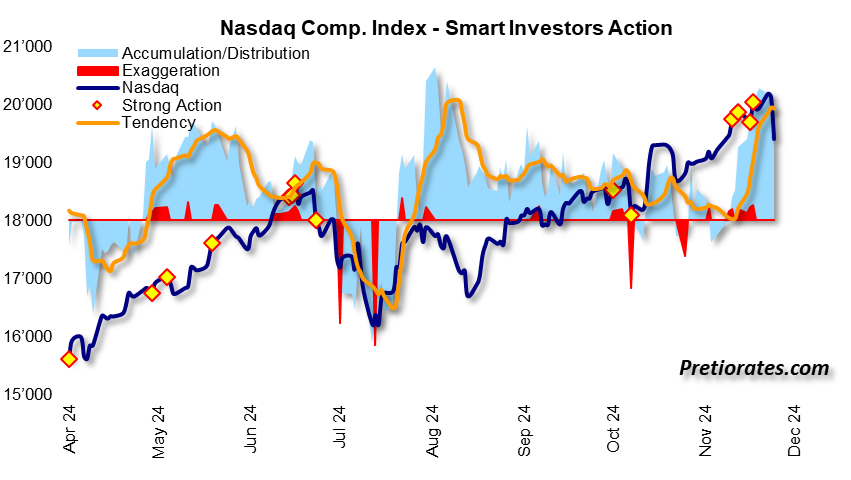

The party has been particularly loud again over the past few days, especially among Nasdaq stocks: strong accumulation, but a large number of 'strong actions' warned that a countermovement is due...

(Click on image to enlarge)

The sentiment has not yet fallen into negative territory... there is still potential there...

(Click on image to enlarge)

There are also fundamental arguments in favor of the bears. According to the strong US dollar development (shown inversely in the chart), the profit expectations for the S&P500 companies are perhaps too high...

(Click on image to enlarge)

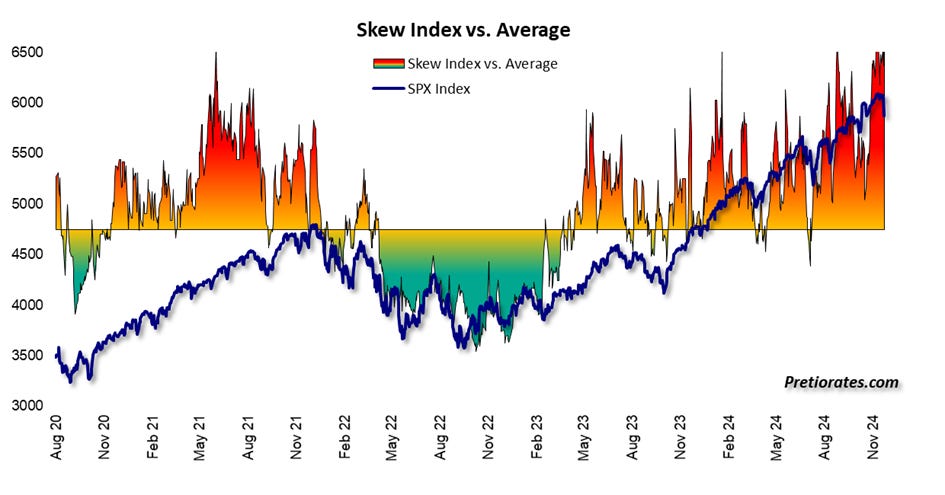

The Skew Index shows how expensive it is to hedge investments (using puts). The bright red area indicates that it has recently been cheaper than almost any time in the last five years. In other words, nobody had an interest in hedging...

(Click on image to enlarge)

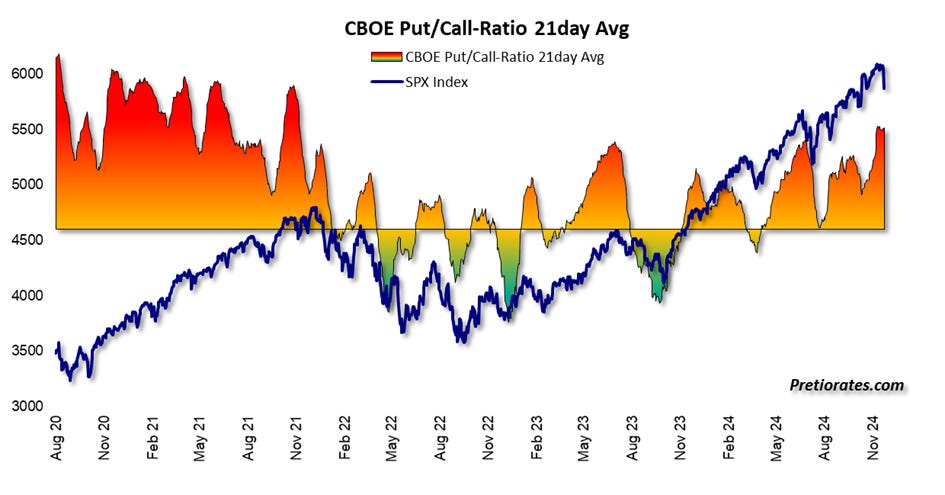

This is also reflected in a (too) confident call/put ratio...

(Click on image to enlarge)

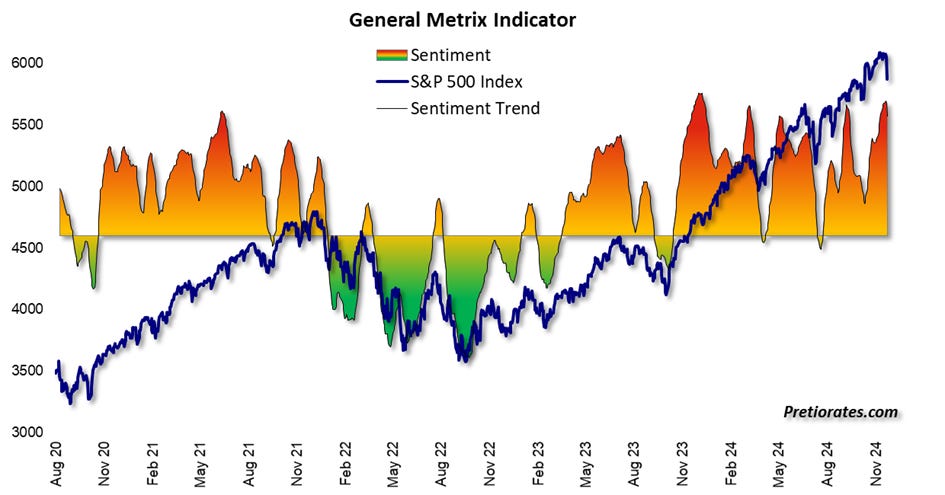

The ‘General Metrix Indicator’, which combines various sentiment indicators, is still at a highly confident level. A long-term low is only to be expected when this indicator falls into the green zone...

(Click on image to enlarge)

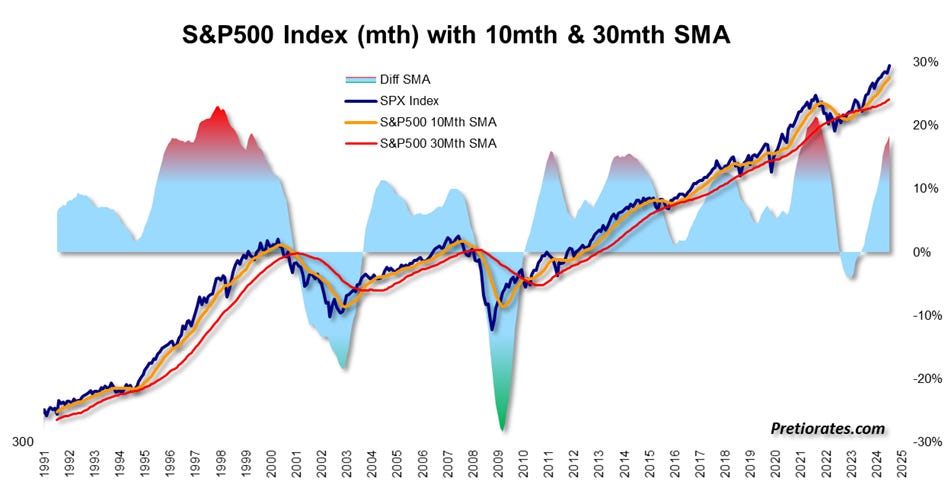

Another (longer-term) indicator: whenever the spread between the 10- and 30-month averages enters the red zone, it is better to be thinking about selling than buying.

(Click on image to enlarge)

In Thoughts 58, we looked at the mysterious 17-year cycle. Is it possible that this cycle has just been confirmed by current developments?

(Click on image to enlarge)

More By This Author:

Hurray, China Is Buying Gold Again

It Is The Last Month Of 2024

The ISM Economic Figures And The Power Behind Them

Disclaimer: The information & opinions published by Pretiorates.com or "Pretiorates Thoughts" are for information purposes only and do not constitute investment advice. They are solely ...

more