Sterling’s Spring Lift: Seasonal Strength Meets USD Softness

- Instrument: GBP/USD

- Average Pattern Move: +0.88%

- Timeframe: April 7 – May 8

- Winning Percentage: 70.00%

You may not realise that GBP/USD has a strong historical tendency to rise through April and into early May. With seasonal tailwinds forming just as the dollar begins to lose its grip on global FX leadership, this could be a timely setup for renewed GBP strength. We want to analyse the data in more detail.

The chart shows you the typical development of GBP/USD between April 7 and May 8 over the last 20 years. During this period, cable has posted gains 70% of the time, with an average return of +0.88%, a median return of +1.36%, and an annualized return of +10.86%.

The consistent upward slope of the cumulative profit line supports the pattern’s robustness, and gains have often come in years when macro headwinds for the dollar began to materialize — just as we’re seeing now.

Why Might It Work Again?

President Trump’s increasingly polarizing tariff policy is shaking global confidence in the dollar. The threat of renewed trade fragmentation is prompting FX markets to price in softer US growth and greater downside risks for the greenback. Add to this the Fed’s recent dovish shift and a flattening US yield curve, and it’s no surprise that USD has started to soften against its G10 peers.

Sterling, meanwhile, is benefiting from relatively firmer UK inflation and a repricing in Bank of England rate expectations. That dynamic, when paired with seasonal strength, could support a continuation higher in GBP/USD — particularly if US data continues to deteriorate relative to expectations.

Technical Perspective

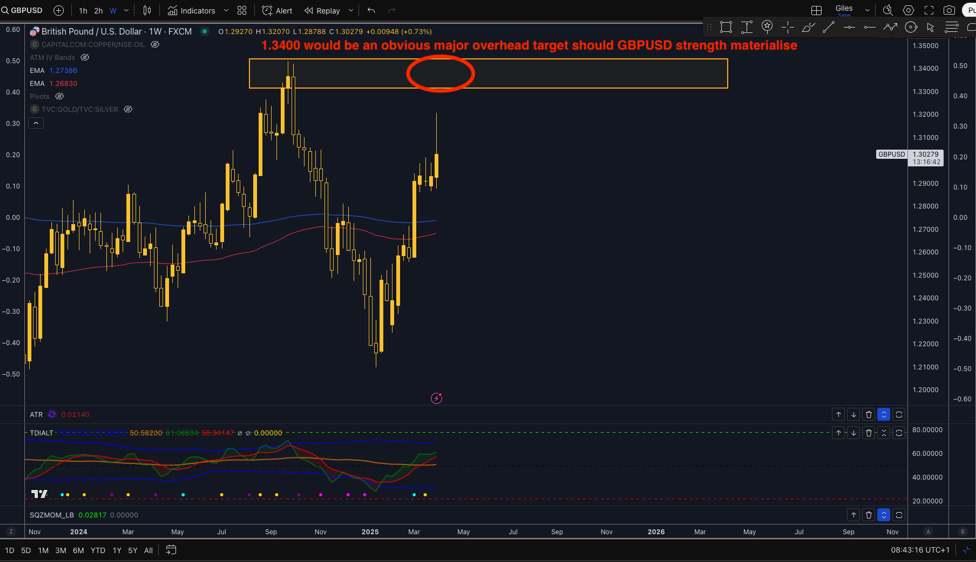

From a technical standpoint the GBPUSD pair has been experiencing strong moves post Trump’s announcement on tariffs. Should USD weakness persist the overhead target at 1.3400 would be an obvious overhead target.

Trade Risks

The moves in GBP/USD will be highly sensitive to the path of US data, the April 10 US CPI release, and evolving commentary around tariffs. A sudden spike in US inflation or a geopolitical shift could reintroduce dollar strength. Past seasonal trends, while compelling, are not guarantees of future performance.

Video Length: 00:01:42

More By This Author:

Can US Tariff News End Up Tipping The USD/CAD Lower This April?Why The FTSE Flies In April

Gold’s Next Move? Watch This Short-Term Seasonal Surge

Disclosure: High Risk Investment Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading ...

more