Gold’s Next Move? Watch This Short-Term Seasonal Surge

- Instrument: Gold

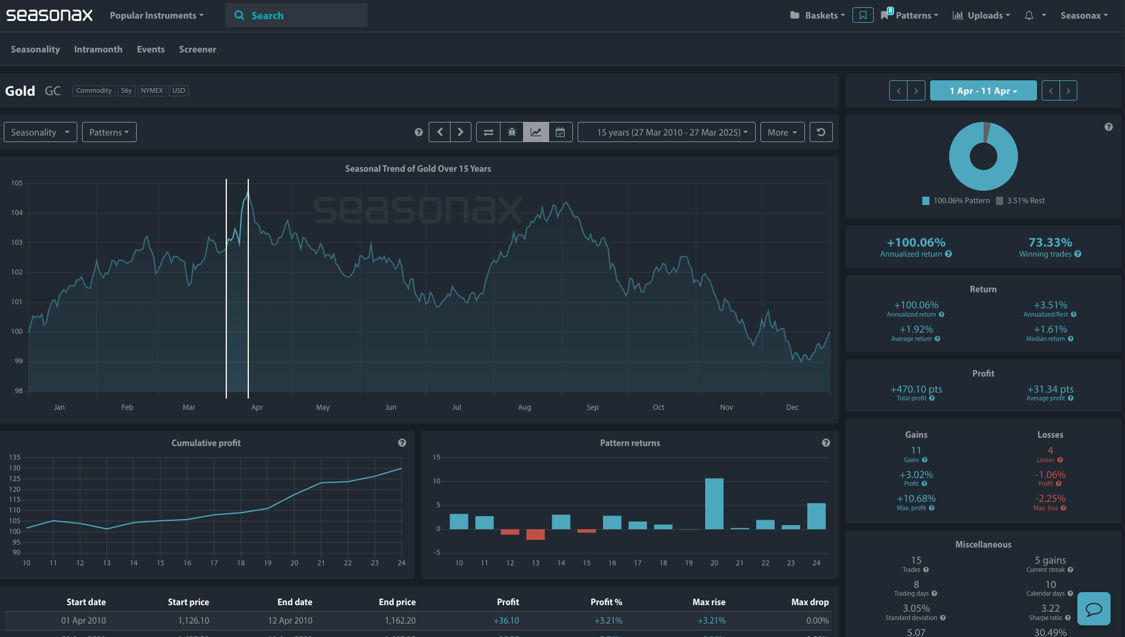

- Average Pattern Move: +1.92%

- Timeframe: 1 Apr – 11 Apr

- Winning Percentage: 73.33%

You may not realise that gold has a habit of posting strong short-term gains at the beginning of April — and in 2025, the macro landscape may offer fundamental fuel for another push higher. With inflation risks persistent, central banks accumulating gold, and deficits ballooning, we want to analyse the data in more detail.

The chart shows you the typical development of the gold price between April 1 and April 11 over the last 15 years. As you can see, gold has averaged a +1.92% gain during this period, with a 73.33% winning percentage — a strong short-term seasonal signal. In fact, this 10-day stretch has delivered a +100.06% annualised return, historically.

(Click on image to enlarge)

Why does it matter now?

The macro case for gold continues to build:

- Central banks are buyers: Gold accumulation by central banks reached record highs in 2023, and demand remains elevated as countries seek to diversify away from USD holdings.

- Production is falling: Major miners are adopting capital-conservative strategies, and there’s a lack of significant new gold discoveries.

- Debt and deficit concerns: Government debt levels and fiscal imbalances are approaching historical extremes. The current environment echoes the debt overhang of the 1940s, the inflation shock of the 1970s, and the valuation extremes of the late 1990s.

- Deglobalisation and geopolitical tension: Ongoing global fragmentation increases demand for hard assets like gold, especially in the face of renewed focus on manufacturing and rising political uncertainty.

- Rebalancing in traditional portfolios: The 60/40 portfolio is under pressure, and investors are increasingly looking for haven alternatives — with gold a natural fit.

What could fuel a short-term rally?

The setup into early April is compelling. A softer US dollar, dovish Fed rhetoric, or continued safe-haven demand could all support a further leg higher in gold. In this window, seasonality is clearly aligned with macro momentum.

Technical Perspective

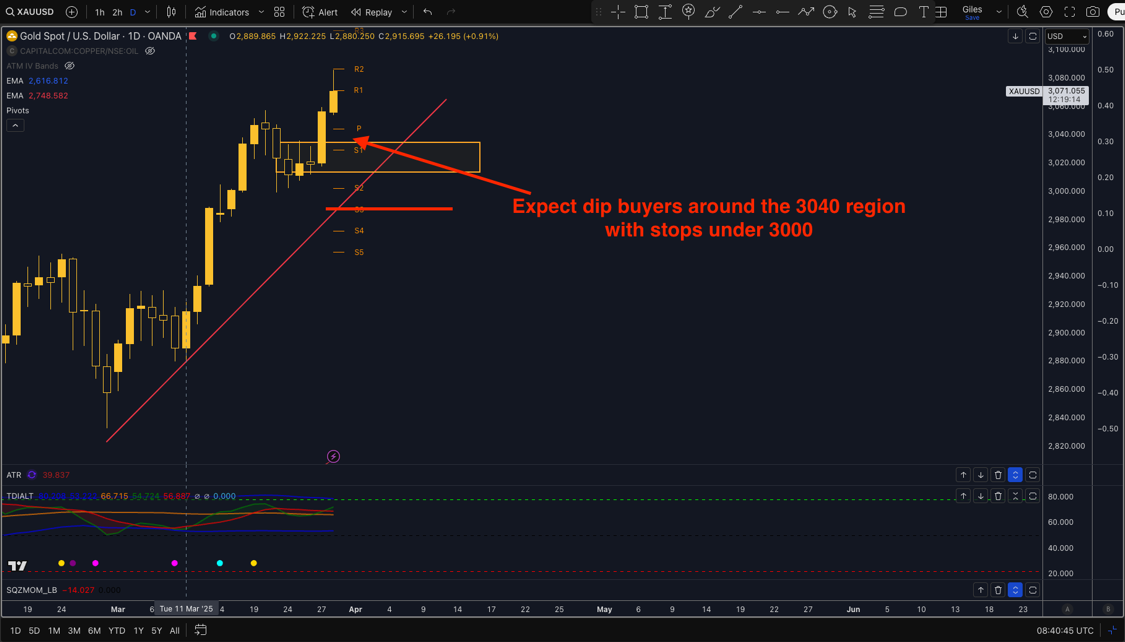

From a technical standpoint gold’s uptrend is unrelenting and dip buyers could be expected from 3,040 with stops easy to place under this key daily trend line under the big round number of 3,000

(Click on image to enlarge)

Trade risks: The main risk is a sharp rise in real yields or a surge in USD that undercuts gold’s relative appeal. A hawkish shift by the Fed, or calming in geopolitical tensions, may limit upsides.

Video Length: 00:02:17

More By This Author:

Will US Treasury Secretary Bessent Send U.S. 10-Year Treasuries Lower This Summer?

Can The FTSE 100 Leave Fiscal Tightening Behind?

BYD’s Seasonal Strength: A Potential Rally Ahead?

Disclosure: High Risk Investment Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading ...

more