Joe Weisenthal’s Take Down Of The ‘Debasement’ Trade

Bloomberg’s Joe Weisenthal wrote an interesting article (Maybe ‘Debasement’ Isn’t The Best Way To Put it), sharing his opinion on the rising popularity of the so-called debasement trade. The debasement trade logic that Joe generally debunks is growing very popular in the media, per the Bloomberg graph below.

While Joe thinks the debasement trade logic is possible, he finds some flaws in it as an explanation for market behaviors. For one, rising gold prices. If the currency were truly being debased, hard assets, such as “the ultimate hard asset” real estate, should be surging alongside gold and precious metals. Per Joe:

This (real estate) is the ultimate “hard” asset, and yet, prices are barely going up. Here’s the Case-Shiller Home Price Index, which is currently growing at a pace well below most of the decade.

His graph shows home prices have been flat. Joe moves on to bonds, questioning why they are trading well if the currency is truly being debased at such an alarming rate. The Ten-year UST note has fallen from 4.70% to 4.00% over the course of the year.

Joe wisely points out that the speculative fervor in the stock market doesn’t align with behaviors associated with dollar debasement. To wit:

But when you look at some of the profit-less names that have been screaming higher, it doesn’t necessarily look like investors trying to get ahead of a steady weakening of the US dollar. It looks like retail traders trying to score a fast win. If investors were, in fact, responding to fears of debasement, I would imagine they would be more excited about investing in a stock like Colgate-Palmolive. People are always going to need to brush their teeth after all, no matter what’s happening with deficits or monetary policy. And yet.

Colgate Palmolive shares have been steadily declining as the “debasement” trade has flourished. Joe sums up his article as follows:

The market isn’t exactly a picture of health. But it’s also not obvious that debasement is the best way to characterize how the market is trading.

What To Watch Today

Earnings

(Click on image to enlarge)

Economy

(Click on image to enlarge)

Market Trading Update

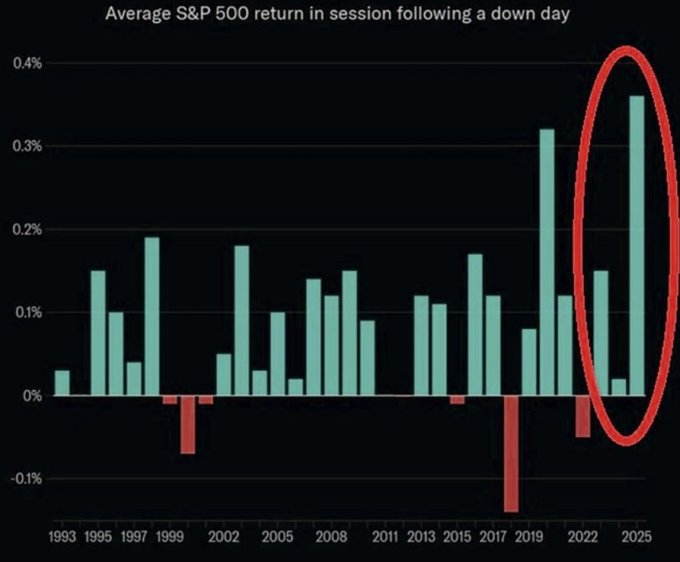

Yesterday, we covered the technical backdrop of the market as we enter this earnings heavy week. However, yesterday, dip buyers returned with a vengeance across the board buying stocks, crypto, gold, and any other asset class that has been going up. As we discussed, in a “zero risk” environment such is not surprising, and buying the dip…in everything, has been a winning strategy this year. In fact, its been the best return for that strategy in 30-years.

Such is why investors need to stay invested for now. However, there are certainly reasons to remain concerned about the risk. Wall Street is happy to produce products to meet investor demand, with the speculative risk soaring it is not surprising to see more speculative products surge in quantity. However, with that demand, is also the risk. These products in particular use options, which work great as long as the market is rising. However, these products can, and will, go to “zero” during a market decline. Most retail investors piling into these securities do not fully comprehend the risk they are taking.

Most notably, we are not talking about the 2x or 3x leveraged products any longer. We are now seeing 5x leveraged products.

As Doug Kass recently noted:

“The bigger picture trends of markets and economies using more and more leverage are quite clear. Leverage in increasingly crowded passive investing products and strategies (markets are not elastic enough to take in the rising inflows – this serves to lower the point in which quants may become a destabilizing market influence).”

- Nearly 70% of daily option trading has an expiration of one day. Leverage in structured products

- Leverage in non-deposit financial institutions, private equity and crypto currencies

- Leverage underlying the AI cap spending cycle

- Leverage at the municipal and Federal government levels (with annual federal debt service payments now topping annual U.S. defense outlays)

Some lack concern regarding a worrisome credit cycle and/or a systemic trend — like my pal, the lynx-eyed Dan Greenhaus. Dan writes that “the recent credit market flare-ups are best viewed as a series of one-offs rather than evidence of a broader systemic issue:

The thing about leverage to remember is that the “edge that cuts you, cuts the deepest.”

Trade accordingly.

The Dollar and Credit Concerns Are Driving Performance

The graphic below, courtesy of SimpleVisor, shows that the most overbought factors (emerging markets and gold miners) are those that benefit from a weaker dollar. While the dollar was weaker last week, it is showing signs of potentially reversing its poor trend. Such a reversal could take some steam out of the foreign markets and precious metals stocks. It may also weigh on the highly speculative factors, which are also among the most overbought on a relative basis.

At the other end of the performance spectrum, small and mid-cap companies are the most out of favor. While the small and mid-cap sectors have been out of favor for a while, recent signs that corporate credit and liquidity are becoming problematic may be keeping those sectors from performing better versus the market. Small and mid-cap companies tend to be more reliant on bank lending instead of the bond markets for trade and investment capital. With the bankruptcy of First Brands and TriColor, along with revelations of other credit losses, investors may be concerned that the primary source of liquidity for smaller companies will dry up and or become more expensive.

Speculative Bull Runs And The Value Of A Bearish Tilt

Friday’s market crack certainly woke up the more complacent bullish investors. Of course, the complacency was warranted, given the recent market surge, conversations about “TINA” (There Is No Alternative), and how “this time is different.” But that is what a speculative bull run looks and feels like. However, deep inside, you know there are risks. Valuations seem insane, credit spreads are historically tight, and sentiment and trading activity push more speculative extremes. Such is why, while considered “bearish,” we discuss risk management protocols. Why? Because such actions can protect you when it matters most. This is why I want to discuss a different approach to portfolio management with you today. Rather, how to think like a “bear,” so you see the risks of the speculative bull run. However, to act like a “bull” to capture the gains while available.

But that is a difficult skill to master.

Yes, thinking like a bear means you are aware of the exceedingly high levels of investor complacency, that valuations are stretched, and credit spreads have been crushed. Furthermore, margin debt is at very high levels, which provides the fuel for the eventual downturn.

The problem with speculative bull runs is that they always end, and most of the time that ending is destructive. READ MORE…

Tweet of the Day

More By This Author:

Speculative Bull Runs And The Value Of A Bearish TiltRally Into Year-End: 3 Reasons To “Buy Dips”

Liquidity Warning: SOFR Raises The Red Flag

Disclaimer: Click here to read the full disclaimer.