Daily Market Outlook - Thursday, April 3

Image Source: Pixabay

Global financial markets experienced a sharp selloff as Trump's unexpectedly aggressive efforts to reshape the global economic landscape rattled investors. Asian markets suffered losses, with Japan's benchmark index plummeting to an eight-month low. Yields on U.S. 10-year Treasuries hit their lowest levels in over five months as investors flocked to safe-haven assets, driving up the Japanese yen. Gold prices surged to a record high. The tariff implications have impacted all headline financial instruments, with equity futures experiencing sharp declines (e.g., S&P 500 down 2.9%, FTSE 100 down 1.5%), Treasury yields falling (e.g., the 5-year yield down 15 basis points to around 3.80%), and the U.S. Dollar weakening (e.g., USD/JPY dropping from 150 to approximately 147). The 2-year U.S. breakeven inflation rate rose by roughly 10 basis points to 3.40%, signalling that inflation concerns are partly driving market reactions. However, the predominant initial response appears to stem from apprehension regarding the broader economic outlook. Major multinational corporations reliant on global supply chains, including Apple, Toyota, and Nike, are expected to continue to scale back operations amid rising uncertainty. Yields also fell across Japan, Australia, and New Zealand, while bond futures rose in Europe and Canada. The market turmoil has sparked expectations of a significant rise in the cost of insuring against corporate defaults, with a key indicator forecasting the largest increase since 2023.

The highly anticipated announcement from Trump introduced a 10% universal minimum tariff on imports into the United States. Several countries will face higher rates, referred to as 'reciprocal' tariffs, determined by evaluations of their bilateral trade deficits and both tariff and non-tariff barriers against U.S. exports. For instance, the European Union will see a total tariff rate of 20% (inclusive of the 10% minimum), while Lesotho could be subjected to rates as steep as 50%. China’s tariff rate will climb to 54%, combining the newly imposed 34% with its existing 20%. The United Kingdom, however, will only be subject to the 10% minimum. These tariffs are scheduled to take effect on Saturday, although the announcement leaves room for Trump to modify terms, enabling significant political manoeuvring and the potential for retaliatory measures. As a result, the uncertainty surrounding the announcement is unlikely to dissipate soon. Certain goods are exempt from the reciprocal tariffs, such as steel, aluminium, energy, and minerals unavailable domestically. Additionally, prior agreements with Mexico and Canada will remain in place. It remains uncertain how lasting these tariff rates will be, as the White House has indicated a willingness to negotiate with various nations. Businesses will struggle to make long-term plans amid such instability. Additionally, counteractions are anticipated, with countries preparing to challenge Trump's new global stance. European Commission President Ursula von der Leyen recently stated that there would be retaliation if talks are unsuccessful.

Today's macro slate includes: Final March Services PMIs, US Services ISM, Initial Jobless Claims (IJC), trade data, and ECB meeting minutes. Key speakers are ECB’s Schnabel and Guindos, along with Fed’s Jefferson and Cook.

Overnight Newswire Updates of Note

- Trump Unveils 10pc Global Tariff, 10pc On Aussie, 34pc On China

- Yen Rallies, Japanese Bonds Surge While Stocks Slump On Tariffs

- Japan’s Bank Shares Plunge As Tariffs Hurt BoJ Rate Hike Outlook

- Japan Calls Trump’s 24% Tariff Regrettable, Pushes For Exemption

- China Urges US To Immediately Lift Tariffs, Vows Retaliation

- China Stocks Pare Loss As US Tariffs Spur Bets On Policy Support

- China Services Growth Picks Up With Economy Pressured By Tariffs

- Bitcoin And Top Altcoins Slide As Trump Kicks Off Reciprocal Tariffs

- Fed’s Kugler Supports Holding Rates Amid Upside Inflation Risks

- Treasury Yields Fall As Markets Digest Tariffs

- EU Vows To Respond With Countermeasures To Trump’s 20% Tariffs

- Europeans Look To Nato Assets For Ukraine Peace Force

- Roche: EMA Requests Clinical Hold On Elevidys Studies

- Rolls-Royce In Talks Over UK Subsidies For New Engine Development

- XAU Corrects From Record High As Focus Shifts To US NFP Data

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0800 (4.8BLN), 1.0850 (2.1BLN), 1.0875 (3BLN)

- 1.0900-10 (3.2BLN), 1.0915-20 (1.3BLN), 1.0930 (300M), 1.0940-50 (1BLN)

- 1.0985 (1.2BLN), 1.1000 (1.2BLN)

- USD/CHF: 0.8595 (600M), 0.8675 (1BLN)

- EUR/CHF: 0.9525 (250M), 0.9545 (558M), 0.9575 (311M)

- EUR/GBP: 0.8325 (200M), 0.8345-55 (840M), 0.8415-25 (309M)

- GBP/USD: 1.3035 (291M), 1.3100-10 (363M), 3100-05 (282M), 1.3120-25 (387M)

- AUD/USD: 0.6260-65 (700M), 0.6290-6300 (1.4BLN), 0.6320 (660M)

- NZD/USD: 0.5690 (720M), 0.5720 (370M), 0.5800 (352M)

- USD/CAD: 1.4280 (659M), 1.4375 (1.2BLN)

- USD/JPY: 145.00 (5.2BLN), 146.00 (1.4BLN), 147.00 (2.1BLN), 148.00 (3.6BLN)

- 148.25-35 (2BLN), 148.50 (1.4BLN). EUR/JPY: 162.30 (645M)

CFTC Data As Of 28/3/25

- Equity fund managers have increased their S&P 500 CME net long position by 83,572 contracts, bringing the total to 915,841. Meanwhile, equity fund speculators have raised their S&P 500 CME net short position by 41,376 contracts, now totalling 236,867. Speculators have also expanded their CBOT

- US Treasury bonds futures net short position by 24,765 contracts to reach 38,275. Additionally, they have reduced their CBOT US Ultrabond Treasury futures net short position by 14,792 contracts, now at 232,366. The CBOT US 10-year Treasury futures net short position has been trimmed by 71,284 contracts, bringing it to 810,090. Speculators have reduced their CBOT US 5-year Treasury futures net short position by 5,853 contracts to total 1,900,087, and the CBOT US 2-year Treasury futures net short position has been cut by 38,970 contracts, now standing at 1,181,586.

- The Japanese yen holds a net long position of 125,376 contracts, while the Swiss franc reports a net short position of -37,593. The British pound has a net long position of 44,283 contracts, and Bitcoin holds a net long position of 1,179 contracts.

Technical & Trade Views

SP500 Pivot 5790

- Daily VWAP bullish

- Weekly VWAP bearish

- Seasonality suggests bullishness into late April

- Above 5885 target 5950

- Below 5815 target 5415

(Click on image to enlarge)

EURUSD Pivot 1.0750

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness into the end of April

- Above 1.0750 target 1.11

- Below 1.0690 target 1.0550

(Click on image to enlarge)

GBPUSD Pivot 1.28

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bullishness into late April

- Above 1.2850 target 1.32

- Below 1.2790 target 1.2660

(Click on image to enlarge)

USDJPY Pivot 150.50

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bullishness into Apr 9th

- Above 1.52 target 153.80

- Below 150.50 target 145

(Click on image to enlarge)

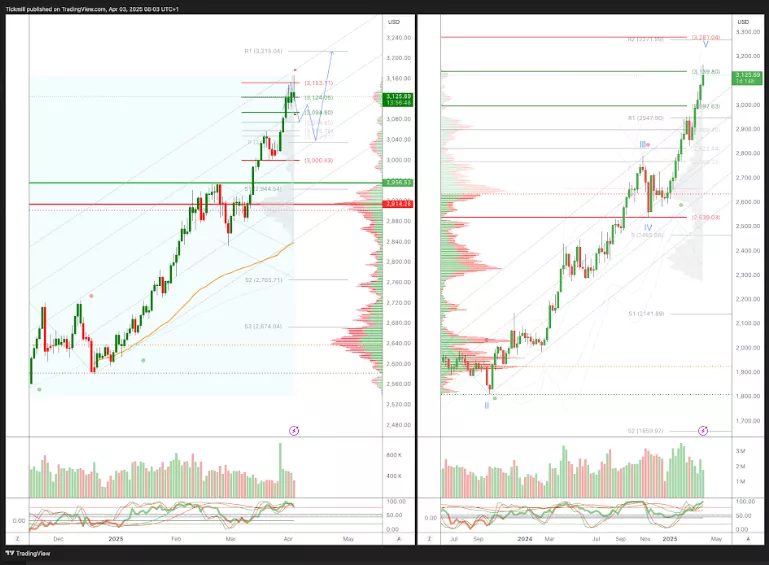

XAUUSD Pivot 2950

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness into mid/late April

- Above 2900 target 3100

- Below 2880 target 2835

(Click on image to enlarge)

BTCUSD Pivot 90k

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bullishness into Apr 9th

- Above 97k target 105k

- Below 95k target 65k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Wednesday, April 2

Daily Market Outlook - Wednesday, April 2

The FTSE Finish Line - Tuesday, April 1