The FTSE Finish Line - Wednesday, April 2

Image Source: Pexels

UK stocks fell on Wednesday as global markets braced for U.S. President Donald Trump's announcement of reciprocal tariffs, heightening fears of an escalating trade conflict that could hinder economic growth. The FTSE 100 index slipped 0.25% near the close. Trump is set to reveal sweeping tariffs on global trading partners at 2000 GMT, an event the White House has dubbed "Liberation Day," potentially challenging established trade norms. Most sectors recorded losses, with Aerospace and Defence leading the decline, dropping 2.5%. Healthcare stocks also took a hit, mirroring European counterparts, as AstraZeneca fell 2.2%, GSK dropped 3%, Convatec Group slid 2.7%, and Hikma Pharmaceuticals dipped 1.9%. A UK healthcare companies index hit its lowest level in nearly two months, down 2.2%. Meanwhile, a survey revealed that pay raises by British employers slowed in the three months leading to February, consistent with official data showing decelerating wage growth. This trend suggests the Bank of England may consider lowering borrowing costs later this year.

Single Stock Stories & Broker Updates:

- Shares of YouGov rose 4.23%. J.P. Morgan initiated coverage with a "Neutral" rating and a price target of 400p, citing growth potential but concerns about strategic direction and leadership. JPM noted low visibility on the strategy as a negative factor until a new CEO is appointed, following Stephan Shakespeare's interim appointment. The company expects modest revenue growth for FY25, while analysts have an average rating of "buy" with a median target UK's Bakkavor Group rises 6.7% to 190p as Greencore agrees to buy it for £1.2 billion in cash and stock. The offer of 200p represents a 12.4% premium. BAKK shareholders will receive 85p in cash and 0.604 GNC shares per Bakkavor share. GNC falls 2.8% to 174p, with BAKK up ~22% and GNC down ~8% this year.of 685p. The stock is down 31.6% YTD.

- Raspberry Pi rises 6.5%, leading gainers on FTSE 250. The company exceeds FY core profit expectations, boosted by sales of Raspberry Pi 5 and semiconductors. Jefferies upgrades to "buy," the only positive rating according to LSEG data, citing recovery from inventory issues and growth from new products. Average stock rating remains "hold" with a median price target of 522.50p. However, stock is down 20.3% this year.

- Shares of Aston Martin are down 1.6%. J.P. Morgan reports unfavorable U.S. market conditions with high inventory and stock clearance, cutting the price target to 90p from 160p. The U.S. market represents 30% of sales, and a 25% tariff on vehicle sales effective April 2, 2025, hasn't been included, posing further challenges. Of ten brokerages, two rate it "buy," seven "hold," and one "sell," with a median price target of 97.5p. The stock has fallen nearly 35% this year.

- UK's Bakkavor Group rises 6.7% as Greencore agrees to buy it for £1.2 billion in cash and stock. The offer of 200p represents a 12.4% premium. BAKK shareholders will receive 85p in cash and 0.604 GNC shares per Bakkavor share. GNC falls 2.8% to 174p, with BAKK up ~22% and GNC down ~8% this year.

- Chemring's stock rose 4.65% after securing a £251 mln missile contract with the UK's Ministry of Defence, part of a multi-year STORM framework. Jefferies suggests this will enhance Roke's FY28 revenue target and address the shortfall in the Sensors & Information division. The stock is up around 15% this year.

- Shares of Topps Tiles dropped 5.3%, making it a top loser on the FTSE Small Cap index. The UK tile retailer anticipates a £4 million increase in annual costs due to the national living wage and insurance, impacting nearly two-thirds of profits for the 2024 fiscal year. HY group sales, excluding CTD assets, rose 4% to £127.7 million. The stock is currently at a session low, bringing YTD losses to approximately 15%.

- RBC Capital Markets raises Rathbones' rating to "outperform" and price target to 2,000p from 1,850p, citing expected earnings benefits from Investec Wealth integration from FY25 onward. RAT appointed Jonathan Sorrell as new CEO last month. RBC notes new management provides a strategic growth opportunity. Current stock rating is "hold" with a median price target of 2,142p; RAT is down 6% this year.

Technical & Trade View

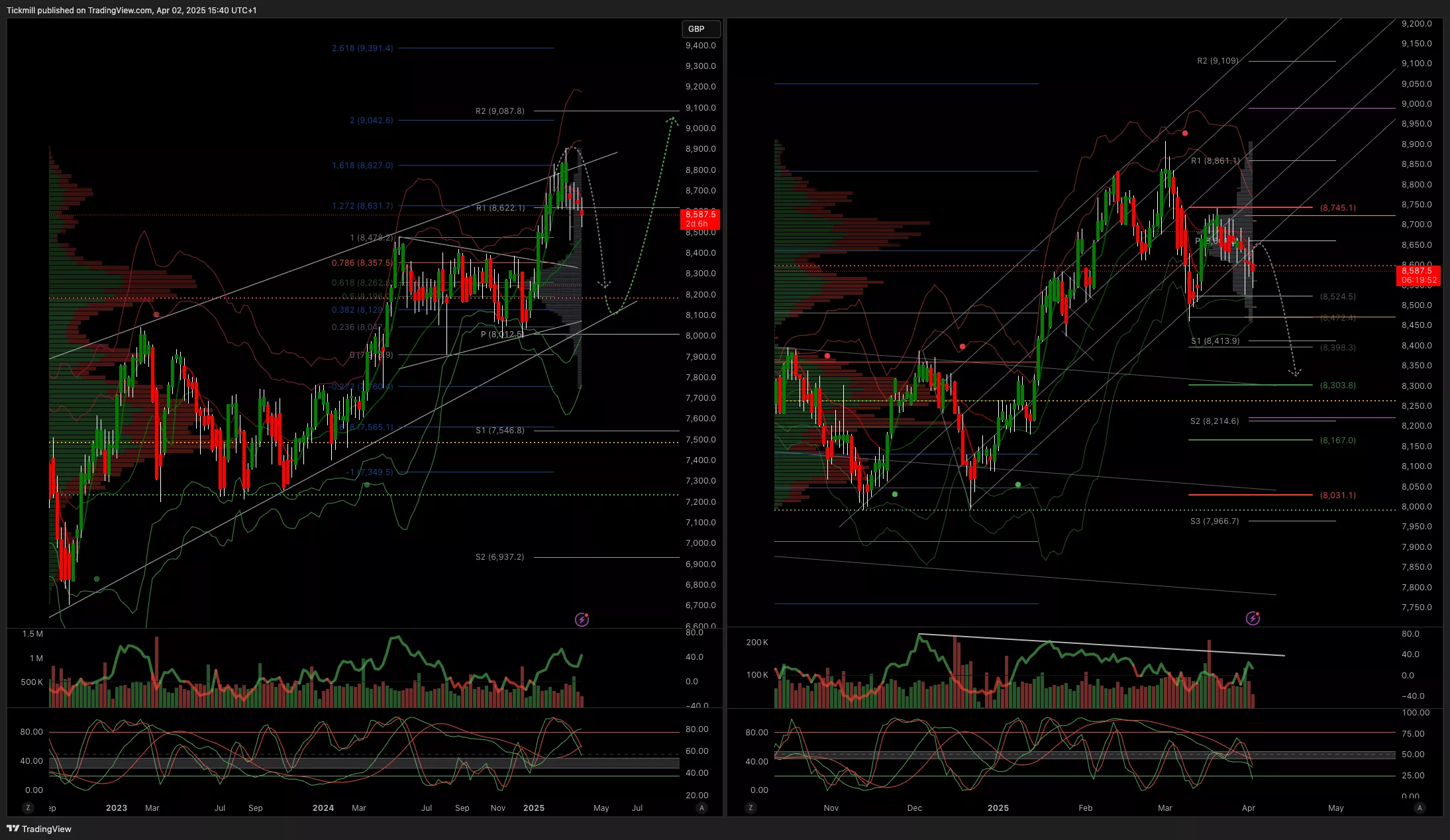

FTSE Bias: Bullish Above Bearish below 8950

- Primary support 8700

- Below 8700 opens 8600

- Primary objective 9050

- Daily VWAP Bearish

- Weekly VWAP Bearish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Wednesday, April 2

The FTSE Finish Line - Tuesday, April 1

Daily Market Outlook - Tuesday, Apr. 1