Daily Market Outlook - Tuesday, Apr. 1

Image Source: Pixabay

Asian stocks rebounded after a multi-day losing streak, driven by heightened market volatility as President Donald Trump prepared to unveil his tariff plan. The regional MSCI index climbed as much as 1.1%, with Taiwanese and South Korean shares leading the gains. Gold surged to a new high amid increased demand for safe-haven assets, while the dollar posted modest gains against most G10 currencies. Investors received updates on Trump's reciprocal tariff plan, set to be announced at 3 p.m. Wednesday during an event at the White House Rose Garden. However, details of the tariffs remain unclear, prompting traders to tread cautiously. Concerns about the potential impact on U.S. economic growth and inflation have tempered large investment moves ahead of the announcement. Global markets remain on edge, grappling with heightened volatility following the worst quarterly performance for U.S. stocks relative to global equities since 2009. The event marked the first time since the pandemic's onset in March 2020 that bonds gained while stocks fell over a three-month period. Meanwhile, the dollar—typically viewed as a safe haven during market turbulence—recorded its weakest start to a year since 2017. Trump's rhetoric over the weekend drove a turbulent start to a busy week, causing early market weakness. However, month-end pension demand helped stabilise markets later in the session.

UK credit extension slowed in February, with net mortgage lending falling to £3.3bn (below the £3.8bn estimate) from £4.2bn in January, and consumer credit decelerating to £1.4bn from £1.7bn. While annual growth is supported by a surge in housing transactions ahead of stamp duty changes, underlying credit demand remains weak, including in the corporate sector. Though credit contraction has eased, it continues to shrink in real terms relative to nominal growth and incomes. Savings are rising, with bank deposits growing steadily, pushing mortgage debt as a share of disposable income to a 22-year low. Household and corporate bank deposits now exceed liabilities by £91bn. Despite rebounding real incomes and a high savings rate, economic uncertainty and fragile confidence sustain the preference to save over borrowing.

In Europe, ECB President Lagarde and Philip Lane speak in Frankfurt today, with euro-area data on inflation, PMI, and unemployment data due. French far-right politician Marine Le Pen plans to appeal her embezzlement conviction, which bars her from the 2027 presidential race. She denies wrongdoing, but her five-year public office ban remains effective despite the appeal.

Overnight Newswire Updates of Note

- UK Shop Prices Fall Less Sharply As Retailers Brace For Tax Hit

- Le Pen Election Ban Threatens Fragile Peace in French Politics

- Market Cautious Pause Before Trump’s ‘Liberation Day’ Tariffs

- Evercore ISI Predicts Market Turning Point Around Trump Tariffs

- Fed’s Barkin: More Cuts Require Confidence On Inflation

- RBA Expectedly Keeps Interest Rates Steady At 4.1%

- Australia Retail Sales Edge Higher As Shoppers Stay Cautious

- Japan Feb Jobless Rate Falls To 2.4%, Job Availability Shrinks

- China's Latest Year Of Property Pain Threatens Trump-proofing Efforts

- China Banks Increase Consumer Loan Rates To Protect Margins

- SoftBank Seeks Record $16.5B Loan for AI Projects In US

- US Chip Grants In Limbo, Lutnick Pushes For Bigger Investments

- US Judge Rejects J&J's $10B Baby Powder Settlement

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0800-05 (1.6BLN), 1.0825-30 (396M), 1.0840 (1BLN), 1.0860 (411M),

- 1.0875-85 (580M), 1.0900 (620M), 1.0930 (937M), 1.0950 (1BLN)

- USD/CHF: 0.8900 (200M). EUR/GBP: 0.8395-0.8400 (380M), 0.8500 (524M)

- GBP/USD: 1.2765 (554M), 1.2850 (902M), 1.2880 (200M), 1.3005 (320M)

- AUD/USD: 0.6220-30 (447M), 0.6250-60 (400M), 0.6265 (410M)

- NZD/USD: 0.5700 (460M), 0.5950 (598M)

- USD/JPY: 150.00-05 (2.3BLN)

CFTC Data As Of 28/3/25

- Equity fund managers have increased their S&P 500 CME net long position by 83,572 contracts, bringing the total to 915,841. Meanwhile, equity fund speculators have raised their S&P 500 CME net short position by 41,376 contracts, now totalling 236,867. Speculators have also expanded their CBOT

- US Treasury bonds futures net short position by 24,765 contracts to reach 38,275. Additionally, they have reduced their CBOT US Ultrabond Treasury futures net short position by 14,792 contracts, now at 232,366. The CBOT US 10-year Treasury futures net short position has been trimmed by 71,284 contracts, bringing it to 810,090. Speculators have reduced their CBOT US 5-year Treasury futures net short position by 5,853 contracts to total 1,900,087, and the CBOT US 2-year Treasury futures net short position has been cut by 38,970 contracts, now standing at 1,181,586.

- The Japanese yen holds a net long position of 125,376 contracts, while the Swiss franc reports a net short position of -37,593. The British pound has a net long position of 44,283 contracts, and Bitcoin holds a net long position of 1,179 contracts.

Technical & Trade Views

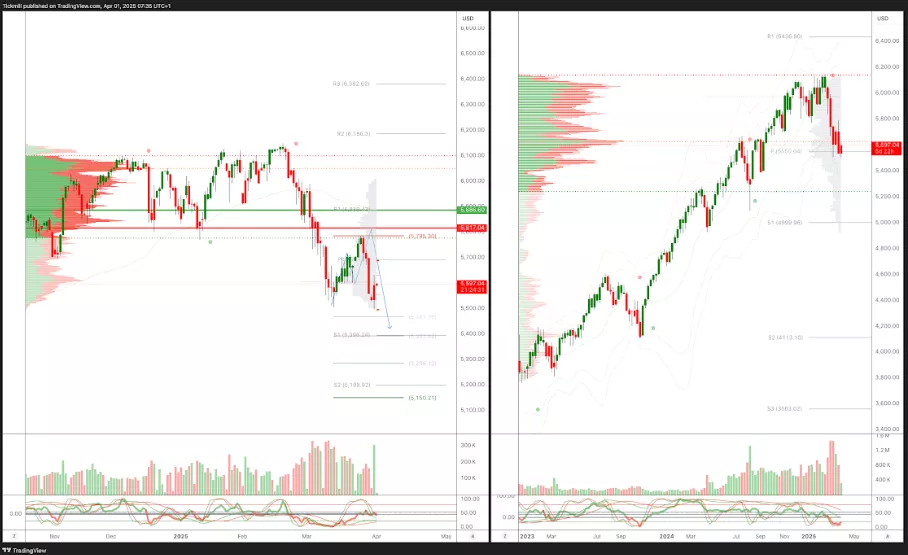

SP500 Pivot 5790

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bullishness into late April

- Above 5885 target 5950

- Below 5815 target 5415

(Click on image to enlarge)

EURUSD Pivot 1.0750

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness into the end of April

- Above 1.0750 target 1.11

- Below 1.0690 target 1.0550

(Click on image to enlarge)

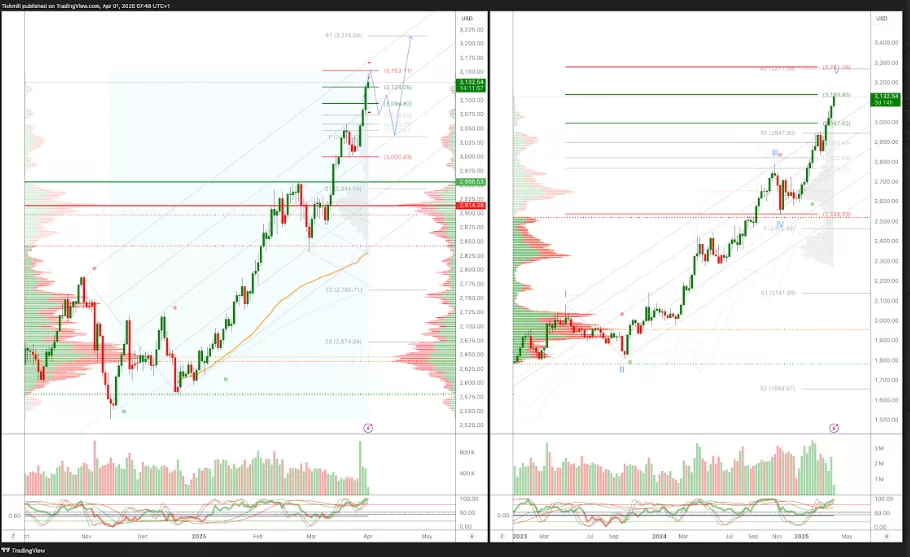

GBPUSD Pivot 1.28

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bullishness into late April

- Above 1.2850 target 1.32

- Below 1.2790 target 1.2660

(Click on image to enlarge)

USDJPY Pivot 150.50

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bullishness into Apr 9th

- Above 1.52 target 153.80

- Below 150.50 target 145

(Click on image to enlarge)

XAUUSD Pivot 2950

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness into mid/late April

- Above 2900 target 3100

- Below 2880 target 2835

(Click on image to enlarge)

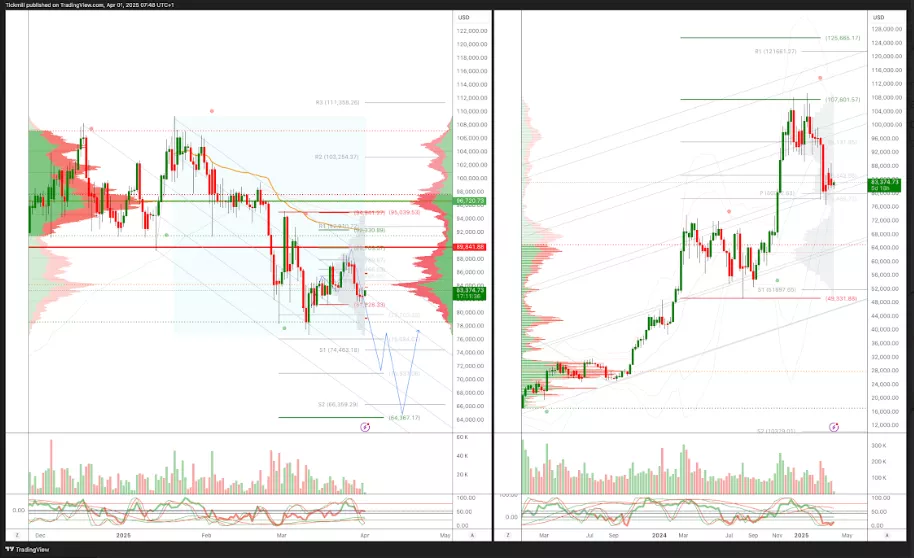

BTCUSD Pivot 90k

- Daily VWAP bullish

- Weekly VWAP bearish

- Seasonality suggests bullishness into Apr 9th

- Above 97k target 105k

- Below 95k target 65k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Monday, March 31

S&P 500 Weekly Action Areas & Price Targets - Monday, March 31

Daily Market Outlook - Monday, March 31