Daily Market Outlook - Monday, March 31

Image Source: Pixabay

Global stocks extended their decline for a fourth consecutive day as President Donald Trump prepared to unveil new tariffs, intensifying fears of a global trade conflict and its potential economic fallout. Markets tumbled across the Asia-Pacific region, with the Nikkei-225 sinking to its lowest level in more than six months. Meanwhile, futures for U.S. and European equities also slid. In contrast, gold prices surged to a record high, and U.S. Treasury yields dropped as investors sought refuge in safe-haven assets. Amid the heightened uncertainty, investment managers worldwide are scaling back risk exposure in their portfolios or refraining from making significant investments. Many remain cautious ahead of the anticipated announcement of reciprocal tariffs and their broader economic implications. Economists at Goldman Sachs have adjusted their forecasts, now predicting that both the Federal Reserve and the European Central Bank will implement three interest rate cuts this year in response to the adverse effects of trade restrictions on global economic growth. Tariff announcements from President Trump are poised to dominate markets. Are these measures strategic bargaining tools, or do they signal a lasting shift aimed at addressing perceived imbalances in the global economic system? This question may linger unanswered for some time. Meanwhile, euro area inflation is anticipated to return to 2% in March, and the US jobs report is expected to show another month of robust employment growth.

**United States: Tariff Announcements in the Spotlight**

While the monthly employment report typically garners significant market attention, this week’s focus pivots to President Trump’s tariff announcements on April 2. Markets have been highly sensitive to the mixed signals surrounding tariffs, with volatility evident even over short periods. Whether these tariffs extend beyond April 2 remains unclear, but the announcements will offer critical insights for market participants.

**Euro Area: Inflation Softens Amid Trade Worries**

In Europe, April 2, also known as "Liberation Day," takes centre stage. The EU’s chief trade negotiator has voiced concerns over the potential imposition of 20% tariffs on the bloc. While headline figures will dominate, nuanced details could prompt swift market reactions. Current forecasts suggest broad tariffs of 10%. Separately, March’s flash inflation data is expected to show a decline in overall inflation from 2.3% to 2.0%, driven by lower fuel prices. Core inflation is also projected to ease slightly to 2.4%, continuing its gradual downward trend.

**United Kingdom: Spring Forecast Brings Modest Adjustments**

The Spring Forecast, though not intended as a significant fiscal event, saw the Chancellor reduce welfare and day-to-day spending to restore £9.9 billion (0.3% of GDP) in fiscal headroom, which had been eroded by rising bond yields. Attention now shifts to upcoming data on the housing market and consumer credit trends.

**Asia Pacific: Divergent Trends Across the Region**

China’s PMIs likely improved in March, buoyed by policy easing. In Japan, the Tankan manufacturing DI for the first quarter is expected to weaken, with FY24 capital expenditure plans likely revised downward due to trade uncertainties. However, non-manufacturing activity likely remained resilient. Japan’s industrial production probably rebounded in February, though retail sales may have softened.

Overnight Newswire Updates of Note

- UniCredit Gets ECB Approval For Banco BPM Buy, To Weigh Options

- Germany’s Spending Push Drives Up Borrowing Costs Across Eurozone

- French Marine Le Pen’s Presidential Bid Threatened By Court Ruling

- Cabinet Office To Scrutinise Failings Of UK’s Official Data Provider ONS

- Fiscal Tweaks Won’t Solve Britain’s Growth Problem

- Treasuries Are The Standout Play As Trump’s Trade War Heats Up

- XAU Conquers $3,100 For The First Time Ever On Tariff War Fears

- Global Equities Investors Gird For Trump’s Next Tariff Body Blow

- ‘Pissed Off’ At Putin, Trump Threatens Russian Oil Tariffs

- Zelenskyy: No To Any US Minerals Deal That Might Risk Ukraine’s EU Bid

- China Factory Activity Expands Ahead Of Expected US Tariffs

- Japan Factory Output Beats, Retail Sales Slow Amid Uncertainty

- Japan JGBs Rise, Buoyed By Possible Safe-Haven Demand

- Japan Earmarks Another $5.4B For Chip Startup Rapidus

- RBA Set To Hold Rate As Tight Election, Trump Tariffs Fuel Risks

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0800 (1.6BLN), 1.0810-20 (614M), 1.0840 (362M), 1.0850-60 (543M)

- 1.0875-85 (477M), 1.0890-1.0900 (802M), 1.0925 (225M)

- USD/CHF: 0.8840-55 (500M)

- EUR/GBP: 0.8360 (958M), 0.8400 (379M)

- GBP/USD: 1.2900 (294M), 1.2995 (302M), 1.3050 (225M)

- AUD/USD: 0.6250 (398M), 0.6300 (1.1BLN), 0.6350 (856M)

- USD/JPY: 149.00 (260M), 150.00 (1.4BLN), 150.50 (270M)

Banks are now issuing signals for FX hedge rebalancing at the end of the month and quarter. Models indicate a strong demand for the USD in both scenarios. The Barclays model highlights significant demand for the USD against all major currencies at month-end. Conversely, the quarter-end model, which utilizes the same methodology, reflects a moderate signal against all major currencies. Nonetheless, this model also forecasts a robust demand for the USD compared to the EUR. It's worth noting that short-term expiry FX options have been set up for potential setbacks in the EUR/USD.

CFTC Data As Of 28/3/25

- Equity fund managers have increased their S&P 500 CME net long position by 83,572 contracts, bringing the total to 915,841. Meanwhile, equity fund speculators have raised their S&P 500 CME net short position by 41,376 contracts, now totalling 236,867. Speculators have also expanded their CBOT

- US Treasury bonds futures net short position by 24,765 contracts to reach 38,275. Additionally, they have reduced their CBOT US Ultrabond Treasury futures net short position by 14,792 contracts, now at 232,366. The CBOT US 10-year Treasury futures net short position has been trimmed by 71,284 contracts, bringing it to 810,090. Speculators have reduced their CBOT US 5-year Treasury futures net short position by 5,853 contracts to total 1,900,087, and the CBOT US 2-year Treasury futures net short position has been cut by 38,970 contracts, now standing at 1,181,586.

- The Japanese yen holds a net long position of 125,376 contracts, while the Swiss franc reports a net short position of -37,593. The British pound has a net long position of 44,283 contracts, and Bitcoin holds a net long position of 1,179 contracts.

Technical & Trade Views

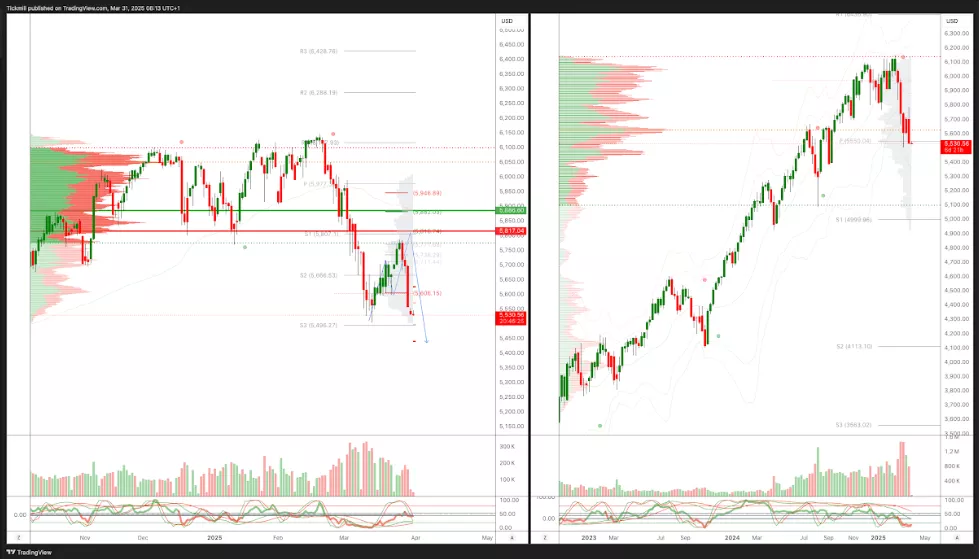

SP500 Pivot 5790

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bullishness into late April

- Above 5885 target 5950

- Below 5815 target 5415

(Click on image to enlarge)

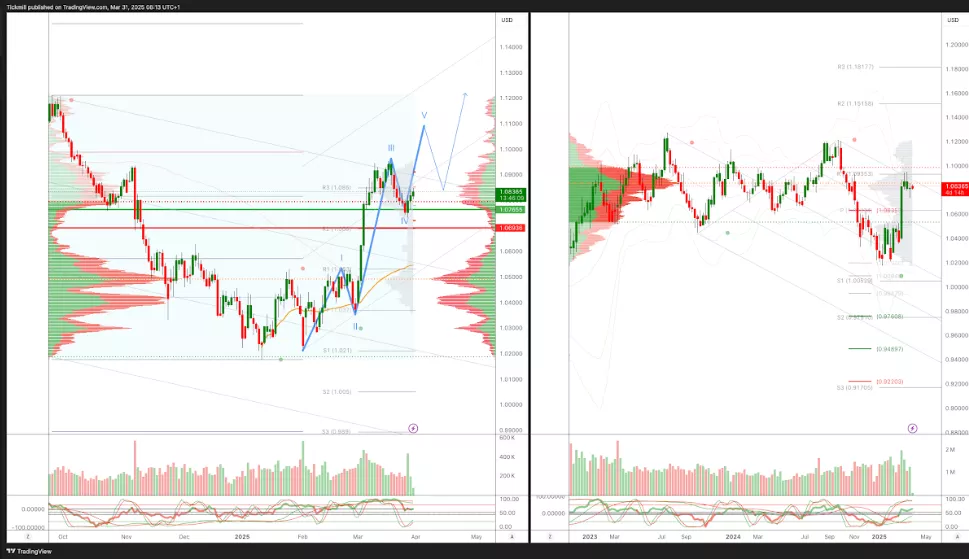

EURUSD Pivot 1.0750

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness into March 30th

- Above 1.0750 target 1.11

- Below 1.0690 target 1.0550

(Click on image to enlarge)

GBPUSD Pivot 1.28

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bullishness into late April

- Above 1.2850 target 1.32

- Below 1.2790 target 1.2660

(Click on image to enlarge)

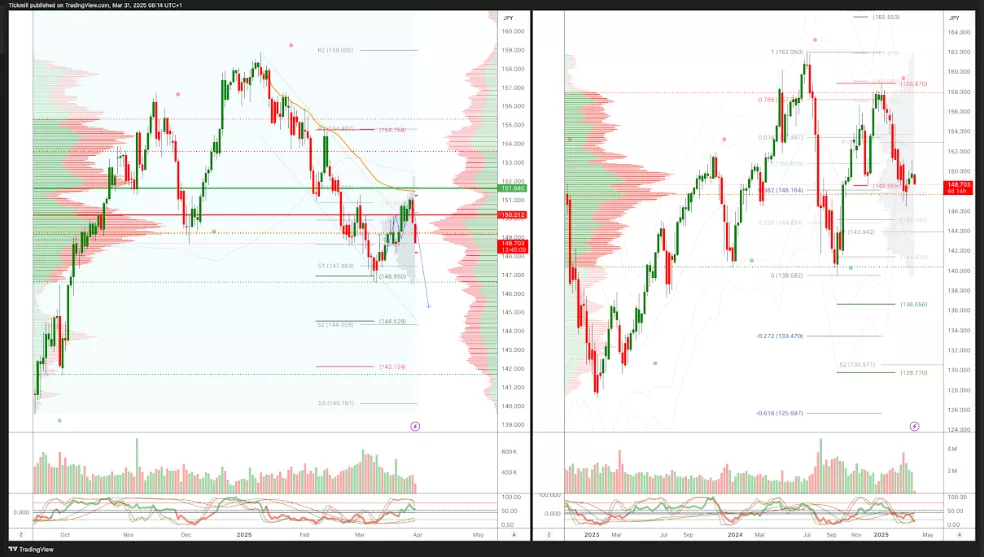

USDJPY Pivot 150.50

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bullishness into Apr 9th

- Above 1.52 target 153.80

- Below 150.50 target 145

(Click on image to enlarge)

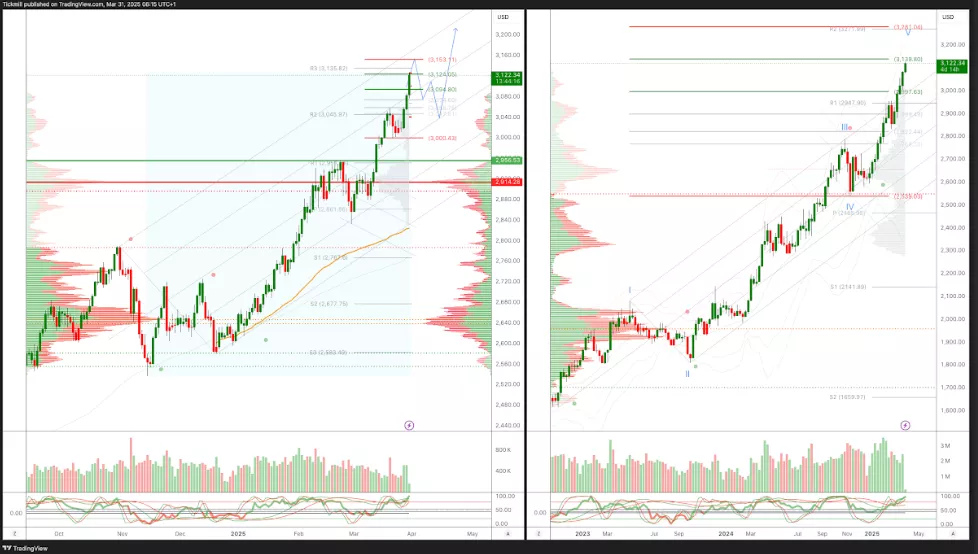

XAUUSD Pivot 2950

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness into mid/late March

- Above 2900 target 3100

- Below 2880 target 2835

(Click on image to enlarge)

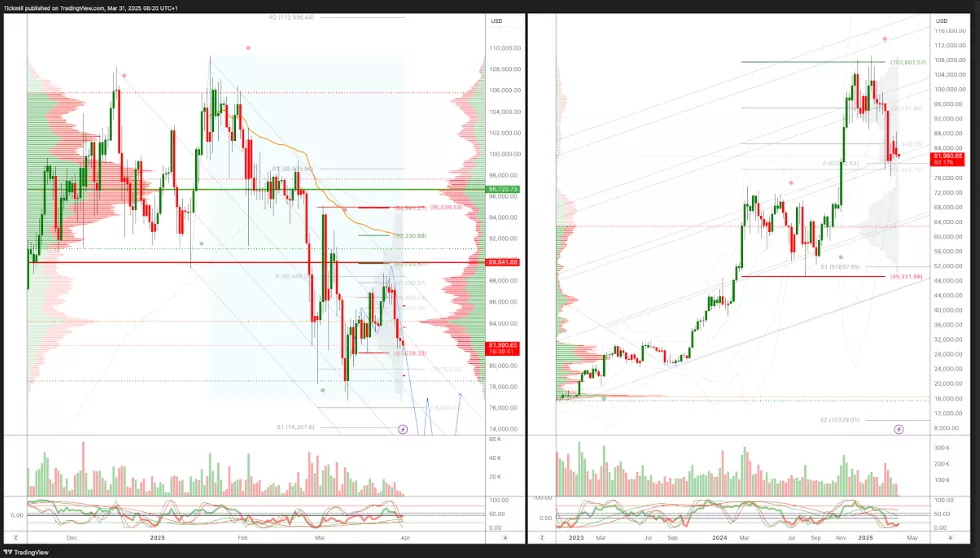

BTCUSD Pivot 90k

- Daily VWAP bullish

- Weekly VWAP bearish

- Seasonality suggests bullishness into Apr 9th

- Above 97k target 105k

- Below 95k target 65k

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Friday, March 28

The FTSE Finish Line - Thursday, March 27

Daily Market Outlook - Thursday, March 27