Yields Haven‘t Given Up

10y tested the top at 4.33%, and retreated back to the 4.23% support – but S&P 500 kept declining yesterday. The dollar and real assets were though less determined to move correspondingly, which means that stocks may hold up better today than the 4,365 (another suppozt zone, its upper border) hints at, equals we wouldn‘t get orderly selling continuation or acceleration into a crash till the closing bell. At the same time, this data light day won‘t be a genuinely VIX crush Friday one – the buyers can reasonably target 4,390 at best. The warning sign is accelerating decline in XLK below $166.50 on heavy volume. Tech simply isn‘t buying the retreat in yields as definitive, but next week would start on a better note for the buyers.

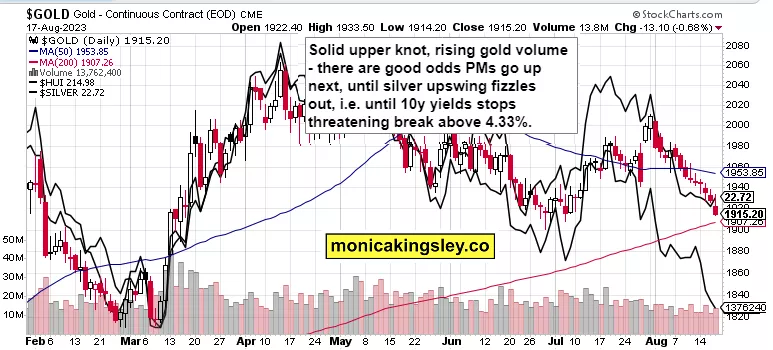

Gold, Silver and Miners

(Click on image to enlarge)

Gold steady slide through $1,930 accelerated into a $15 support breaak, which gives less that 50/50 odds of it being the washout (well, washout less so rather than a move wearing you out and noticeably accelerating while doing many upper knots). Silver with copper have started to look brighter already – copper $6.68 is likely to hold, and both of these metals (the red and white one) are likely to finish marginally up today. The PMs tentative bottom call lives on, and is being tested.

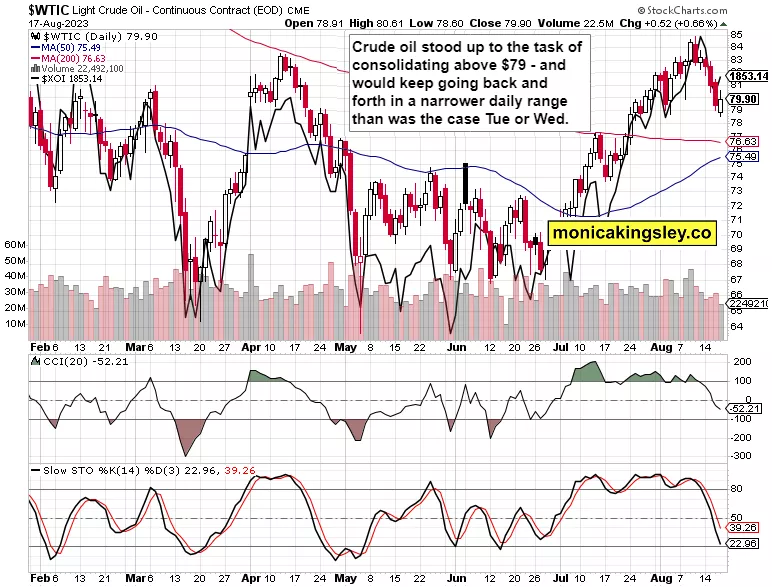

Crude Oil

(Click on image to enlarge)

Crude oil performed according to expectations, and the yesterday discussed $79 line held. The prospects for today are about more testing of the $79 area in what‘s shaping up to be another day of 10y yield rebounding off 4.23% perhaps 5 basis points higher and USD going up relatively more so than yields.

More By This Author:

SP500 To Correct Some More

SPY, Yields Top And China

SPY Bearish Turn

Subscribe to Monica‘s Insider Club for trade calls and intraday updates. more