Weekly Market Pulse: The Crypto Distraction

It was hard not to hear about cryptocurrencies last week what with the bear market and all. Actually, you can make the case that bitcoin has had two bear markets since mid-April. There was a 27% decline followed by a 27% rally, followed by last week’s rout. From its intraday peak in April to its intraday low last week, bitcoin fell over 53%. Is that the end of the sell off? Anyone who tells you they know anything about where this goes from here is either lying to you or to themselves. Given the number of scams in crypto land the former is highly likely. Given the quality of the “analysis” in crypto so is the latter.

I got an email from a young reader this weekend asking if this was the crypto crash I wrote about a few weeks ago. What I wrote then was that I would treat crypto just like every other bubble type asset I’ve witnessed in my three decades of watching markets. I will wait for the crash and pick through the debris to find the survivors. Is this that crash? Not even close, my young friend. As I’ve said before I think there will be many applications for blockchain – smart contracts if you will – but most of them will be mundane, mere replacements of non-digital processes of today. Still, those changes could have a profound impact on productivity and economic growth. But the idea that bitcoin or some other cryptocurrency is going to replace the dollar (or Yen or Euro)? Yeah, I don’t think so and China just showed you why. Entities with power don’t give it up easily.

But enough about that. What’s going on in the crypto space is a distraction for everyone except the people who have money at risk there. There were some potentially important developments in markets last week and none of them had anything to do with bitcoin. Doubts about the post-virus boom scenario that has dominated markets since November are creeping into markets. Nominal bond yields have stalled since mid-March while real yields have continued to fall. The result is that inflation expectations have been rising while real growth expectations have been falling. Copper made an all time high a couple of weeks ago and commodities in general have been on fire and commodity stocks too. Materials and energy stocks are two of the biggest winners year to date and over the last year.

But we may have already seen the peak in the rate of change for growth and inflation expectations. The nominal 10 year Treasury yield has stalled since mid-March even as TIPS yields continued to fall – until last week when TIPS yields rose 9 basis points while the 10 year yield fell by a couple. The result was a drop in inflation expectation and a small rise in real growth expectations. Copper fell nearly 4% last week and is down 8% since making an all time high earlier this month. Gold, meanwhile, has been rallying, up another 2% last week and 6% since the beginning of May. The result was a drop in the copper/gold ratio of 6% just last week. Unless that reverses quickly I would expect the 10 year yield to follow the ratio down. Nominal growth expectations have stopped rising and if that turns out to be prophetic, stocks may be next to peak. If nominal growth has peaked, then earnings growth probably has too. There is also the small matter of a potential change in the corporate tax rate somewhere down the road although Biden seems to be having problems finding allies anywhere in the world on that front. While Biden seeks a hike in the US rate from the current 21%, the administration is negotiating a global floor that last week was revealed to be a mere 15%. And it seems likely that will fall to 13% if Ireland and a few other countries have their way.

Commodities have had a great run recently and speculators have, of course, done their part in driving up prices. Large speculators are very long across the entire agriculture complex – still – even after a recent small correction in most. Commodity markets are not uniform though so I wouldn’t expect a big downdraft. Speculators are long the industrial metals too but the positioning is not extreme. But a correction in commodity prices seems overdue and with growth and inflation expectations potentially peaking would make perfect sense.

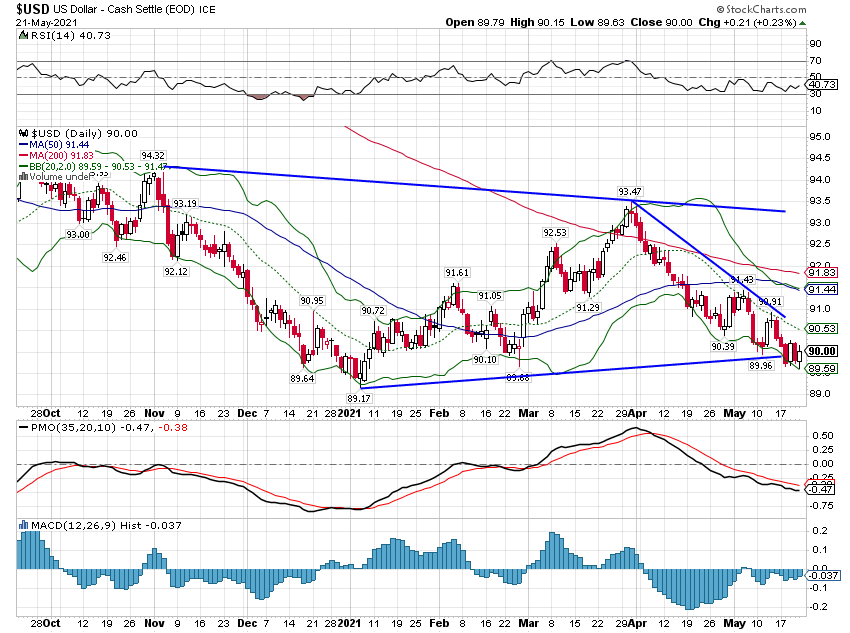

Ultimately, a longer term bull market in commodities will depend, at least to some degree, on the course of the dollar. The dollar has struggled a bit too as the boom expectation gets rolled back a bit. The buck was down last week and we’re back to where we started the year. I am still calling the dollar neutral but if it falls much more I think we’ll have to acknowledge that it is in a more durable downtrend. I also watch futures market positioning in the dollar and right now sentiment appears fairly neutral. Large speculators are long the dollar index but only slightly (and remember market positioning is really only useful at extremes). The only currency where I could make a case for extreme positioning is against the Canadian dollar where both large and small specs are at their longest in about 18 months. Against most other currencies there doesn’t appear to be any conviction either way. The pound has rallied from 1.2 to 1.4 and large specs appear to have hardly noticed. The point is that there is no extreme short position in the futures markets against the dollar and a further fall therefore seems more likely than not.

Just to be clear, I am not saying that the recovery is over. There are no indications right now of renewed recession. There are some areas of the economy that are struggling with supply side issues but those will get solved in due time. But the boom everyone was expecting with the re-opening seems much less likely than it did just a couple of months ago. I have been out recently like everyone else and it is obvious that there is more public activity right now. And if you need a contractor to get anything done on your house, well good luck to you, you’re going to need it. But in the long run I continue to expect that one of the results of the pandemic will be that individuals and companies act more conservatively with their money. That may seem counterintuitive with all the speculative activity going on but for a lot of people the government handouts of the last year were like playing with house money. I would not expect people to be so cavalier with savings for which they’ve worked hard – or at all. Once things settle down, after everyone gets the vaccine euphoria out of their system, I expect a more subdued growth path. We came into the pandemic growing at 2.2%, added a lot of debt and we’ll exit with a larger government footprint on the economy. I can’t see how that translates into higher growth.

The economic data last week was sparse and tended to confirm the peak rate of change argument. The housing market continues to struggle with starts down nearly 10% from last month. That appears to be a function of cost, particularly lumber prices. Permits did manage a rise but as a friend of mine in the construction business says, anyone can pull a permit. The Empire State and Philly Fed surveys also fell from last month’s peaks. Again, to be clear, these survey numbers are still quite high; it’s just the rate of change that has peaked. Existing home sales also fell but that is mostly a function of supply. In any case the economic impact of existing home sales is not that great.

We get a lot of data next starting with our favorite broad indicator, the CFNAI which has been up big and down big recently. The 3 month moving average still puts growth slightly above trend but I would expect that the moderate this month. We’ll see. We also get durable goods orders and personal income and consumption numbers this week.

US stocks were down last week as were commodities. Real estate was up again and I still expect more outperformance versus the S&P 500. Foreign markets were up last week and you might not have noticed but European stocks are outperforming the US YTD and over the last year. So are EM and Asia ex-Japan stocks. If the dollar really does get into a sustained downtrend I would expect that to continue. I’d also point out that the economic stats coming out of Europe actually look pretty darn good. UK data also looks robust, particularly retail sales.

Real estate, health care and utilities led last week which isn’t exactly inspiring from a growth perspective.

Until just recently everyone knew that everyone knew we were going to have a boom once the virus was vanquished. When a consensus about the consensus becomes so strong markets more than fully price in the outcome. If the consensus turns out to be incorrect, markets have to reevaluate, sometimes quickly. So far, the recalibration – if that’s what this is – is moving at a leisurely pace. The same can’t be said of bitcoin and the crypto space and that to me is somewhat worrisome. Volatility in any market is a function of liquidity and that is true in both directions. Bitcoin’s rapid rise and fall is evidence of an extreme lack of liquidity. What continues to concern me is that crypto markets have attracted a lot of leveraged speculators who may not be able to sell bitcoin (or whatever other junk they own) if the downdraft continues. On Wall Street, the margin clerk doesn’t care what you sell just that you do. So, if they can’t sell bitcoin they’ll sell something else. I think you can imagine what that might be.

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more