Tuesday Talk: No Air In The Ball

With no good news coming from the Ukraine on the eve of Wednesday's Fed meeting the markets show no signs of bouncing back this week.

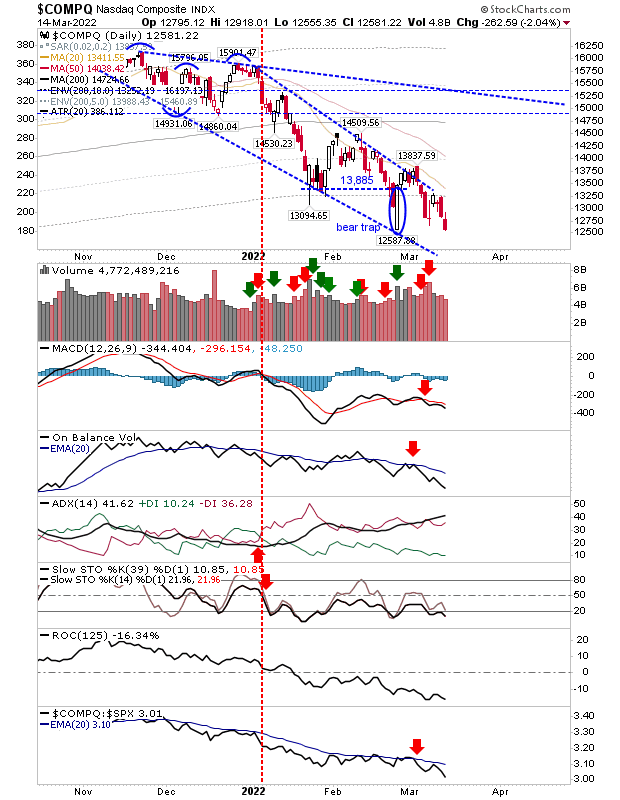

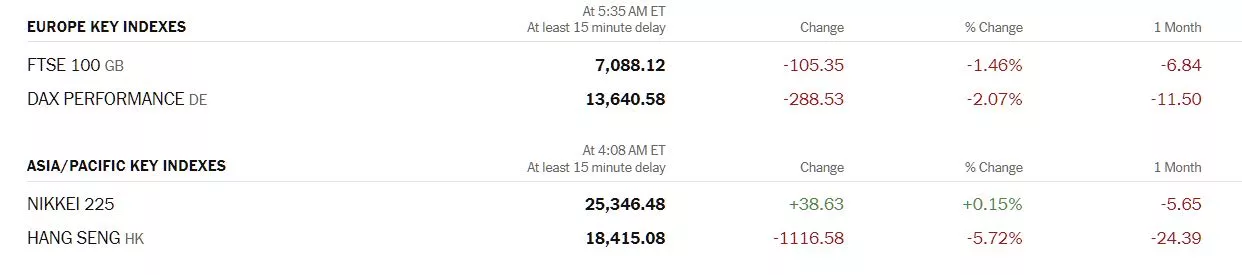

Monday the S&P 500 closed at 4,173, down 31 points, the Dow closed at 32,945, up 1 point, and the Nasdaq Composite closed at 12,581, down 263 points. In early morning trading market futures have switched to green, S&P futures are up 12 points, Dow futures are up 47 points and Nasdaq 100 futures are up 59 points. Asian markets closed mixed and European markets are down in Tuesday morning action.

Chart: The New York Times

TalkMarkets contributors are focused on the news looking for the good among the bad, however Bob Lang says Don’t Let The News Dictate Your Trading

"For the past two years, we have been glued to the news. Most of that time has been focused on the COVID-19 pandemic. Recently, it’s been the war in Ukraine and rampant inflation in the economy. If you think about your own trading during this time, there is no doubt you have made financial decisions based on how well these issues were going."

"In March 2020, the stock market and global economy were in tatters and the pandemic dominated the news. Investors and traders wanted no part in the massive uncertainty and anxiety, and they bailed on the markets...If you studied the charts, you could see evidence of a clearing; you just needed to be patient and wait for confirmation. Once the Fed announced drastic measures to support markets and the economy, indicators began flashing buy signals and money flow returned in a hurry. The SPX 500 recently peaked at 4,800 – more than 128% higher than the lows ticked in March 2020...

My point: If you paid more attention to the dour headlines than you did to the charts and technicals, you probably would have stayed on the sidelines and missed out on tremendous opportunities to grow your portfolio.

Read the news, but trust the charts and technicals."

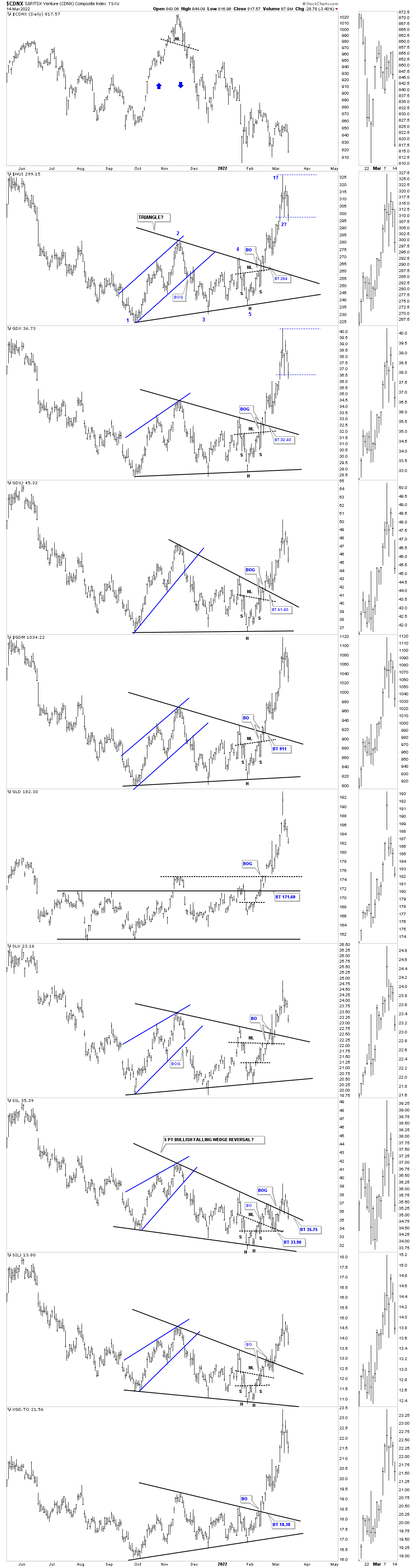

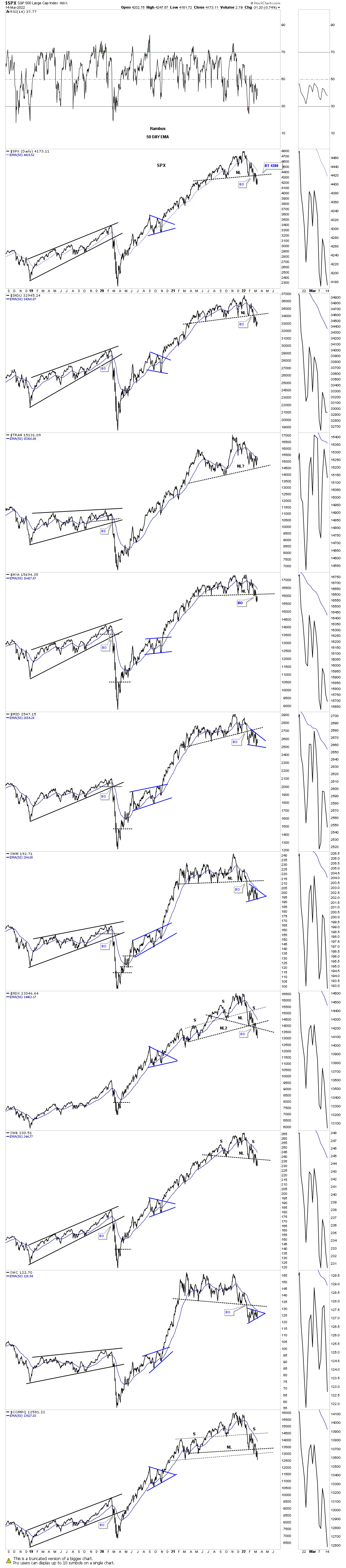

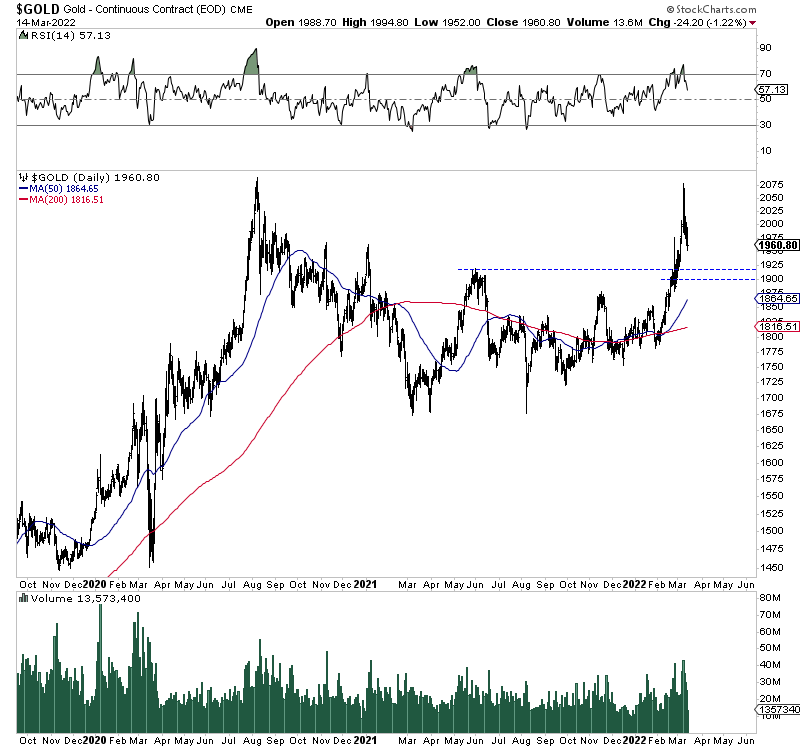

TalkMarkets contributor Rambus supplies the charts in his article Markets Update - Precious Metals Consolidation / Stock Market Bear Action . There are several covering both precious metals and stocks. A few charts are posted below, see Rambus' article for the rest.

"Last week I mentioned that it might be time for the precious metal stocks to start consolidating their gains from the last reversal point in the blue 5 point triangle reversal patterns. It looks like it has now started after last week's high."

"This last chart for today is the longer-term daily line chart. What stands out the most for me is the rally leading into the H&S tops. If there was ever a place to look for some reverse symmetry to the downside these charts show that possibility. One step at a time."

As might be expected Gold is attracting attention as a safe haven asset during the current volatility the markets are experiencing. Contributor Jordan Roy-Byrne is bullish on gold and writes Gold Has Done This Only Twice as it regards the current pullback.

"Gold is correcting a short-term overbought condition. Gold surged nearly $300/oz in less than six weeks and almost touched its all-time high. It was a logical point from which a correction could begin. This is only the third time in Gold’s history in which it corrected after reaching or approaching the previous all-time high."

"Gold has strong support at $1920 and $1900 and the top of the breakaway gap at $1908. A test of $1908 would mark an 8% decline from the peak."

"I’m looking for a bullish consolidation to develop, as Gold has support at $1920 and very strong support around $1900. A triangle or a bull flag could form over the next few months. Note that a bullish consolidation would set up the handle on Gold’s cup formation over the past 19 months. This smaller cup and handle formation is not confused with the larger, super bullish one, but it does project to an upside target of nearly $2500/oz...

The implication is that the weeks ahead could be your last chance to buy quality gold and silver stocks at cheap or reasonable prices. The next move higher has the potential to be spectacular. "

Michael Kramer, a TM regular says Stocks Are Now On The Cusp Of A Major Move Lower.

In his current column he posits on the major indices, as well as Fed rates, Apple (AAPL) and Nvidia (NVDA). Below are his comments on the SPDR S&P 500 ETF Trust (SPY).

"Stocks finished the day lower, with the S&P 500 dropping by almost 75 bps, with the Nasdaq QQQ ETF falling by around 1.9%. It could have been much worse for the S&P 500 had it not been for the XLF ETF climbing by 1.25%. Today that triangle in the SPY broke, and if we get a move lower tomorrow, it likely results in the start of the next leg lower for the markets, which could amount to a drop of around another 7%."

S&P 500 ETF

Contributor and chartist Declan Fallon is also pessimistic about today's upcoming trading noting S&P And Nasdaq Set Up For Big Loss Tomorrow.

"When I see markets edge back to a big reversal low, then the set up is for a panic collapse once the lows get taken out, which seems inevitable for the Nasdaq and S&P. Tomorrow could be a rough day. Bulls can try and cling on to the generally light volume in the selling to the lows.

In the case of the Nasdaq, all technicals are negative and an already weak relative performance is accelerating lower. February was a 'death cross' between 50-day and 200-day MAs and this is marking the long term trend lower. "

"It's ready to get ugly for markets and tomorrow could be the day losses accelerate into a new sharp move lower. Of course, nobody knows what will happen tomorrow, but you have to be prepared for the likely outcome from this setup."

Ahead of Wednesday's Fed meeting contributor Tyler Durden presents a contrarian view in his article Suffocating Impact From Higher Rates Will Force The Fed To Ease Much Sooner Than Expected.

"Back in December, when we first showed that the market had begun pricing in rate cuts as the forward OIS curve inverted, many laughed: after all, such a dire (for the Fed) outcome - one which suggested that the Fed's tightening would lead to a hard landing, was seen as anathema by the majority who believed (erroneously) that the Fed would keep hiking and hiking and hiking... and the US economy would just somehow take it without imploding.

Well, fast forward to today when nobody is laughing anymore.

First, as we noted on Sunday, in one of his multiple "market dislocation" charts, DB's Jim Reid showed a chart of two-year forward OIS rates (the same chart we pointed to back in December) which are now at their lowest in a decade. As Reid explained, "markets are now pricing the Fed funds rate to be 36bps higher from 2023-2024 than 2025- 2026. Markets are expecting the Fed to have to quickly cut rates shortly after the hiking cycle begins, which looks like a hard landing."

Durden who tends towards being both critical and cynical when it comes to the Fed closes his article with this:

"Alas, as recent events in the stock market have demonstrated vividly, the Fed is finding it impossible to have a "gentle" recession, one which does not crash stocks as well. The question is what the Fed will do then."

Russian-Ukrainian ceasefire talks are expected to continue today, though Putin shows no sign of wanting to quit his war of violence and murder. There is no making sense of this, one can only cry watching the pain and suffering we see and hear on our multiple screens. One hundred years ago in 1922, the American philosopher George Santayana wrote the following:

"If experience could teach mankind anything, how different our morals and our politics would be, how clear, how tolerant, how steady! If we knew ourselves, our conduct at all times would be absolutely decided and consistent; and a pervasive sense of vanity and humor would disinfect all our passions, if we knew the world...Only the dead are safe; only the dead have seen the end of war. Not that non-existence deserves to be called peace; it is only by an illusion of contrast and a pathetic fallacy that we are tempted to call it so."

Contribute to Ukrainian relief efforts.

Have a good week.