"Suffocating" Impact From Higher Rates Will Force The Fed To Ease Much Sooner Than Expected

Back in December, when we first showed that the market had begun pricing in rate cuts as the forward OIS curve inverted, many laughed: after all, such a dire (for the Fed) outcome - one which suggested that the Fed's tightening would lead to a hard landing, was seen as anathema by the majority who believed (erroneously) that the Fed would keep hiking and hiking and hiking... and the US economy would just somehow take it without imploding.

Well, fast forward to today when nobody is laughing anymore.

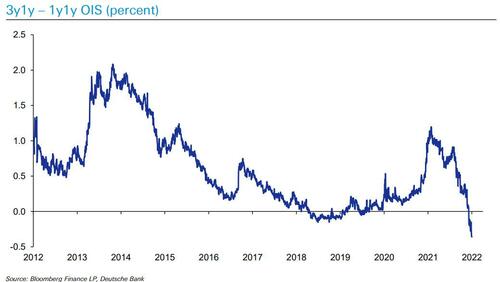

First, as we noted on Sunday, in one of his multiple "market dislocation" charts, DB's Jim Reid showed a chart of two-year forward OIS rates (the same chart we pointed to back in December) which are now at their lowest in a decade. As Reid explained, "markets are now pricing the Fed funds rate to be 36bps higher from 2023-2024 than 2025- 2026. Markets are expecting the Fed to have to quickly cut rates shortly after the hiking cycle begins, which looks like a hard landing."

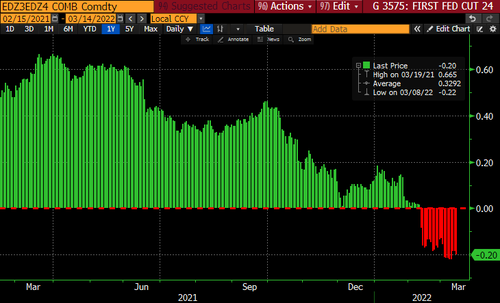

Second, as Nomura's Charie McElligott writes in his daily note as he previews what the Fed will do on Wednesday, as Powell scrambles to contain runaway inflation (UBS' economist Paul Donovan said this morning that "there is little a central bank can do about commodity prices—Fed Chair Powell can hardly dig an oil well in the middle of Washington D.C") "the market expects the hiking cycle to be completed by early / mid ’23 (with the July ’23 – Dec ’23 spread @ -2bps), while a full-blown inversion in EDZ3-Z4 (Dec ’23 – Dec ’24) shows that the Fed’s guidance will turn outright dovish towards easing in ’24 (-20bps priced…i.e. 80% odds of a Fed CUT in that window)." Spoiler alert: the easing will begin in 2023, if not late 2022, but we'll cross that bridge (soon enough).

Some more details from the CME note:

- I continue to believe that with March done-and-dusted at 25bps, May is absolutely a very high probability of a 50bps move for the Fed, which would then comfortably get us to 5 hikes by end Summer and 7 hikes through the Dec meeting (where market-implieds are already moving / leading the Fed to)

- A front-loaded FOMC hiking cycle would ultimately be the right outcome for the Economy, as it “rips off the bandaid” and gets us to “Neutral” policy rate fast—critically, giving the Fed future optionality across two opposing scenarios moving-forward:

- The first scenario would be to “buy time,” in order to see if inflation “relief” organically appears in 2H22 (i.e. supply chain issues easing in-time, or “demand destruction” from higher prices), which would allow the Fed to accordingly slow tightening efforts and avoid “overtightening policy error” by going fast then pausing, theoretically improving the odds that the economy could be managed back into a goldilocks “soft landing”

- The second scenario would be “if you’re gonna break it, break it fast” move in the case that there is no pull-back in inflation, as the latest Commodities disruption catalysts (Russia sanctions effectively removing their supply from a western world that is “short” them, along with Ukraine infrastructure destruction; new wave of COVID in China seeing lockdowns which further disrupt global shipping / supply chain) only extend the inflation shocks—which perversely then requires global Central Banks to actually seek to “hike us into a recession” so that a growth crash works to destroy demand and regain control over inflation

- And despite these seemingly polar opposite scenarios listed above, the market has already made up its mind as to what it means: EDM3-Z3 shows us that the market expects the hiking cycle to be completed by early / mid ’23 (with the July ’23 – Dec ’23 spread @ -2bps), while a full-blown inversion in EDZ3-Z4 (Dec ’23 – Dec ’24) shows that the Fed’s guidance will turn outright DOVISH towards EASING in ’24 (-20bps priced…i.e. 80% odds of a Fed CUT in that window)

Finally, we go to Bloomberg's Simon White who today published the most scathing assessment of just how cornered Powell finds himself, and how brief the upcoming rate hike cycle will be, and how the economy is already suffocating from higher rates... even though the Fed hasn't even hiked once yet, and only concluded QE last week:

Of course, this is all according to plan: as we said more than a month ago in another view that roundly mocked at the time and has now become consensus, the Fed is now desperate to start a "soft" recession (in order to create the demand destruction needed to send commodity prices lower) but without also crashing the market.

Fed desperate to figure out how to start a soft recession without also crashing the market

— zerohedge (@zerohedge) February 10, 2022

Alas, as recent events in the stock market have demonstrated vividly, the Fed is finding it impossible to have a "gentle" recession, one which does not crash stocks as well. The question is what the Fed will do then.

Disclaimer: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more