S&P And Nasdaq Set Up For Big Loss Tomorrow

When I see markets edge back to a big reversal low, then the set up is for a panic collapse once the lows get taken out, which seems inevitable for the Nasdaq and S&P.Tomorrow could be a rough day. Bulls can try and cling on to the generally light volume in the selling to the lows.

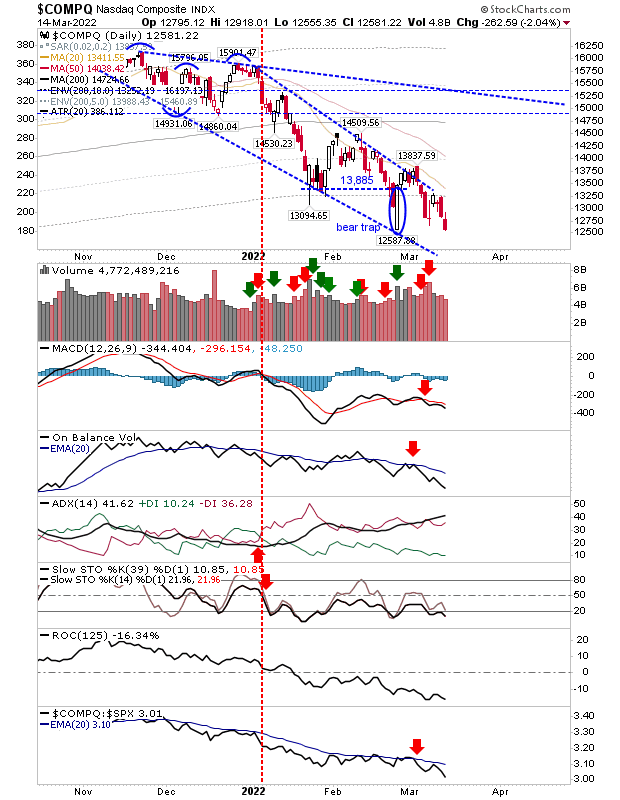

In the case of the Nasdaq, all technicals are negative and an already weak relative performance is accelerating lower. February was a 'death cross' between 50-day and 200-day MAs and this is marking the long term trend lower.

The S&P is likewise pressuring the low of the 'bear trap', but unlike the Nasdaq, it's doing so on higher volume selling. Today's action also marked the start of a 'death cross' between 50-day and 200-day MAs - is this just the start of a larger trend lower.

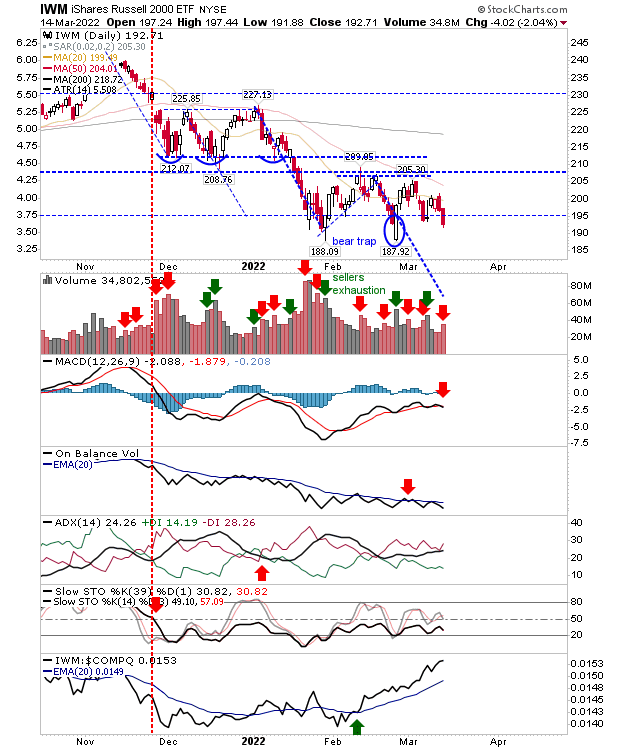

The Russell 2000 also closed with confirmed distribution but hasn't yet fully challenged the 'bear trap'. Adding to this is a new MACD trigger 'buy' to make all technicals net bearish. However, the index continues to sharply outperform peer indices and if you are a bull this is the best news.

It's ready to get ugly for markets and tomorrow could be the day losses accelerate into a new sharp move lower. Of course, nobody knows where will happen tomorrow, but you have to be prepared for the likely outcome from this setup.

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more