Thoughts For Thursday: Ugly And Uglier

Saying Wednesday was not a good day for institutional and Jane and John investors alike is an understatement. At the closing bell, everything was down except for TJ Maxx.

Yesterday the S&P 500 closed at 3,923, down 4%, losing 165 points. The Dow closed at 31,490, down 1,165 points, a loss of 3.5% and the Nasdaq Composite closed at 11.418, down 4.7%, losing 566 points. This morning the futures market is wrestling with a massive hangover and the hangover seems to be winning. Currently S&P 500 market futures are trading down 45 points, Dow market futures are trading down 344 points and Nasdaq 100 market futures are trading down 141 points.

The one year graph below shows just how ugly things look:

Graph: The New York Times

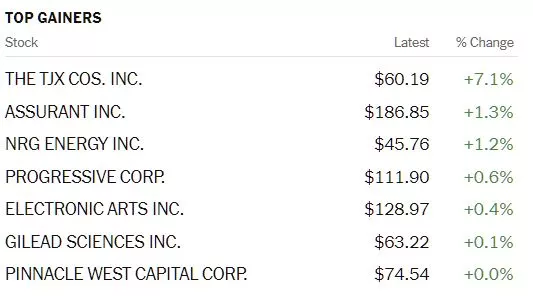

Looking at the chart of Top Gainers for May 18 provides little relief:

Chart: The New York Times

The only stand-out is TJMaxx (TJX), which bucked the downtrend, reporting Q1 earnings of $0.68 per share on revenues of $11.4 billion, beating estimates of $0.60 per share on revenues of $11.6 billion.

Contributors at the Staff of Equitmaster India write that the Sensex Cracks 1,000 Points As IT & Metal Stocks Bleed, letting us know that Asian and Indian markets are faring no better this morning than the NYSE.

"Asian share markets are deep in the red, tracking a steep Wall Street selloff, as investors fretted over rising global inflation, China's zero-Covid policy, and the Russia-Ukraine war.

The Nikkei is down 1.9% while the Shanghai Composite fell 0.2%. The Hang Seng plunged by over 3%.

Indian share markets are trading deep in the red.

Benchmark indices staged a gap-down opening today tracking the US market's worst intra-day fall in two years.

At present, the BSE Sensex is trading down by 979 points. Meanwhile, the NSE Nifty is trading lower by 294 points."

Talk Markets contributor Stephen Innes, in a TM "In the Spotlight" feature, headlines, Stocks Sink In A Vicious Sea Of Red.

"US equities fell sharply Wednesday, S&P down 4%, the most significant daily decline since June 2020. The weakness came as Target's quarterly earnings added fuel to the recession risk narrative, while the drop of US10 year yields down 10bps to 2.88% offered little support. And Oil settled at 2.3% lower on the day.

Equities continue to be at the mercy of broader macro themes, with more hawkish comments from Fed Chair Jay Powell leading to a further move higher in front-end rates, which continues to prove problematic for risk.

Medium-term, the Fed is likely to respond to any easing in financial conditions by ratcheting up the hawkish noises and, in effect, acting as a lid on the markets. And this should keep active money on the sidelines.

The relief rally trap door sprung when the S&P 500 4000 pins snapped after Target's earnings results exacerbated some recession fears that continued the theme of rising inventories detailed by Walmart on Tuesday. And the broad-based sell-off absolutely hammered tech."

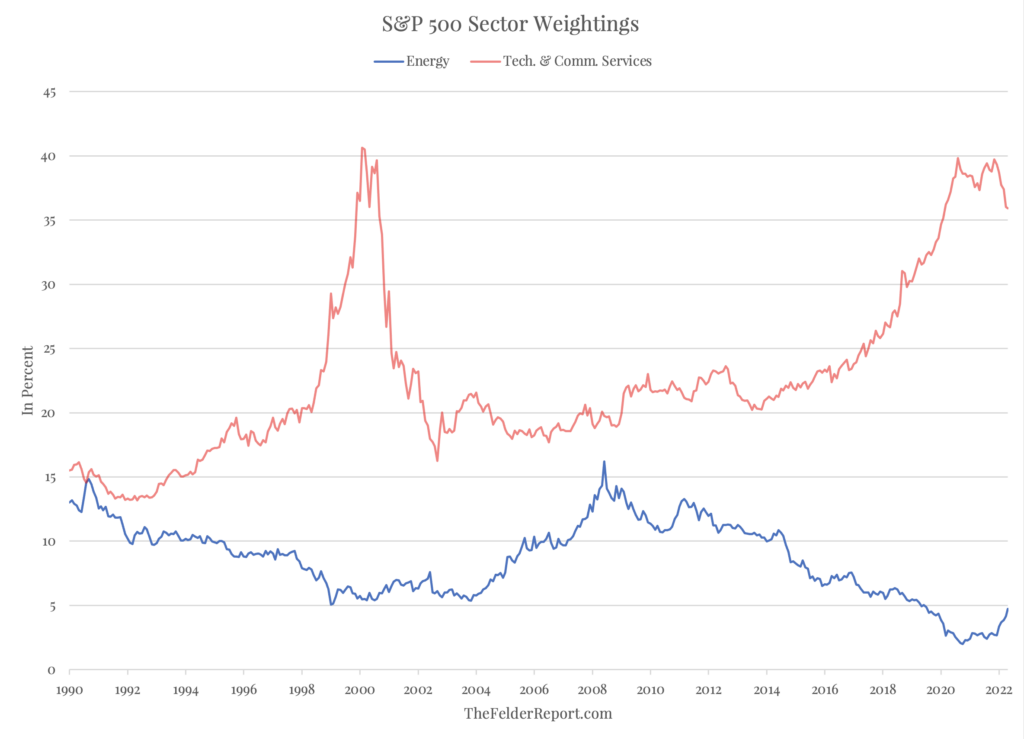

Contributor Jesse Felder discusses An Epic Set Of ‘Alligator Jaws’ in reviewing the fortunes of the Energy sector vs the Technology and Communications sectors.

"Exactly a year ago I shared a chart here that represented “An Epic Set Of Alligator Jaws.” It plotted the weighting of the energy sector within the S&P 500 Index versus the combined weightings of the tech and communications services sectors (which were a single sector until recently). “For my money, those alligator jaws look more likely to snap shut than to open even wider,” I wrote at the time. Indeed, the energy sector has risen more than 60% over the past twelve months, outperforming the index, while the combined tech and communications services sectors have fallen, underperforming the index, resulting in those alligator jaws closing to some degree."

"But it’s astounding to note how little these jaws have actually closed in light of the dramatic performance gap between the two groups of stocks...looking at the chart above, does it appear that energy has become overextended? Or is it more likely popular sectors like tech still have some give back ahead of them?”"

In an excellent and detailed article, Laurent Maurel writes that Inflation Is Linked To A Commodity Supply Problem and due to pandemic and continuing post-pandemic production issues, productivity is likely to continue to wane and inflation to linger. The article is worth a deeper look, but here is some of what Maurel has to say:

"Can the Fed ensure a soft landing for the economy and bring down inflation without causing a recession? This is the big economic question of the moment. It divides those who still believe that Mr. Powell has the tools to accomplish this feat and those who believe, on the contrary, that the Fed is at an impasse."

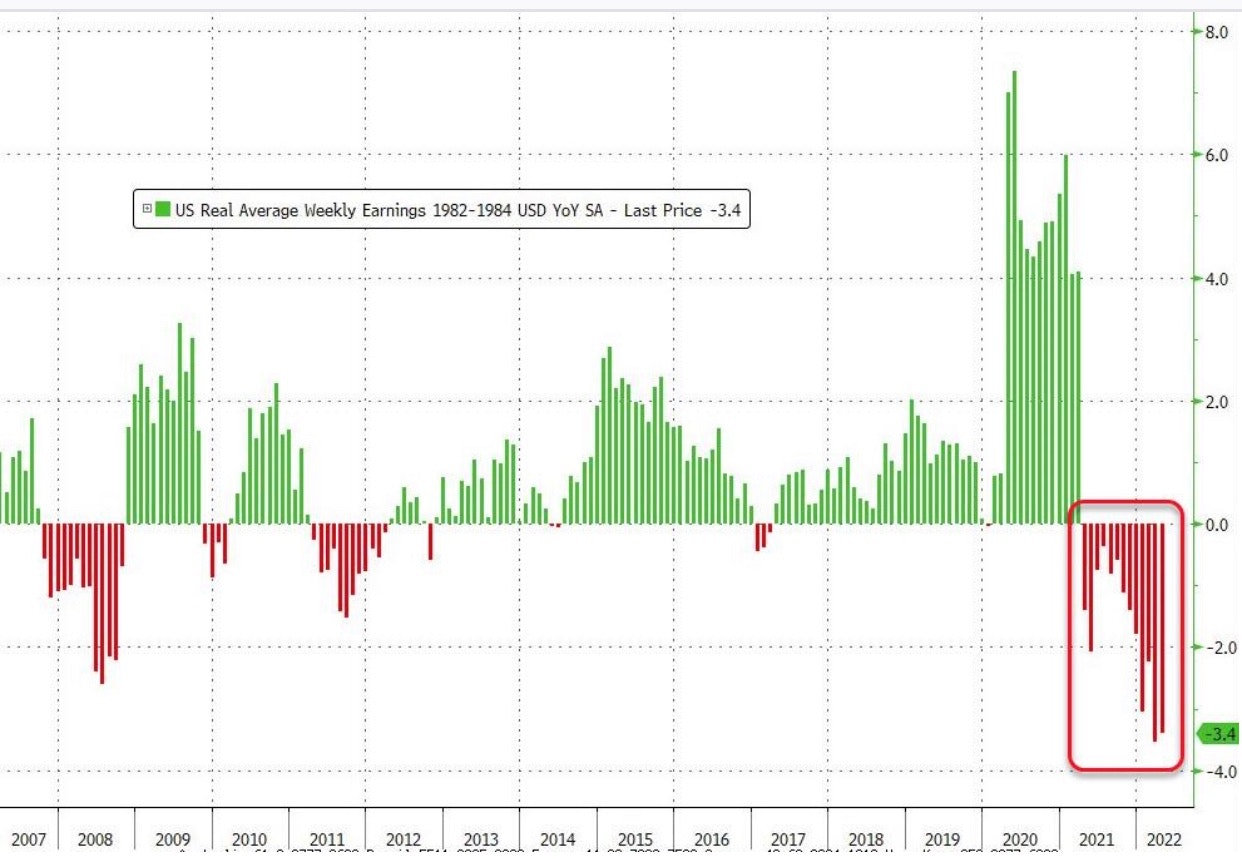

"In the United States, consumption is holding up (retail sales figures are down only slightly this month), but at the cost of record debt.

Americans are using their credit cards because their real income has collapsed:"

"Inflation is already depriving entire sectors of labor because wages are too low and do not keep pace with inflation. The restaurant sector is in danger in some stretched areas, precisely because of the lack of manpower.

This phenomenon leads to a unique historical situation: the unemployment figures appear to be excellent, but they mainly reflect a drop in applications for jobs that are too poorly paid in relation to the cost of living. This very low number of job applications comes at a time when the conditions for purchasing goods have never been so unfavorable, precisely because of the price level."

"Consumption continues to be strong in the US. We are also seeing a recovery in consumption in Europe, at some levels. This week, regional air traffic has returned to 85.5% of its pre-pandemic level, according to the network manager, Eurocontrol.

The recovery is also confirmed in China where health restrictions are gradually being lifted.

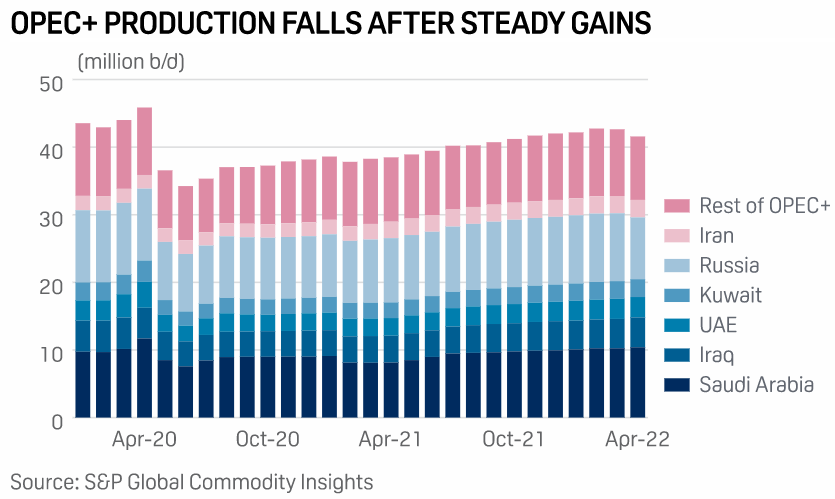

This global recovery is taking place in a context where the oil supply is increasingly tight.

The supply of OPEC+ countries has never been able to recover its pre-COVID level and is even falling again in April:"

"Demand for oil has already largely returned to its pre-COVID level, but extraction activity is far from being back to a level sufficient to meet that demand.

Beyond the supply of oil, it is the supply of refined oil that poses the most concern. Diesel and kerosene inventories are at historically low levels, and shortages of both refined products are likely to be a reality this summer.

We have moved from an oil supply problem to an even more challenging refined petroleum product supply problem."

"Unfortunately, no monetary policy can do anything about the supply of essential refined products. Until this supply problem is resolved, inflation is unlikely to come down."

"These new conditions (raw materials supply chain problems) are reducing business productivity, which has been a deflationary driver in recent years. The decline in productivity is accelerating in the developed countries and this phenomenon is further accentuating inflation.

U.S. worker productivity is down 7.5% from last year, its worst figure since... 1947!"

"Rising wages, falling productivity: inflation is not transitory and is becoming uncontrollable for the Fed because it is linked to a problem in the supply of raw materials. The Fed has decided to lower demand to fight inflation, even if it means risking an explosion of the asset bubble that its monetary policy has artificially inflated."

In the crypto realm contributor Crispus Nyaga notes that the Bearish Trend Is Still Intact as regards bitcoin (BITCOMP).

"The BTC/USD pair will likely keep falling as bears target the next key support level at 27,500.

Bearish View

- Sell the BTC/USD pair and set a take-profit at 27,500.

- Add a stop-loss at 31,000.

- Timeline: 1 day.

Bullish View

- Set a buy-stop at 30,300 and a take-profit at 32,000.

- Add a stop-loss at 28,000.

The performance of the BTC/USD pair was also a reflection that the recent rally (in equities) was not strong enough. It is what is known as a relief rally or a dead cat bounce that happens after a major sell-off. Other cryptocurrencies like Ethereum (ETH-X), Ripple (XRP-X), and Avalanche (AVAX-X), also crashed hard.

Another reason for the sell-off is that there are simply not enough buyers amid the sell-off and that many holders have decided to exit their positions."

Looking for the positive amidst the red is TM contributor James Knightley, who in a short video, explains Why Inflation-Led Recession Fears In The States Are Overdone.

"The US Federal Reserve is actively slamming on the breaks as inflation hits 8% and unemployment falls below 4%. Might recession be looming in America? After all, the economy contracted in the first quarter. We don't think so. In fact, data shows that growth is rebounding strongly. ING's James Knightley in New York is looking for an annualized rate of 3%-plus this quarter."

Rounding out the column today we head over to the "Where to Invest Department" where contributor Robert Ross, in another "In the Spotlight" piece, finds 3 Safe Stocks To Buy As We Head For A Recession.

"Here are three recession-resistant stocks to consider buying during this bear market:

Kroger Co. (KR)

Even when recessions hit and the economy contracts people still need to eat and buy basic household products. That’s is why consumer stocks like Kroger are typically safe bets. As prices soar, people naturally downsize from restaurant dining and instead turn to the grocery stores and packaged food makers.

Aside from its instantly recognizable name, Kroger operates nearly 3,000 supermarkets and is the largest independent grocer in the country. Unsurprisingly, its earnings soared throughout the Covid-19 pandemic, while its revenue exceeded analyst’s expectations in Q4.

Since the start of 2022, Kroger’s stock is up about 28%, crushing the S&P 500’s 18% drop. While other industry titans like Walmart are out-growing the Cincinnati-based retailer and winning market share in the fresh food niche, Kroger still pays a higher dividend yield at 1.57%.

Other reliable stocks include Procter & Gamble (PG), PepsiCo (PEP), and Tyson Foods (TSN)

Sun Communities (SUI)

‘Home’ is a word we know well thanks to the pandemic. Even after lockdowns relaxed, most of us remained static, introverted, and married to our humble abodes for another year.

But ‘home’ means different things to different people. It can include houses, apartments, and even something called manufactured home communities (otherwise known as trailer parks).

Every day, 10,000 Boomers are retiring with nowhere near enough money. But there’s a solution: 60% of US households own a home. And Duke University economics professor Charles M. Becker thinks many will sell their homes and move into—you guessed it—manufactured homes.

That’s where Sun Communities comes into play. The company is the largest provider of manufactured homes in the US. While most retirees simply cannot afford their dream house on the beach. Many will turn to manufactured home parks as a back-up plan.

Everyone should be taking advantage of this trend. It’s a no-brainer. With stock market volatility on the rise, you want to add safe and stable companies to your portfolio.

Abbot Laboratories (ABT)

It’s obvious why the health care sector outperformed during the global pandemic. But with the shockwave impression Covid left on the world, diversified health products companies like Abbot Labs are sure to see more future growth. Neither governments nor investors want to see another pandemic, especially considering how much worse it could have been.

Abbot Labs sells its broad portfolio of medical devices, diagnostics, nutrition, and generic medicines to 160 countries. In 2021, it grossed $42 billion in total revenue. Though the company has been off to a rough start this year – suffering the effects of supply chain shortages and a recall of powder formulas – it’s still one of the leaders in the healthcare space.

The company has capitalized on the boom in COVID testing sales. But with a steady stream of revenue from its structural heart products, a robust product pipeline, and plenty of acquisition targets in this depressed market environment, large cap healthcare players like ABT are a great place to ride out the bear market.

Other reliable healthcare stocks include Johnson & Johnson (JNJ), Pfizer (PFE), and CVS Health (CVS)."

Caveat Emptor.

Take good care.

I'll see you next week.

Image: David Marshall

Good stock picks by Robert Ross. Thanks.