The Bitcoin-Meme Stock Relationship Breaks Down

Ed Carpenter Racing's Bitcoin-sponsored number 21 Chevrolet in last month's Indy 500.

Tuesday Morning Quarterbacking

Below are a few observations about Monday's markets, followed by attractive way readers who purchased our recent top name, AMC Entertainment Holdings (AMC), can lock in most of their gains while staying long for more.

Bitcoin's Original Tag Team Returns

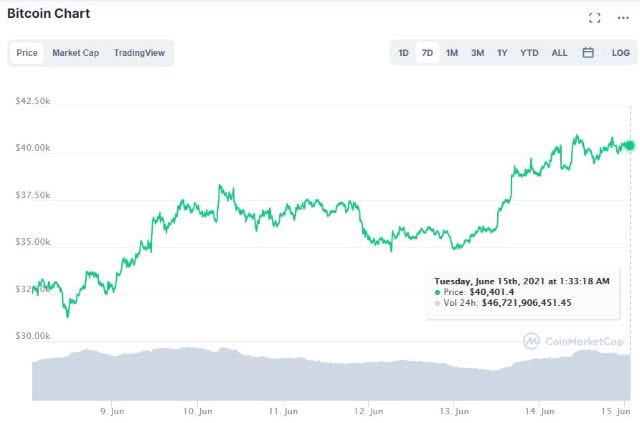

Bitcoin bounced early this week with boosts from its original plunge protection tag team. On Sunday, Tesla (TSLA) CEO Elon Musk intimated that his car company would start accepting the cryptocurrency again after miners met a seemingly achievable bar for "clean" energy use.

This is inaccurate. Tesla only sold ~10% of holdings to confirm BTC could be liquidated easily without moving market.

— Elon Musk (@elonmusk) June 13, 2021

When there’s confirmation of reasonable (~50%) clean energy usage by miners with positive future trend, Tesla will resume allowing Bitcoin transactions.

As we noted in a post last week (Republic Of The Savior), what's considered pollution has been a moving target in recent decades: as our environment got cleaner (in the West, at least), activists turned their concern toward greenhouse gasses. So far, they've given one of those gasses (water vapor) a pass; if that remains the case, then the promised Salvadoran volcano-powered Bitcoin mining may give Musk the political cover he needs to start accepting Bitcoin for sales of his electric cars again.

The second member of the tag team, MicroStrategy (MSTR) CEO Michael Saylor, stepped in on Monday, announcing that his company had filed to raise as much as $1 billion in a new equity offering and use the proceeds to buy more Bitcoin. This came on the heels of his company's $500 million bond sale last week.

MicroStrategy Launches “At the Market” Securities Offering for Flexibility to Sell Up to $1 billion of its Class A Common Stock Over Time $MSTRhttps://t.co/qouK8pFmBF

— Michael Saylor (@michael_saylor) June 14, 2021

Bitcoin broke above $40,000 for the first time in weeks on Monday.

The Bitcoin-Meme Stock Relationship Breaks

An observation we've made in previous posts (e.g., AMC: Return Of The Meme Stock) was that the resurgence in meme stocks came as Bitcoin sagged. That made sense, as the previous rally in Bitcoin and other cryptocurrencies, had siphoned some of the speculative fervor out of meme stocks. On Monday, though, that relationship broke down: Bitcoin and one of the hottest recent meme stocks, AMC, were both up double digits.

Another Chance To Be Right

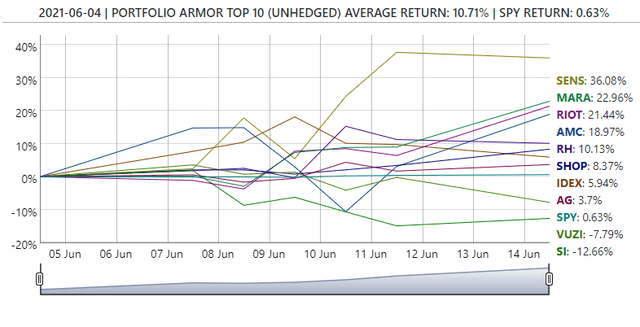

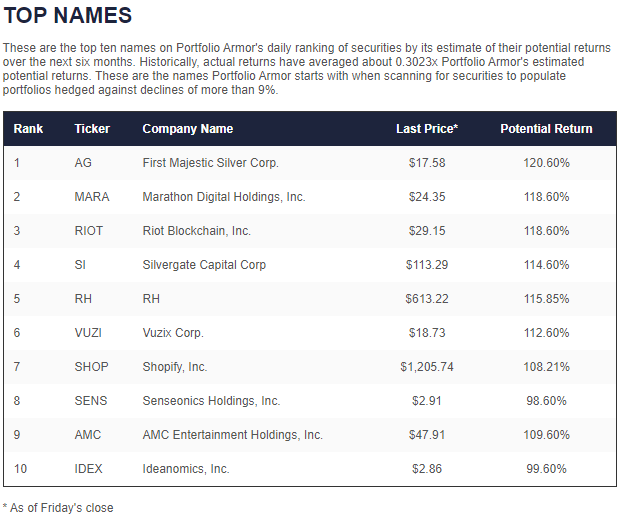

You could see that in the performance of our top ten names cohort from June 4th on Monday. We mentioned that cohort in a post at the time (AMC: Another Chance To Be Wrong):

Screen capture via Portfolio Armor on 6/4/2021.

Note that that top names cohort included two Bitcoin miners as well: Marathon Digital Holdings (MARA) and Riot Blockchain (RIOT). As of Tuesday's close, both the Bitcoin miners and AMC were up double digits from June 4th.

What Didn't Go Up On Monday

What didn't go up on Monday was commodities. In a post on Sunday (Instead Of Gold: Consider Iron), we wrote that crypto and commodities had been two ways investors were playing the post-COVID lockdown inflation this year and that our system had picked up both crypto and commodity names. The iron miner we mentioned in that article, Cleveland-Cliffs (CLF), was down 9.41% on Monday, on no news. As of Monday's close, though, our system was still bullish on it.

Locking In AMC Gains

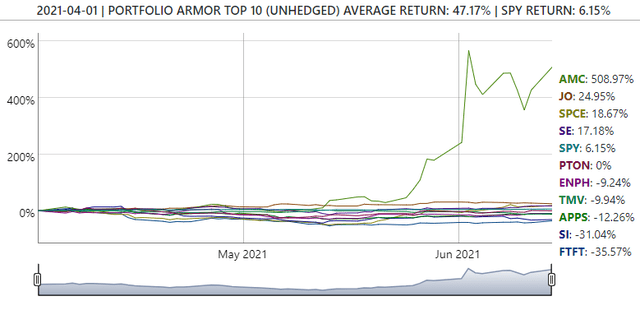

Since it first hit our top ten this year on April 1st, shares of AMC were up more than 500% as of Monday's close.

If you've been long the stock over that time frame and haven't hedged it yet, here's an approach to consider.

Capped Upside, Negative Cost

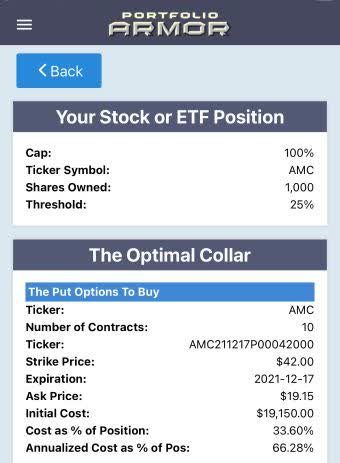

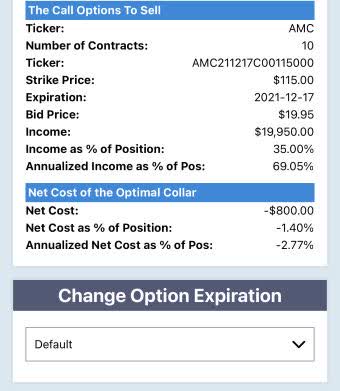

AMC was too expensive to hedge with optimal puts on Monday, but the optimal collar below offered protection against a greater-than-25% drop in 1,000 shares over the next six months, while still giving you a chance at another 100% of possible upside.

Screen captures via the Portfolio Armor iPhone app.

The net cost on that collar was negative, meaning you would have collected a net credit of $800 when opening that hedge, assuming, to be conservative, that you placed both trades (buying the puts and selling the calls) at the worst ends of their respective spreads.

Something to consider if your sitting on big AMC gains now.