AMC: Return Of The Meme Stock

Technical analysis by Swan Financial Studios on AMC.

As Crypto Crabs, A Meme Stock Comes Back

We've speculated before that the insane rally in crypto this year siphoned some of the speculative fervor from the sort of stocks formerly favored by the Wall Street Bets crowd. Perhaps it's not a coincidence that on Thursday, Bitcoin and Ethereum were essentially flat as shares of AMC (AMC) spiked more than 35%. Our friend Andy Swan offered some tongue-in-cheek technical analysis on AMC Thursday afternoon.

Important MARKET UPDATE from Swan Financial Studios pic.twitter.com/f3joLgK5Ey

— Andy Swan (@AndySwan) May 27, 2021

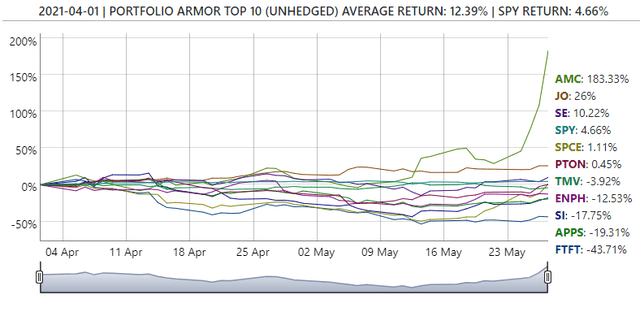

Big Gain For A Top Ten Name From April 1st

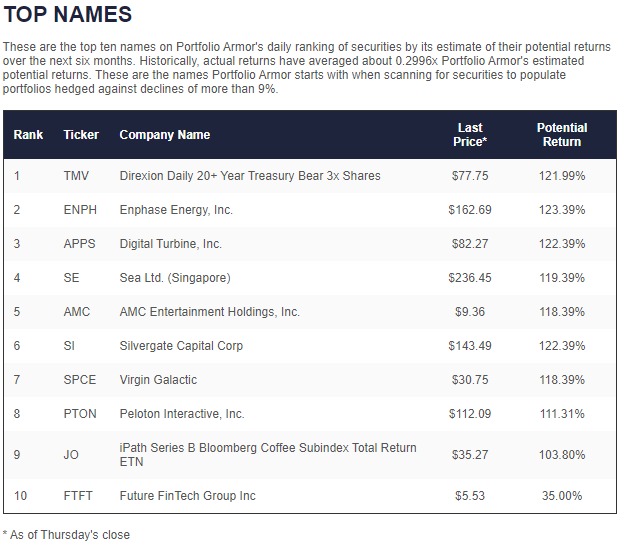

AMC was one of our top ten names on April 1st.

Screen capture via Portfolio Armor on 4/1/2021.

After Thursday's pop, it's now up 183% since then. Quite a skew in returns from this top names cohort so far, with the coffee ETN JO and Sea, Ltd (SE) posting double-digit returns, Virgin Galactic (SPCE) and Peloton (PTON) essentially flat, and everything else in the red. Still, thanks to the huge gain in AMC, the average return of these top names so far is 12.39%, versus 4.66% for SPY.

At this point, prudent AMC longs may want to consider adding some downside protection. We'll look at a couple of ways to do so below.

Locking In AMC Gains

In the video below, we show a couple of ways of optimally hedging AMC using our iPhone app.

Both hedges we show in that video have generous net credits. Consider taking advantage of one of them if you're sitting on large AMC gains now.

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more