Powell’s Words Can’t Shape Gold’s Medium-Term Fundamentals

On the eve of the Fed's boss's speech, officials suggested a more hawkish central bank policy. But even if Powell's words trigger a rally, they won’t help the gold market in the long run.

With the S&P 500 rallying by 1.41% on Aug. 25, the late-afternoon surge was likely a short-covering rally in advance of Powell’s Jackson Hole speech. In the process, gold rose by 0.56%, silver by 1.13%, GDX ETF by 0.85%, and GDXJ ETF by 0.65%. Conversely, the USD Index declined by 0.17% and the U.S. 10-Year real yield also retreated.

Therefore, while volatility should be amplified today, the PMs’ medium-term technical and fundamental outlooks are profoundly bearish. As a result, Powell’s words should have little impact on their prices in the months ahead.

Gold and the Central Bank Effect

With the Qatar Central Bank increasing its gold purchases in the second quarter, Krishan Gopaul, Senior European and Middle East Analyst at the World Gold Council, tweeted on Aug. 23:

“The Central Bank of Qatar added 14.8t of #gold to its official reserves in July 2022 - appears to be the largest monthly increase on record (back to 1967), although early data is patchy. Gold reserves now stand at 72.3t, the highest on record.”

Thus, you may be curious about how central bank activity influences gold. Well, the reality is that central banks are steady purchasers of the yellow metal, and all things considered, their activity has an immaterial impact on the gold price.

For example, the World Gold Council released its Gold Demand Trends Q2 2022 report on Jul. 28. An excerpt read:

“The LBMA Gold price PM averaged US$1,871/oz in Q2, 3% above the Q2’21 average. However, this comparison conceals the 6% decline in the price during the most recent quarter, pressured by rising interest rates and the rocketing value of the U.S. dollar.”

However:

“Central banks continued to buy gold. Global official gold reserves grew by 180t in Q2, taking H1 net purchases to 270t.”

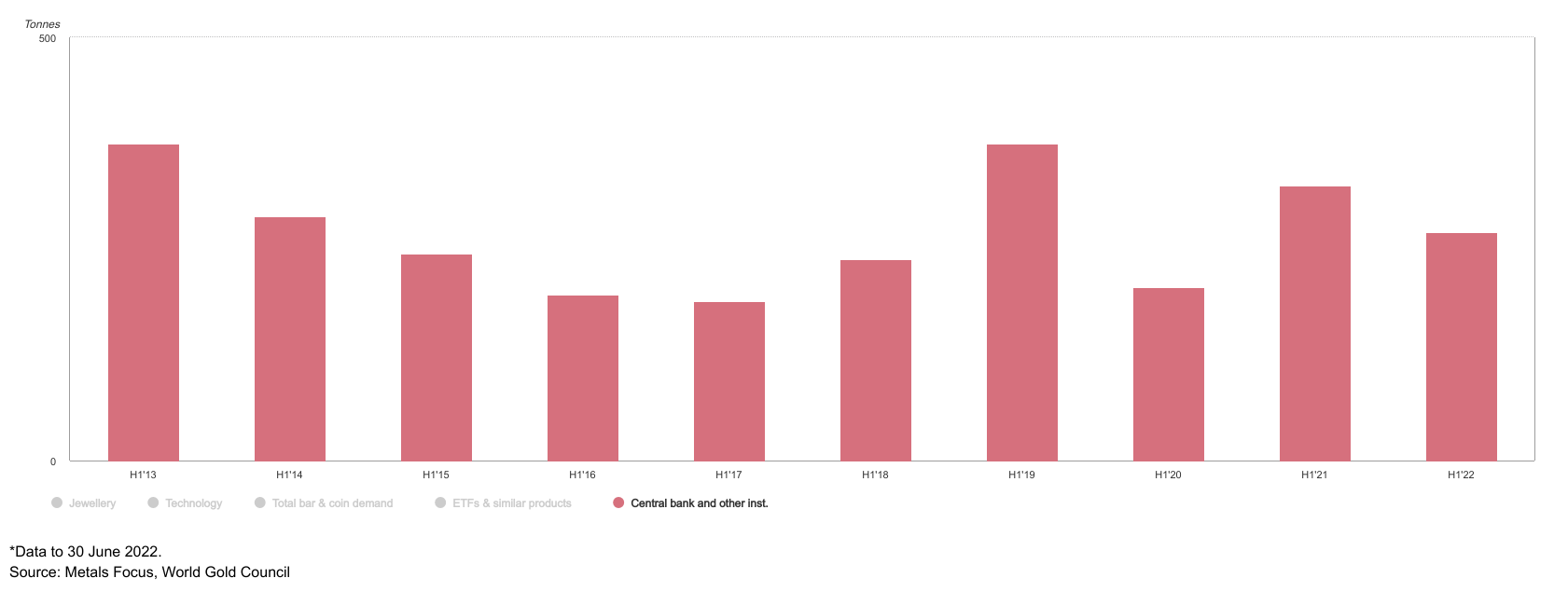

Please see below:

(Click on image to enlarge)

To explain, the red bars above track the gold purchases of central banks and “other institutions.” If you analyze the symmetry, you can see that net flows tend to stay in a relative range of 200 to 300 tons per six-month period.

Furthermore, while H1 2022 purchases were less than H1 2021 and exceeded H1 2020, the data shows that central banks aren’t the best market timers.

Please see below:

(Click on image to enlarge)

To explain, the candlesticks above track the gold futures price, while the vertical gray lines represent the six-month (H1) periods in 2020, 202,1, and 2022. If you analyze the left side of the chart, you can see that the gold futures price ended the six-month period higher, even though central bank purchases were near the low end of the historical range (204.50 tons on the first chart above).

Likewise, central banks purchased 325.25 tons of gold in H1 2021, only to watch the gold futures price end the six-month period lower than where it started. Moreover, central bank purchases fell to 269.62 tons in H1 2022, and the gold futures price was roughly flat throughout the period.

All in all, headlines about central bank gold purchases often garner a lot of excitement from the Perma bulls. However, their activity doesn’t provide much insight into where gold is headed, let alone where the GDXJ ETF is headed.

In contrast, the technicals, the USD Index, and real interest rates are much better predictors of gold’s short-and-medium-term movement. In addition, with the junior miners influenced by the behavior of the general stock market, the S&P 500 is another critical metric.

Powell’s Prayer

With Fed Chairman Jerome Powell set to speak at the annual Jackson Hole summit today, investors went from front-running a hawkish hammer to front-running a dovish pivot. However, while investors’ manic mood swings have become the norm in an era of easy money, Powell’s words can’t shape the medium-term fundamentals.

Furthermore, with gold, silver, and mining stocks underperforming the S&P 500 on Aug. 25, the PMs have been relatively weak. Therefore, while Powell could ignite a pump or a dump today, his deputies’ messaging on Aug. 25 signals more hawkish surprises to come.

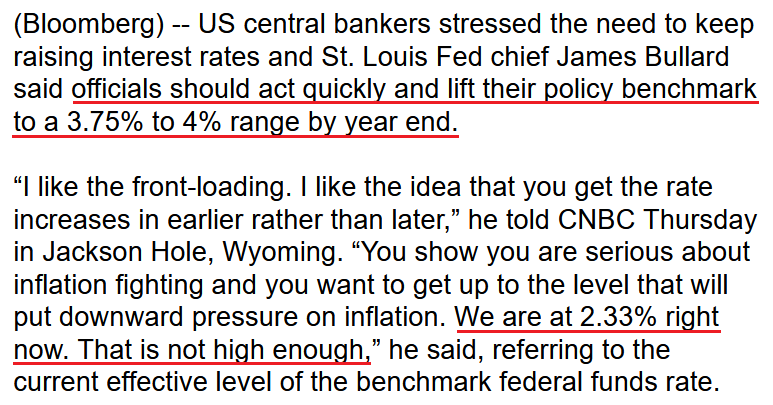

For example, St. Louis Fed President James Bullard said that if the Fed doesn’t front-load interest rate hikes, “a baseline would be that probably inflation would be more persistent than what many on Wall Street expect and that’s going to be higher for longer. That’s a risk that’s underpriced in the markets today.”

As a result, he stressed that the Fed needs to raise the U.S. federal funds rate (FFR) quickly to show it's “serious about inflation fighting.”

Please see below:

Source: Bloomberg

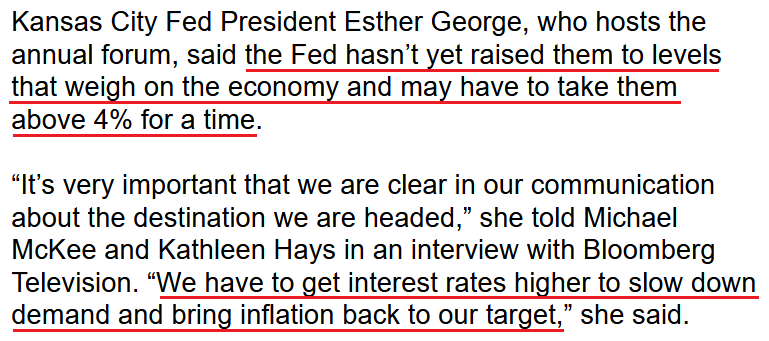

Likewise, Kansas City Fed President Esther George said on Aug. 25 that the central bank has “more work to do” with regard to interest rate hikes, and that “we are trying to get back to 2% inflation as quickly as we can, without doing damage to the economy.”

"So July looked like there was some easing in those price pressures, but certainly not enough that you would say, we're in the right direction," George said. "So I think we have more data to see. And I think we have more work to do, to begin to see that trend move down."

Thus, while George is on the more dovish side of the spectrum, she noted that the FFR may have to exceed 4% before it’s all said and done. For context, we expect inflation to be more problematic than the consensus realizes, and for the FFR to hit 4.5%+ in 2023.

Please see below:

Source: Bloomberg

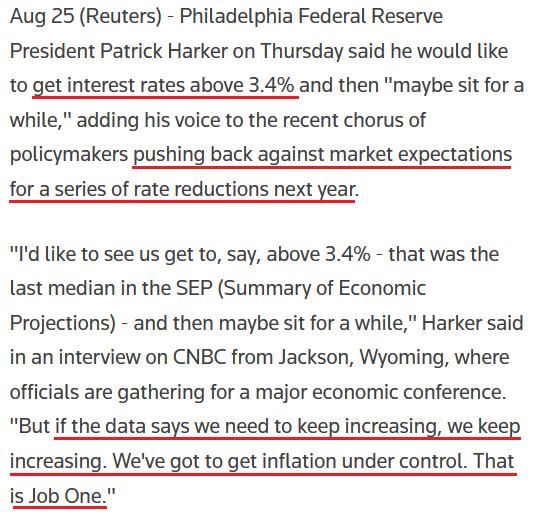

Continuing the theme, Philadelphia Fed President Patrick Harker said on Aug. 25: “We don’t need to rush way up and then rush way down. We need to go up and sit for a while and let things play out,” adding that when rates are above 3.4%, they will begin to slow the economy.

As a result, while his FFR prediction is less hawkish than Bullard and George's, he reiterated that curbing inflation is “Job One.”

Please see below:

Source: Reuters

Joining the fray, Atlanta Fed President Raphael Bostic said on Aug. 25 that he’s split between a 50 or 75 basis point rate hike in September. “At this point, I’d toss a coin between the two,” he said. “We all, as policymakers, understand that inflation is a big problem and is a challenge that we’re going to do all that we can to handle.”

Thus, while it’s quite coincidental that Powell sent out his minions the day before his Jackson Hole speech, I noted during our post-FOMC recap on Dec. 16, 2021, that Powell uses his deputies as messengers. I wrote:

As one of the most important quotes of the press conference, he admitted:

“My colleagues were out talking about a faster taper, and that doesn’t happen by accident. They were out talking about a faster taper before the president made his decision. So it’s a decision that effectively was more than entrained.”

And while Powell sounded a little rattled during the exchange, his slip highlights the importance of Fed officials’ hawkish rhetoric. Essentially, when Clarida, Waller, Bostic, Bullard, etc., are making the hawkish rounds, “that doesn’t happen by accident.” As such, it’s an admission that his understudies serve as messengers for pre-determined policy decisions.

Therefore, if Powell is up to his old tricks, the hawkish rhetoric from Bullard, George, Harker, and to a lesser extent, Bostic on Aug. 25 may have been a subtle hint at his Jackson Hole speech. Only time will tell.

However, what’s not up for debate is the deteriorating fundamental outlook that confronts financial assets. With unanchored inflation mixed with deteriorating growth, investors have way too much faith in the Fed’s ability to solve the economic conundrum. So while the consensus assumes that a recession is unlikely, the reality is that avoiding a recession under these circumstances has never occurred since 1954.

To that point, Greg Jensen, Co-Chief Investment Officer at Bridgewater Associates – the world’s largest hedge fund – warned on Aug. 25 that “inflation will be more stubborn” despite “the market pricing a decline in inflation to occur in a relatively stable economy.”

Furthermore, he added that long-only investors have nowhere to hide “to totally avoid this,” as the inflationary realities signal material downside for risk assets. Thus, while he’s one of the few that share our fundamental view, a realization is profoundly bearish for gold, silver, mining stocks, and the S&P 500.

Source: Bloomberg

The Bottom Line

While Powell's rhetoric today remains a coin flip, his deputies' hints on Aug. 25 foreshadow more hawkish policy in the autumn and winter months. Moreover, with investors' inflation and rate hike expectations below the Fed's forecast and the Fed's projection below ours and Jensen's forecast, there is plenty of room for more hawkish re-pricing.

As a result, while Powell may spark a short-term rally today, please remember that we've been here many times. For example, several Powell press conferences over the last ~18 months have ended with a weaker USD Index, lower real yields, and a higher GDXJ ETF. Yet, the former forged ahead to make new highs, while the latter sank to new lows. As such, the important point is that the Fed's inflation fight supports a stronger USD Index and higher real yields and that the environment is bearish for the PMs.

In conclusion, the PMs rallied on Aug. 25, as the S&P 500 ended the day higher. However, the GDXJ ETF underperformed the general stock market, even as the USD Index and the U.S. 10-Year real yield retreated. Therefore, our medium-term expectations are unchanged.

More By This Author:

If Investors Revive After Jackson Hole, Will The GDXJ Rise?Don’t Be Influenced By Powell’s Upcoming Speech

With The EUR/USD At A 20-Year Low, What Are Gold’s Prospects?

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more