Don’t Be Influenced By Powell’s Upcoming Speech

With oil prices rallying on the hope of output cuts by OPEC+, the PMs benefited from the enthusiasm. For example, gold rose by 0.73%, silver by 0.78%, the GDX ETF by 1.70%, and the GDXJ ETF by 2.08%. Moreover, profit-taking helped push the USD Index lower by 0.39%. However, long-term Treasury yields jumped, and with quantitative tightening (QT) set to double next week, the PMs’ optimism is unlikely to last.

The Bull/Bear Narratives

While the consensus assumes that peak inflation means the Fed is closer to the end of its tightening cycle than the beginning, I’ve warned on numerous occasions that normalizing the metric to 2% will result in much more economic pain than currently expected. Therefore, while the financial markets tread water in anticipation of Fed Chairman Jerome Powell’s Jackson Hole speech, the reality is that his words don’t change the medium-term ramifications.

For example, the bears are hoping that Powell will reaffirm his commitment to reducing inflation on Aug. 26, resulting in lower asset prices as the hawkish realities resurface. In contrast, the bulls hope that Powell will strike a dovish tone and help re-ignite the risk rally that pushed the S&P 500 above 4,300 and helped uplift gold, silver, and mining stocks.

However, while sentiment moves markets in the short term, nothing that Powell says will change the deteriorating U.S. economic outlook. Furthermore, Powell was profoundly dovish during his post-FOMC press conference on Jul. 27, and other than looser financial conditions, little has changed fundamentally that signals a 180 in his communication.

As such, it’s prudent to look past the daily narratives and focus on the realities that manifest when the Fed attempts to rein in unanchored inflation.

Speaking of which, the U.S. 10-Year Treasury yield closed above 3% on Aug. 23, and the recently elusive milestone helps the benchmark inch closer to its 2022 highs.

Please see below:

(Click on image to enlarge)

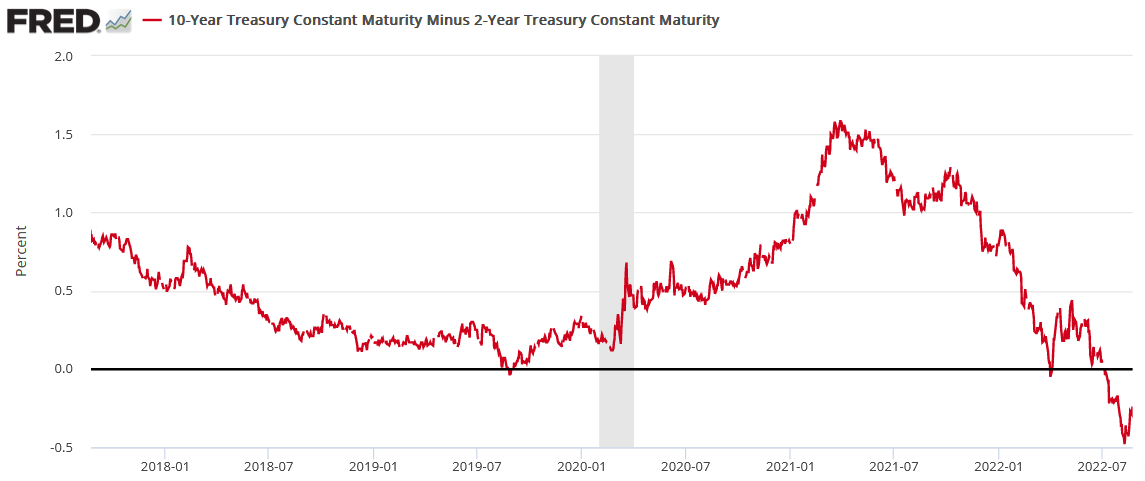

Furthermore, if you analyze the bottom right-hand corner of the chart below, you can see that the 10-2 spread has started to turn.

(Click on image to enlarge)

For context, the spread is calculated by subtracting the U.S. 2-Year Treasury yield from the U.S. 10-Year Treasury yield. In a nutshell: when the 2-year outperforms, the red line falls (flattening), and when the 10-year outperforms, the red line rises (steepening).

The media now highlights how a negative (inverted) 10-2 spread is the bond market’s way of signaling an impending recession. However, while this is true, the important point is that a negative 10-2 spread often steepens before recessions.

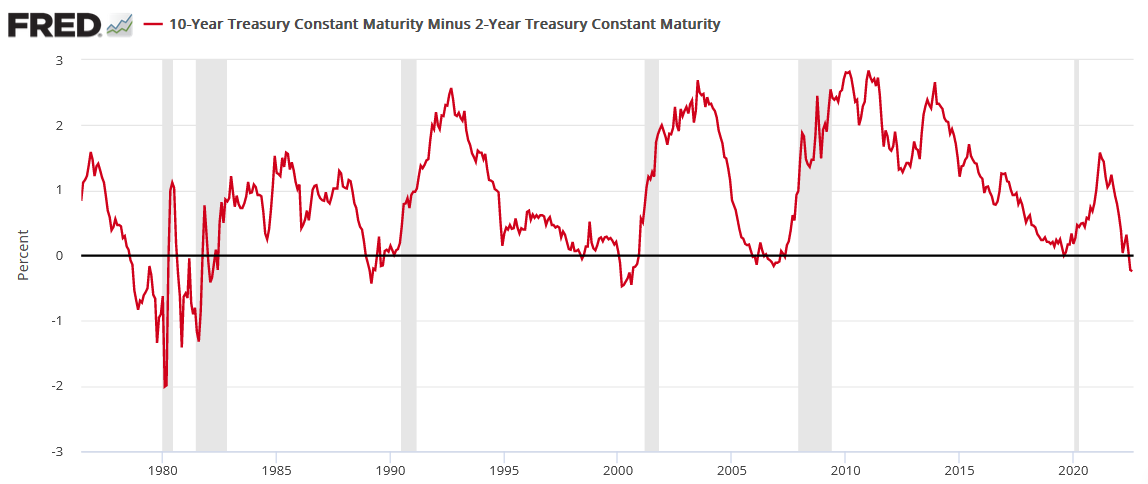

Please see below:

(Click on image to enlarge)

To explain, the early 1980s show a more mixed picture. However, the lead-up to the recessions in 1990, 2000, and 2010 (the vertical gray bars) shows how the 10-2 spread often steepens from a negative base before an economic climax unfolds. For context, the chart above uses monthly data, so the move on the right side doesn’t capture the small uptick shown on the daily chart that preceded it.

However, the fundamental implications are more relevant than what Powell says or doesn’t say on Aug. 26.

PMI Problems

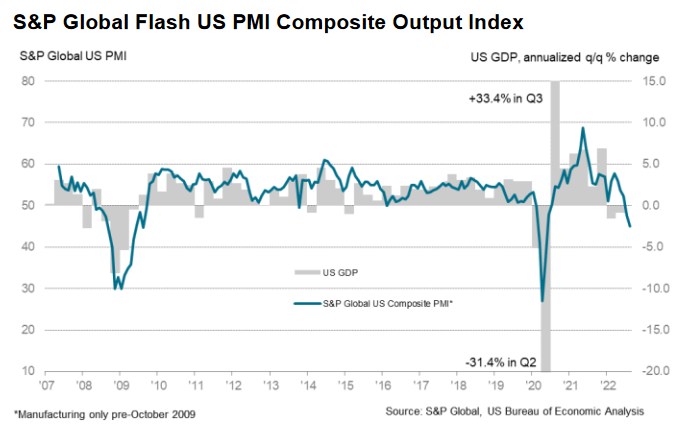

S&P Global released its U.S. Composite PMI on Aug. 23. The headline index declined from 47.7 in July to 45.0 in August, marking the “second successive monthly decrease in total business activity.” Also, a reading below 50 signals that the U.S. manufacturing and service sectors are in contraction.

Please see below:

To explain, the blue line above tracks S&P Global’s U.S. Composite PMI, while the gray bars above track the annualized quarter-over-quarter (QoQ) percentage change in U.S. GDP. If you analyze the right side of the chart, you can see that the blue line has sunk to levels seen during the global financial crisis (GFC) and the COVID-19 crash.

Furthermore, the data shows how sharp declines in the blue line culminated with sharp declines in U.S. GDP in 2008 and 2020. As a result, while a small technical recession has already occurred, a continuation of the trend implies a broad-based slide in economic activity.

Conversely, while inflation and employment have softened, they’re still increasing as output falters. The report revealed:

“Weak client demand and lower new orders led firms to scale back their hiring efforts, as employment rose at the slowest pace in 2022 to date. Although some companies

continued to note challenges finding suitable replacements for voluntary leavers, a growing number of firms stated that uncertainty and rising costs led them to delay the immediate replacement of staff.”

In addition:

“In line with the trend for cost burdens, firms increased their selling prices at the softest pace in 18 months in August. The softer rise in output charges was linked to efforts to pass through any concessions to customers to encourage the placement of orders. That said, the rate of inflation was marked overall and faster than in any period before March 2021.”

Thus, while the picture is nowhere near perfect, the reality is that employment and inflation rose during the survey period from Aug. 5 to Aug. 27. As such, the results are bullish for Fed policy because of the central bank’s dual mandate is maximum employment and price stability.

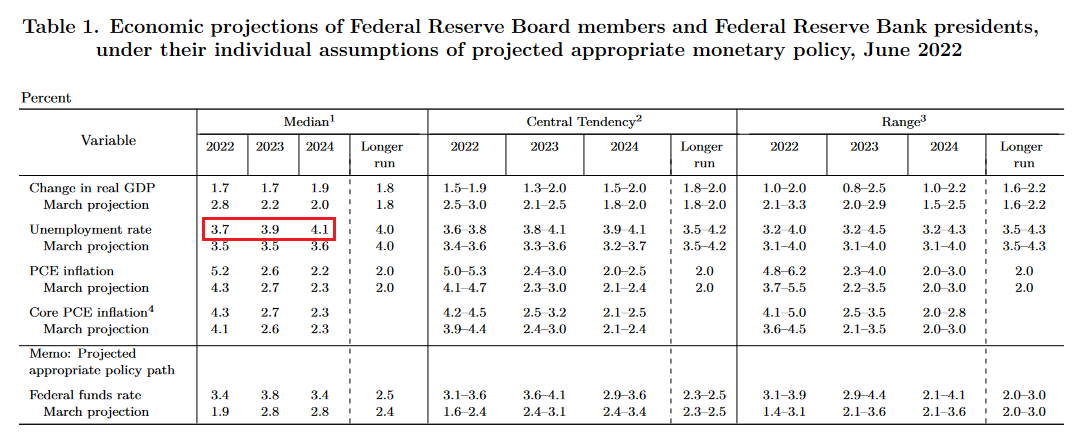

To that point, with the U.S. unemployment rate hitting a ~50-year low of 3.5% in July, further labor market strength is antithetical to the Fed’s 2022 projection of a 3.7% unemployment rate and its ability to reduce wage inflation.

Please see below:

(Click on image to enlarge)

Source: U.S. Fed

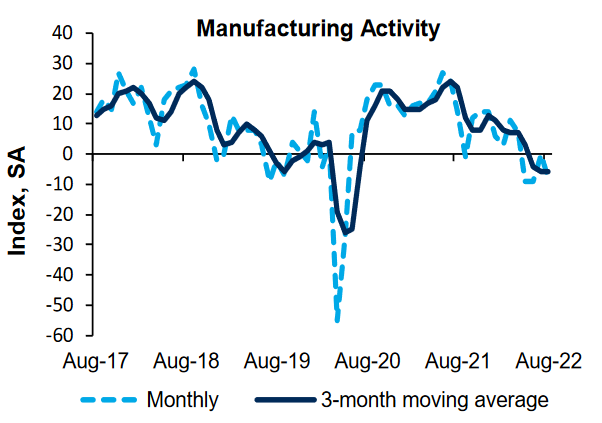

Continuing the theme, the Richmond Fed released its Fifth District Survey of Manufacturing Activity on Aug. 23. Moreover, the headline index declined from 0 in July to -8 in August, as “the indexes for shipments and volume of new orders slid from 7 and −10 in July to −8 and −20 in August.”

Please see below:

Source: Richmond Fed

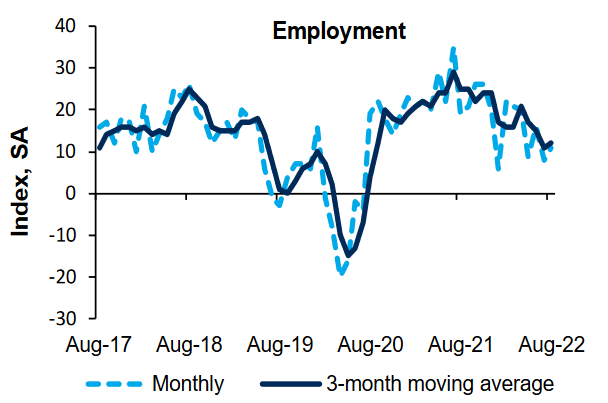

In contrast, the Richmond Fed’s employment index increased from 8 in July to 11 in August. As a result, the U.S. labor market continues to showcase immense resiliency.

Please see below:

Source: Richmond Fed

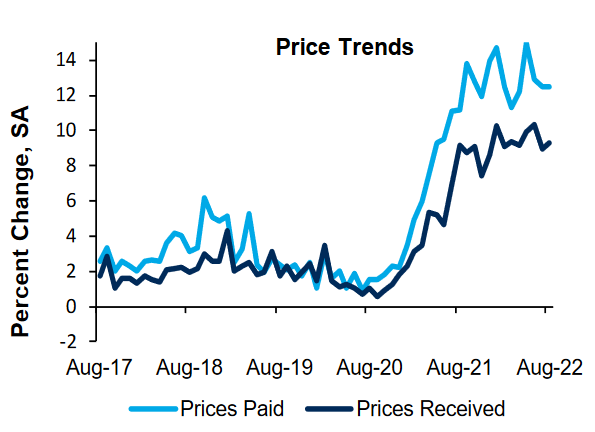

In addition, the report revealed that “the average growth rate of prices paid was virtually flat in August, while the average growth rate of prices received increased somewhat.” Thus, it’s become a recurring theme that as output indices crater, employment and inflation remain highly elevated.

Please see below:

Source: Richmond Fed

Furthermore, the developments highlight the growth-inflation divergence that I’ve warned about for months. With the Fed slow-rolling toward tighter monetary policy, the central bank allowed inflation to fester while growth decelerated. Moreover, history shows that the longer inflation remains elevated, the more it pressures growth and further widens the gap. Therefore, the Fed needs to hammer inflation to avoid a 1970s-style malaise.

Likewise, while U.S. employment remains resilient for now, history reminds us that inflation upends growth first, then comes the U.S. labor market. To explain, I wrote on Aug. 16:

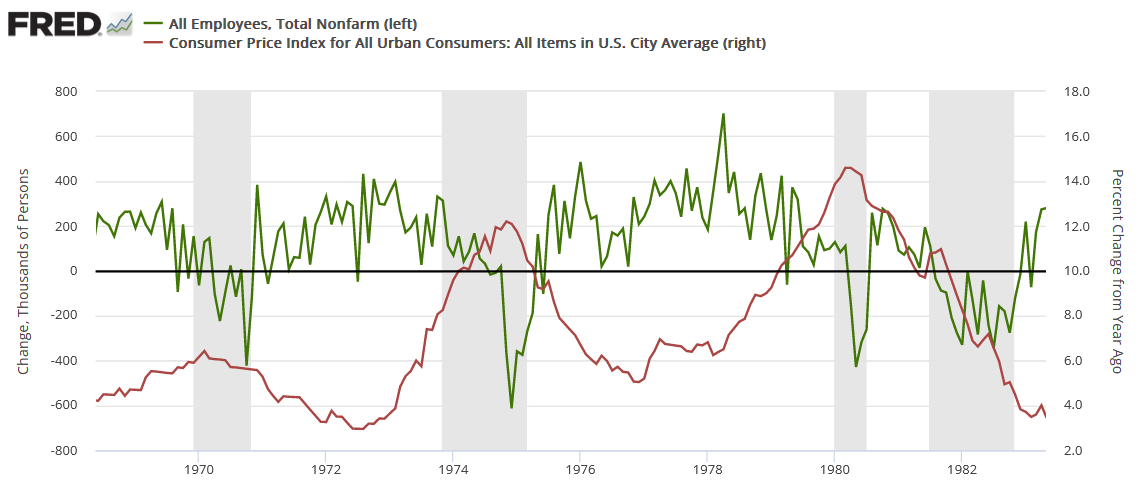

(Click on image to enlarge)

The red line above tracks the year-over-year (YoY) percentage change in the headline CPI, while the green line above tracks the monthly change in U.S. nonfarm payrolls. For context, the consensus cites near-record job openings and robust payrolls growth as evidence for why only a mild recession can occur (if one occurs at all).

However, the chart above highlights how unanchored inflation torpedoed that narrative in the 1970s. If you analyze the shaded gray areas (recessions), notice how the green line remained positive during the early stages of the recessions in 1970, 1974, and 1980? In a nutshell: monthly payrolls growth stayed positive during the outset of all three recessions.

However, if you focus your attention on the sharp drops in the green line near the end of the 1970, 1974, and 1980 recessions (negative monthly payrolls prints), you can see that reality re-emerged and the U.S. labor market suffered mightily. Moreover, negative payrolls growth was also present during the 1982 recession, but inflation was declining at that time.

As further evidence, Paul Volcker’s inflation-fighting crusade was built on the notion that unanchored inflation would eventually derail the labor market. Thus, investors don’t realize that a patient Powell will only make a bad situation worse.

Source: U.S. Fed

The Bottom Line

While the short-term fate of the S&P 500 and the PMs likely hinges on Powell’s rhetoric, it’s foolhardy to place too much emphasis on a largely immaterial speech. In reality, the deteriorating technical and fundamental backdrops confronting gold, silver, and mining stocks will be more impactful over the medium term. Therefore, while Powell’s message on Aug. 26 is anyone’s guess, the bearish realities that confront risk assets in the months ahead are crystal clear.

In conclusion, the PMs rallied on Aug. 23, as they benefited from the USD Index’s small pullback. However, the U.S. 10-Year real yield rose once again, and higher real yields and a stronger U.S. dollar should be on the horizon. As such, the PMs will likely head in the opposite direction as the drama unfolds.

More By This Author:

With The EUR/USD At A 20-Year Low, What Are Gold’s Prospects?If The S&P 500 Plunges, The Gold Market May Follow

The USDX Situation Suggests The Peak in Gold Is Already In

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more

always great PR!