Light Crude Oil Is Targeting Further Declines In The Near Term

Image Source: Unsplash

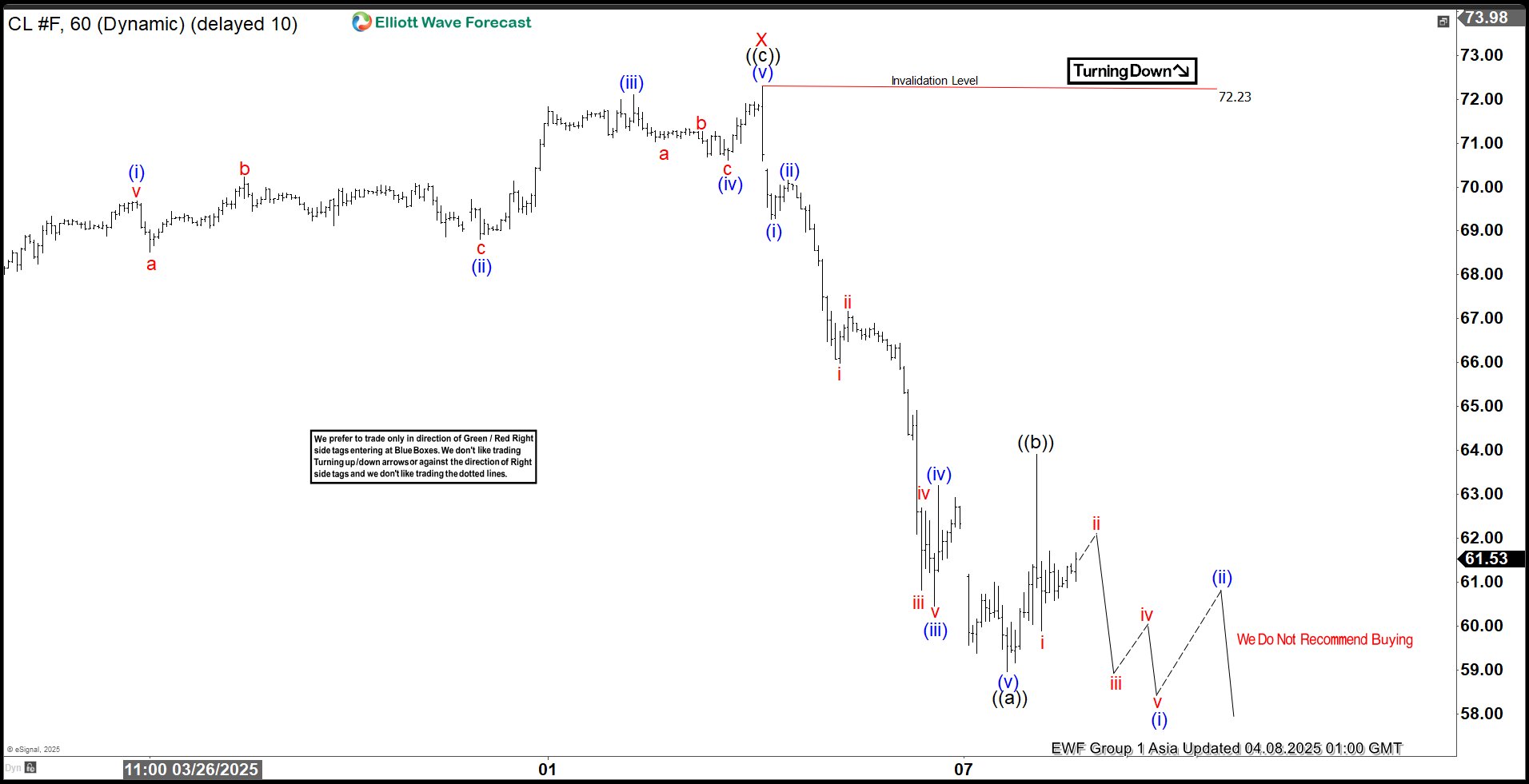

Light Crude Oil (CL) has exhibited a downward trajectory since reaching its high on January 16, 2025, with indications suggesting further declines ahead. The descent follows an incomplete bearish pattern, structured as a double three Elliott Wave formation. The initial decline, termed wave W, concluded at 65.22, followed by a recovery to 72.23, designated as wave X. The price has since resumed its downward movement in wave Y, characterized by a zigzag pattern.

From the wave X peak of 72.23, the price fell to 69.27, marking the end of wave (i), then rose to 70.15 in wave (ii). The decline continued in wave (iii) to 60.45, followed by a recovery in wave (iv) to 63.20. The final segment, wave (v), concluded at 58.95, completing wave ((a)). A subsequent rise in wave ((b)) reached 63.90, after which the price resumed its descent in wave ((c)). For this downward trend to solidify, the price must fall below the 58.95 level established by wave ((a)). Otherwise, a potential stabilization or reversal remains possible.

In the near term, as long as the 72.23 high remains intact, any upward movements are expected to lose momentum—potentially after 3, 7, or 11 incremental rises—leading to further declines.

Crude Oil 60 Minute Elliott Wave Chart

Crude Oil (CL) Video

Video Length: 00:02:26

More By This Author:

SPX Elliott Wave : Incomplete Sequences Calling The Decline

Apple Gains Momentum With 5 Swing Rally, Upside Likely

The DAX Is Declining In An Impulsive Structure, According To Elliott Wave Perspective

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more