Apple Gains Momentum With 5 Swing Rally, Upside Likely

Image Source: Unsplash

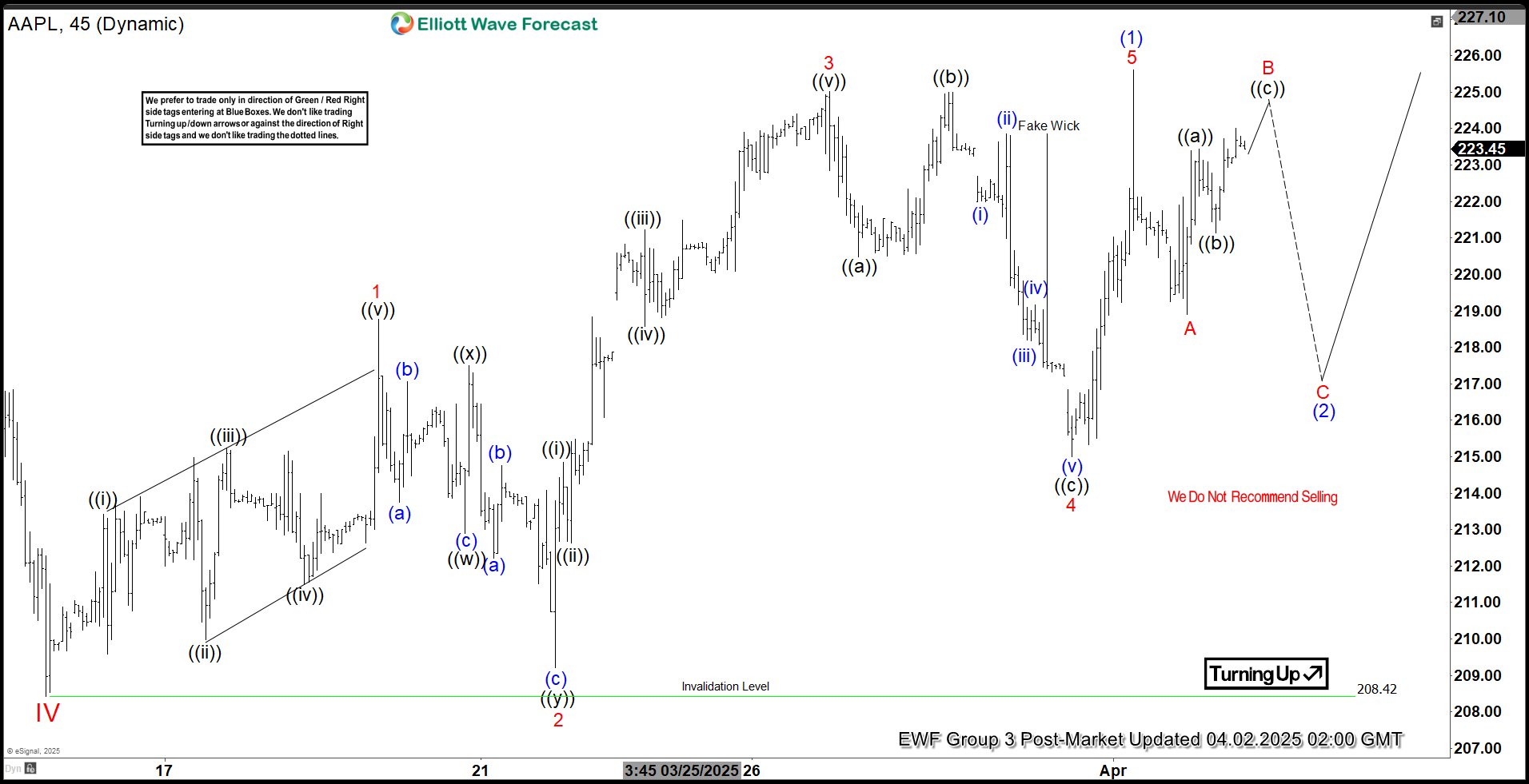

Apple Inc. (AAPL) is showing signs of strength as it builds momentum in a classic Elliott Wave structure. Today’s chart highlights a 5-swing rally from 208.4 low that has propelled the stock higher, signaling potential for further upside in the near term. After establishing a solid base, $AAPL has completed a 5-swing sequence—a bullish pattern often seen in trending markets. The rally began from a key support zone of 184.6 – 209.5. The latest leg up has ended wave (1) in 5 swing, suggesting the short term trend shifts to the upside. As long as pullbacks hold above the recent swing low, the path of least resistance is upward.

The immediate support sits at the prior swing low at 208.4. A hold above this zone keeps the bullish outlook alive. A break below this critical level would negate the bullish view, potentially signaling a deeper correction. Expect pullback in wave (2) to find support in 3, 7, or 11 swing for further upside. For those looking to join the trend, consider waiting for a 3 waves dip toward 100% – 161.8% Fibonacci support to optimize the risk-reward ratio.

Apple (AAPL) 45 Minutes Elliott Wave Chart

AAPL Video

Video Length: 00:03:22

More By This Author:

The DAX Is Declining In An Impulsive Structure, According To Elliott Wave Perspective

Elliott Wave Perspective: Dow Futures (YM) Poised To Continue Its Rally

Elliott Wave View: EURUSD Correcting In Zigzag Structure

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more