Here’s Why This Gold Run Is Just Getting Started

Image Source: Pixabay

Gold keeps blasting through new highs. Last week, it closed at $3,237.97 per ounce – a new record. It’s lived up to its reputation as a safety net and a wealth-accumulating asset. Gold’s determined strength and velocity has surprised even seasoned investors.

If you’ve been wondering whether you missed the moment, please take a deep breath – this uptrend still has more room to run. That’s because we’re now entering the next phase of this mega-bull cycle.

Deeper structural forces are driving the current phase of gold, layered on top of investor flows. This isn’t just about inflation headlines or short-term rate speculation. It’s not a temporary blip. What’s unfolding is a structural shift. It’s about deep realignments: geopolitical fractures, tariff uncertainty that emerges week-to-week, the continued erosion of trust in fiat, and, ultimately, the re-emergence of gold as the ultimate reserve asset – all at once.

Understanding why this is the next phase of a larger gold bull supercycle is pivotal. Nearly a year ago, we forecast that gold would break above $3,000. Then, at Prinsights, we detailed that would happen in the early days of the Trump administration – well before the rest of the market caught on.

That’s now become the consensus. My former employer, Goldman Sachs, along with UBS, and Citi have all revised their outlooks upward, citing central bank demand, geopolitical risk, and growing investor rotation into real stores of value.

And according to the World Gold Council (WGC), global gold ETFs saw $8.6 billion in inflows in March alone, pushing Q1 totals to $21 billion—the second strongest quarter on record. Total global holdings now sit at 3,445 tonnes, the highest since May 2023. Assets under management hit a new record of $345 billion, up 28% for the quarter. North America and Europe have led the way, but Asia has continued to buy gold, punching above its weight.

These trends are growing and have more legs than past periods of gold buying.

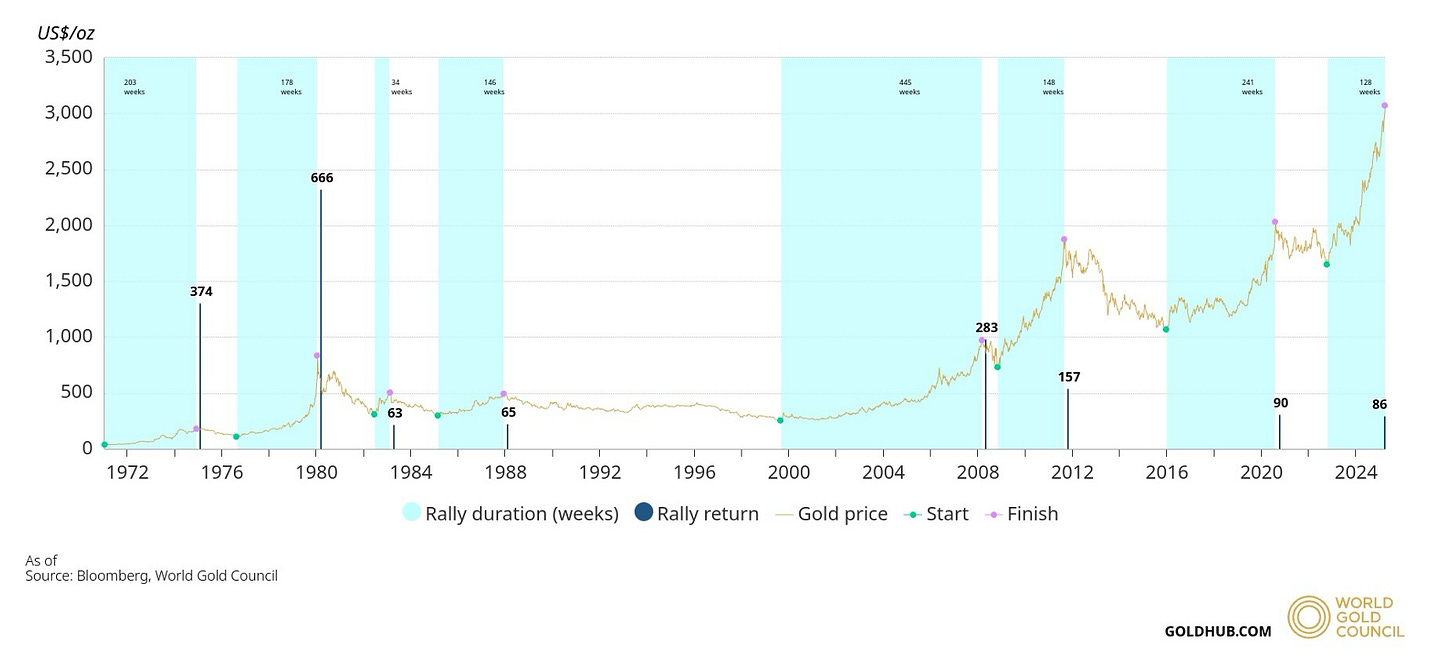

As you can see in the chart from the WGC, the currently rally has yet to surpass even 2011 and 2020 levels.

(Click on image to enlarge)

One thing we’ve been watching closely: the steady accumulation of gold by central banks. They’re diversifying from the dollar and adding to strategic reserves that hedge away from the dollar and U.S. trade policy uncertainty. Recent history shows us that this policy, which took hold during the 2018 tariff period, has only accelerated now, as we’ve discussed before. That strategy won’t stop.

Premium readers, be sure to check out your exclusive March monthly issue!

We continue to stand by our forecast: we believe gold will reach $3,800–$4,000 per ounce by the turn of the year and $5,000 within two years.

Now that, in recent weeks, gold has rallied both when markets sold off and when they recovered, outperforming equities and proving its role as a hedge not just against crisis, but against policy confusion. When tariffs were announced April 2, global markets lost over $5.8 trillion in value in the days that followed. Yet gold climbed. Equity markets lost even more. Gold then climbed further. Even as equities rebounded, gold kept climbing.

My Favorite Gold CEO Thought Leader

We’re not the only ones seeing this shift. One leading CEO of a junior miner we featured exclusively last year in our Premium issue and earlier this year, recently wrote me a note that framed it nicely. He described today’s gold market not as a reaction to headlines, but as the accelerated unwinding of a system that began in 1971, when the U.S. closed the gold window and launched the petrodollar era.

Since then, a strong dollar policy has tried to replace gold’s role with fiat and paper assets. But the 2008 crisis, the rise of QE, and now the weaponization of trade, currency and credit are reversing that.

"Gold is moving back to the center of the global financial system – as final settlement, as central bank ballast, and as a hedge against what’s coming," he told me.

We agree. The real moves are still ahead.

That brings us to the practical part: where and how to buy gold.

How to Build or Expand a Position

The gold landscape is more dynamic than it’s ever been.

Below are five approaches where each offer different tradeoffs:

-

Gold ETFs

If you want simplicity, liquidity, and accessibility, ETFs like iShares Gold Trust (IAU) offer a strong option to consider. They’re backed by physical gold and can be held in a standard brokerage account. This is a clean entry point for investors who want exposure without dealing with storage or delivery. Just keep in mind that you're owning a share of a fund, not the metal itself.

-

Direct Purchase from Mints

For those who value physical control, national mints are a trusted source. The U.S. Mint and Austrian Mint (from where I shared my exclusive analysis) both offer gold bullion coins and bars. These are important because the products are backed by sovereign credibility and high purity standards. While you'll pay a premium over spot price, many investors see that as worthwhile for direct ownership, especially in uncertain times.

These purchases also allow for long-term storage strategies, whether personal or vault-based, and can be passed on generationally or sold back with relative ease. For some, there’s also a tactile reassurance in holding a tangible asset – it is something you can see, store, and secure on your own terms.

-

User-Friendly Gold Apps

Digital apps like Glint enable you to purchase fractional gold that’s fully allocated and securely stored. I’ve been using Glint for years. I find it to be one of the simplest ways to build a steady position in gold. For anyone looking to start with smaller amounts or build a position over time, it’s easy to use – and the fact that it’s tied to physical gold adds peace of mind.

It's also a good tool for those who want to dollar-cost average into gold with smaller amounts. The interface is user-friendly, and for those who want to link gold ownership to a card for spending – it’s an added flexibility.

-

Private Brokers with Strong Track Records

Asset Strategies International (ASI) is a family-owned business with decades of credibility in the physical metals space. I caught up with their co-Founder, Michael Checkan and President, Rich Checkan, at a conference only a couple weeks ago. Now, if Rich sounds familiar, that’s because we shared a Prinsights exclusive with Rich recently. His insights and hands-on approach resonate even more today. What you should know is that ASI offers segregated vaulting, delivery, and personal guidance.

Gold Bullion International (GBI) is another respected player that provides direct gold ownership with flexible storage and digital integration, which is ideal for those looking for institutional-grade infrastructure. For investors who value trust, long-term relationships, and strategy over speed, this path provides something rare: real expertise you can talk to.

-

Junior Miners

I’ve spent real time exploring and cultivating relationships in this space – walking sites, meeting with CEOs, digging into the operations of teams building solid value under the surface. Investing in junior miners is not for the faint of heart. But when the geology is real, and management knows what they’re doing, this is where some of the most asymmetric returns can be found.

Junior miners have been lagging their large-cap counterparts in this latest gold rally due to broader risk-off sentiment, which creates a pricing dislocation we see as an opportunity. We’ve broken down the full story for Premium readers and believe the timing is right to look more closely at it for those not in this position (yet).

Each of these five approaches offer a different way to gain exposure to gold, some more liquid, some more hands-on, and others tied to long-term upside through equity markets. They’re not mutually exclusive, and depending on your goals, you may find value in a combination.

Gold’s uptrend isn’t hype. It’s history returning. Only this time, it’s expanding, as gold’s future is being written now.

More By This Author:

The Next Big Market Shift In Defense

Beyond Big Tech: 3 Key Global Hedge Opportunities

What The Fed's Still Not Telling You

Disclosure: None.