The Next Big Market Shift In Defense

Image Source: Unsplash

The U.S. Defense Department Secretary, Pete Hegseth, just announced more than half a billion dollars of contract spending cuts to the U.S. military budget, as identified by the Department of Government Efficiency (DOGE).

The move came after President Trump directed Elon Musk and DOGE to review Pentagon spending last month. "We're going to find billions, hundreds of billions of dollars of fraud and abuse," Trump said of the largest federal department.

As it turns out, that was not without merit. In November 2024, the Pentagon failed its annual audit once again. That means it couldn’t fully account for how its massive budget was spent. This is the seventh year in a row it has not been able to align its budget, following mandatory audit reviews that started in 2018.

Out of 30 individual sub-agencies reviewed in the Pentagon’s 2024 audit, only six received a clean opinion. The rest failed – meaning they either couldn’t fully account for their assets or couldn’t verify where they were.

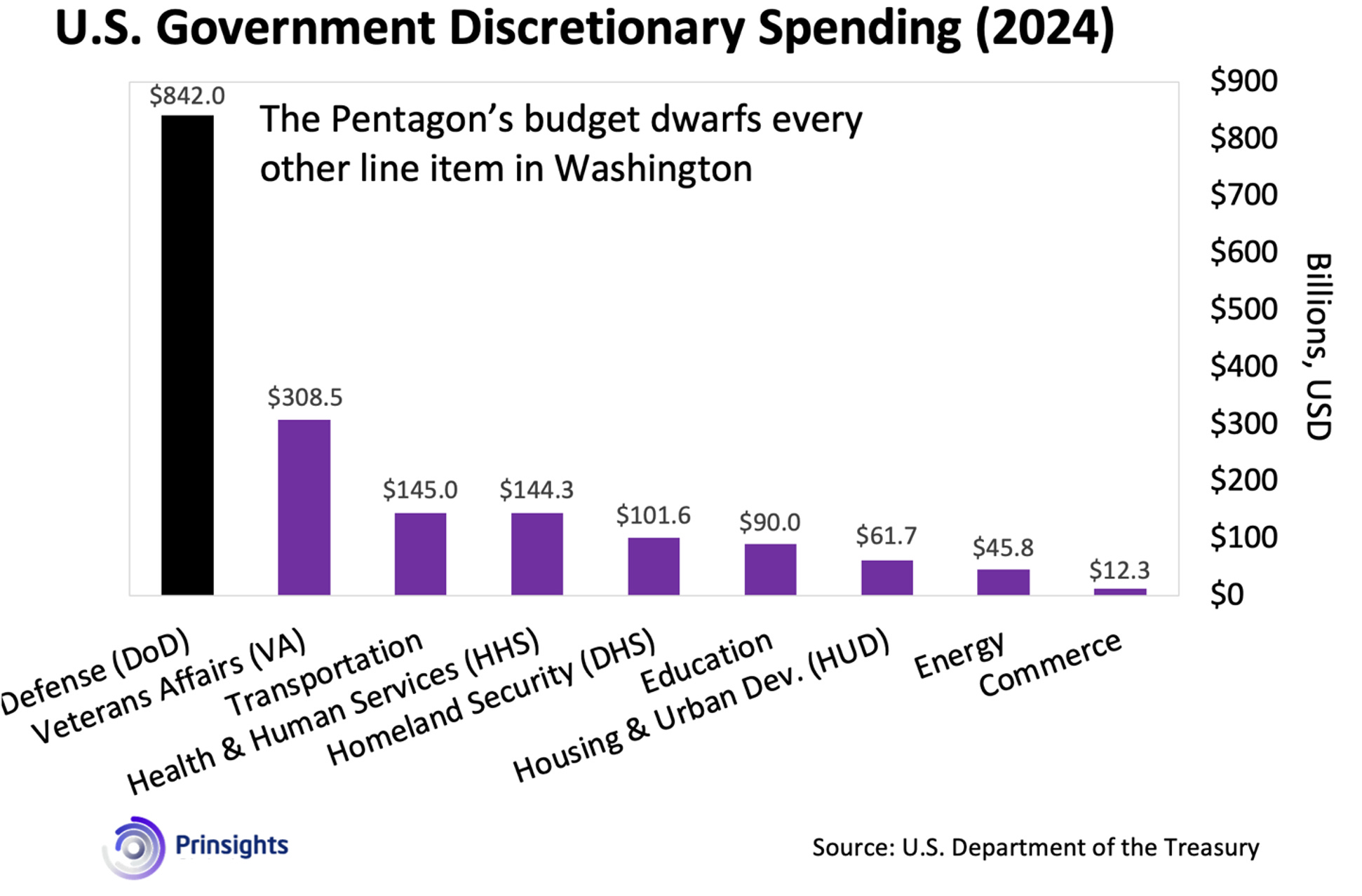

In any other industry and nearly any other government agency, this would be a scandal. After all, the Defense Department commands the largest discretionary budget in the entire U.S. government – it dwarfs everything else. Just look at the chart below.

(Click on image to enlarge)

But in the world of defense, it’s not a flaw – it’s baked into the system. And more than half a billion dollars one way or another doesn’t make a big dent.

No one in power has a real incentive to shrink the Pentagon’s budget – even when they know it’s inefficient. That’s why defense spending isn’t just resilient… it’s structurally protected and politically untouchable.

But that’s the story in the U.S. When we dig deeper, the next big market in military defense spending is changing.

The European Story

In Europe, where most NATO members reside, the story was very different – until recently.

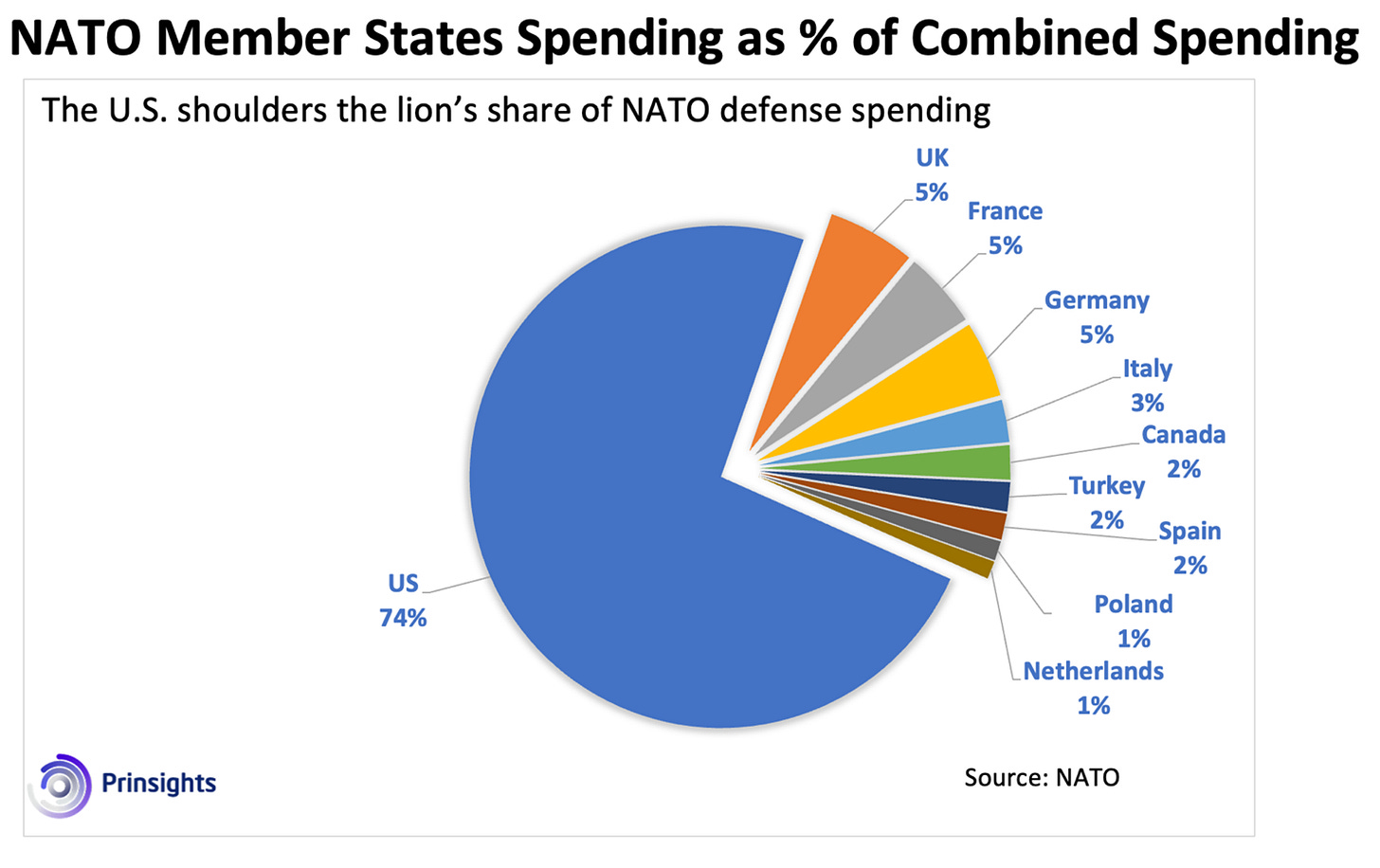

For decades, European governments gutted their defense budgets. Here’s a glimpse of the imbalance: the U.S. still accounts for roughly two-thirds of NATO’s total defense spending.

(Click on image to enlarge)

And why wouldn’t Europe underfund its military? War seemed like an exception. The U.S. was expected to keep the peace. European governments were happy to focus on roads, welfare, and climate policy – while mothballing tanks, outsourcing ammo production, and relying on diplomacy (backed by American firepower).

Now, consider this. In 2014, NATO set a formal guideline: each member should spend at least 2% of GDP on defense by 2024. Yet, back then, only three countries met the target (the U.S., UK, and Greece). By 2021, that number had risen to just nine.

But then something happened.

A Big Shift in Priorities

Donald Trump was the first major catalyst. Starting in 2017, he pushed NATO allies to “pay their fair share” – referring to that 2% spending benchmark. That pressure campaign rattled European leaders. But the real shock came later.

In 2022, Russia invaded Ukraine – a sovereign European country bordering multiple European Union (EU) members. The invasion didn’t just redraw borders – it redrew assumptions. Suddenly, the idea that “great powers don’t do that anymore” vanished overnight.

This jolted European policymakers into a new mindset: the postwar peace era was over. Europe needed to arm up – urgently.

French President Emmanuel Macron underscored this shift just weeks ago, declaring that Europe can no longer "live off the dividends of peace" and must build up its defense capabilities independently.

And he’s right – because the starting point is dire.

-

Germany, Europe’s largest economy, has fewer than 20,000 combat-ready troops.

-

The UK’s active-duty force has fallen below 75,000 – its smallest in centuries.

-

Ammunition reserves across NATO Europe? Enough for about a week of sustained combat.

But things are already changing.

The Great Repositioning Is Underway

In 2024, 23 NATO countries met the 2% GDP defense spending target. Again, that’s up from just nine a few years earlier. And keep in mind, this all happened before Donald Trump returned to the White House (which probably means the trend is only just beginning). Already, we’re seeing major moves on the ground:

-

Germany has committed over €100 billion (~$108 billion) to defense modernization, with a 2024 military budget of €71 billion (~$77 billion) – its largest since World War II.

-

Poland is now spending over 4% of GDP, the highest share in NATO.

-

France, Italy, and Spain are boosting defense spending by 10-20% per year.

-

The European Defense Fund is directing €8 billion (~$8.6 billion) into joint procurement from 2021–2027.

I’m a frequent visitor to Europe. In fact, as we shared, I just returned from a month of high-level meetings across the continent. I know perfectly well how divided the continent is on many issues – immigration, fiscal policy, energy, football teams. But on defense, there’s growing unity. Even left-wing parties, once skeptical of military spending, now see it as a matter of national survival.

Still, rebuilding will take time. Tanks take 2+ years to manufacture. Ammunition lines can't scale overnight. Training troops takes 6-12 months at minimum.

This isn’t just about 2025. It’s the start of a multi-decade rearmament cycle. And once these budgets are locked in, they’re unlikely to shrink – just like the Pentagon’s.

Washington, meanwhile, is quietly encouraging this trend. The U.S. has long wanted Europe to take more responsibility for its own defense. And now, Europe is finally listening.

Despite the headlines and occasional friction, this transatlantic division of labor doesn’t mean less cooperation – it just means Europe is becoming a more capable partner.

Now, U.S. defense firms are expanding across Europe to meet surging demand. Lockheed Martin (LMT) has opened new facilities in Poland and Romania, while Raytheon (RTX) has partnered with Germany’s Rheinmetall to ramp up munitions production. American contractors aren’t just supplying equipment – they’re embedding themselves into Europe’s defense infrastructure for the long haul.

Recognizing this trend doesn’t mean betting on war or favoring geopolitical tensions. It means understanding that deterrence is the foundation of peace – and that this new wave of defense investment is already reshaping the landscape. It can also support technological advancements that can, and very often do, help society as a whole.

More By This Author:

Beyond Big Tech: 3 Key Global Hedge Opportunities

What The Fed's Still Not Telling You

Why Now Is The Time For Uranium

Disclosure: None.