Beyond Big Tech: 3 Key Global Hedge Opportunities

Image Source: Pixabay

The financial optimism of recent years has all but vanished, leaving investors scrambling to reconsider their strategies in 2025’s volatile landscape.

While pockets of growth are emerging, uncertainty lingers — particularly over the direction of the U.S. economy and its once seemingly invincible technology sector.

For investors that have grown used to the steady upward climb of U.S. equities, especially the tech giants in the "Magnificent 7," this shift requires a sober evaluation of portfolio considerations and strategies. The time for complacency is over; the era of proactive hedging has arrived.

The Perfect Storm Brewing in the U.S.: A Volatile Cocktail

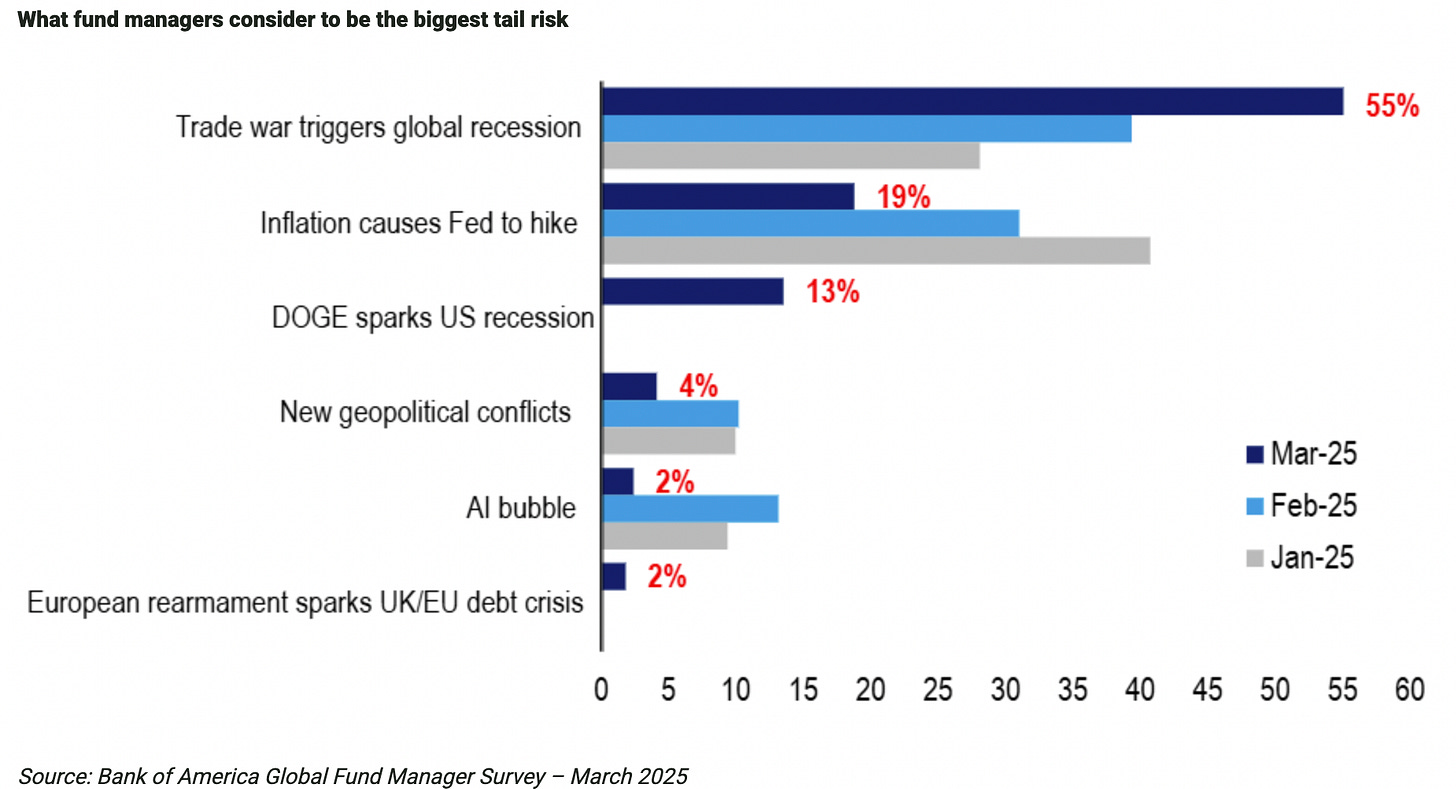

The U.S. economy is facing a complex web of challenges that are contributing to increased market volatility. On Wall Street, the latest Bank of America Global Fund Manager Survey recorded the second biggest monthly rise in macro pessimism on record while 63% of investors expect the global economy to weaken over the coming 12 months.

(Click on image to enlarge)

The BofA survey above shows that Wall Street considers a recessionary trade war the largest, growing risk. Regardless of political views, ignoring these headwinds can and likely will leave you at a disadvantage.

3 Key Factors Driving Volatility:

-

The Resurgence of Tariffs in Trump 2.0: Tension within the global trade landscape remain high. While outright trade wars may have cooled (for now), the underlying protectionist sentiments aren’t going away. The threat of new or increased tariffs, whether targeted at specific sectors or broader U.S. trading partners, looms large. For the wider economy, tariffs can serve as a direct tax on businesses and consumers – ultimately, leading to higher inflation, reduced earnings and harming global supply chains in post-Covid recovery. The market craves certainty. Uncertainty breeds volatility. That’s why trade policy shifts are triggering market fluctuations on a moment-by-moment basis. As investors attempt to anticipate the next move and policy impacts on various sectors, that unpredictability makes it difficult to accurately forecast future earnings while also adding layers of risk.

-

Geopolitical Uncertainty on the Rise: The global stage is increasingly characterized by instability and conflict. From ongoing regional tensions in the Middle East, South China Sea and Eastern Europe to the rise of new global power dynamics, geopolitical uncertainty is a new certainty. These dynamic events, while for many seem to be in a distant locale, can have real and immediate impacts on financial markets. As we saw with the war in Ukraine, supply chain disruptions, commodity price spikes (particularly in energy and food), and shifts in investor sentiment can go from a global issue to a local one. The interconnectedness with the global economy means that even regionally-confined conflicts can (and do) have far-reaching consequences for investments. The inability to predict events and their outcomes underscores the need for strategies that can weather unexpected storms.

-

The Whispers (and Increasingly Louder Calls) of Recession: While economists and the financial media continue to debate the timing and severity, concerns over a potential recession in the U.S. are growing. Persistent inflation (despite recent moderation), tightened monetary policy by the Federal Reserve, and slowing growth in pockets of the economy are all factors fueling the fire. The truth is that a recession, even a mild one, can (and will) have a significant impact on corporate growth, consumer spending trends and general market sentiment. The “vibecession” may become a recession. That’s because what looks good from 30,000 feet away, doesn’t pay all the grocery bills when you’re up close. The reality is that equity markets typically experience significant downturns during recessionary periods.

The Mundane Magnificent 7's Performance Should Be A Wake-Up Call

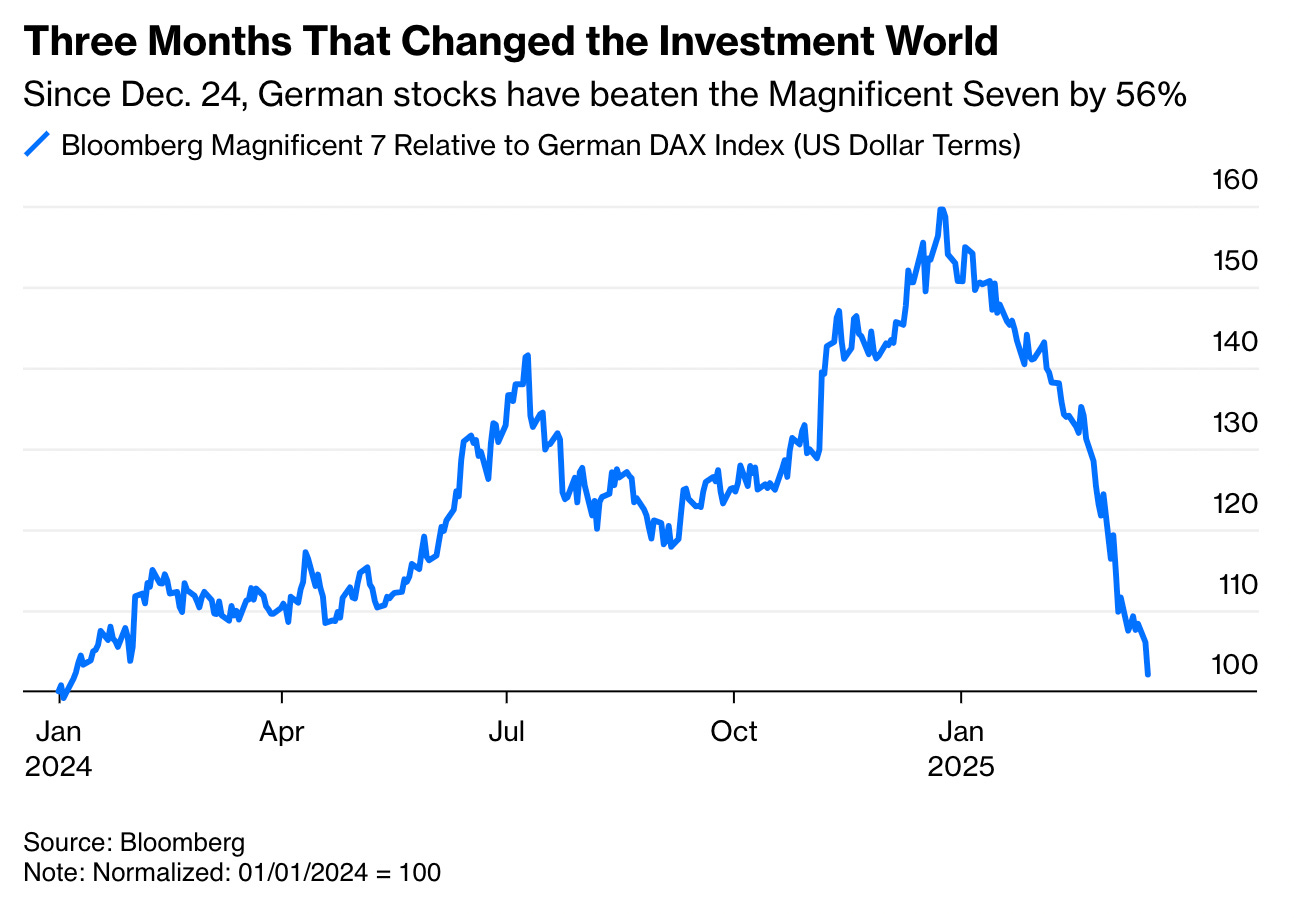

For years, the “talk on the Street” of U.S. tech dominance has been a powerful driver of investment decisions. The "Magnificent 7" – a group of mega-cap technology companies – have delivered exceptional returns over the last several years. Their growth led many to believe that these stocks were virtually immune to global economic trouble. In many ways, it separated the U.S. financial markets from their peers. That trend is quickly changing.

The combined return of the Magnificent 7 since the start of 2024 has been equivalent to that of the German DAX index. This is a departure from the outperformance that investors have come to expect. While some companies within the group may have outperformed others, the overall performance suggests that the era of unquestioned U.S. tech supremacy may be slowing – at least for now.

Beyond the American Horizon: Exploring International Opportunities

The relative underperformance of the Magnificent 7 highlights a crucial point. The global landscape is vast and offers opportunities to strategically diversify your portfolio beyond focusing solely on Silicon Valley tech stocks or U.S. market risks.

Three themes to watch over the long term include:

-

China's Resurgence: After a period of financial recalibration, China's economy is showing signs of renewed strength. While material challenges remain, the sheer size and growth potential of the Chinese market should not be ignored. Certain sectors, such as renewable energy, electric vehicles, and metals, are poised for significant growth. By watching select Chinese companies or funds, opportunities can offer diversification and access to a re-emerging market.

-

The European Union's Quiet Strength: Often overlooked in favor of the U.S. tech sector, the European Union represents a relatively stable and diverse economic bloc. As we relayed with on-the-ground analysis from Spain, Austria and Switzerland many European companies are global leaders in their respective industries, ranging from financial outlets to revolutionary tech products. European equities can offer exposure to a more value-oriented market with potentially lower valuations compared to their U.S. counterparts.

-

The Untapped Potential of Emerging Markets: Beyond China, the broader emerging market landscape offers a variety of opportunities. These markets, often seen for higher growth potential (combined with often with higher volatility), can be a great diversification opportunity for investors. Countries in Southeast Asia and Latin America are experiencing significant economic development and could offer strategic investments. As always, understanding the sector, implicit and explicit volatility and the geopolitical landscape will be crucial.

Countries to Watch for Hedging

Certain markets offer compelling U.S. alternatives for potential hedging and upside. These alternatives can work toward offseting potential volatility and losses in U.S. markets during periods of volatility.

-

The United Kingdom: A Value Proposition with Global Reach: As we shared earlier this month, the UK is well prepared and continues to position itself for any trade war ramifications. The market has also been overlooked in recent years, partly due to Brexit-related uncertainties. However, this has also created potential opportunity. Many UK-listed companies are multinational corporations with significant global revenue streams, making them less reliant on the domestic UK economy. The relatively lower valuation of UK equities compared to their U.S. counterparts, coupled with attractive dividend yields, makes the UK an interesting market to consider.

-

Japan: A Sleeping Giant Awakening? For decades, the Japanese economy has been characterized by low growth and deflation. That seems to be changing. Recent policy shifts and a solid relationship with Trump 1.0 contribute to reasons for optimism during Trump 2.0. The Tokyo Stock Exchange offers exposure to leading companies in sectors like automobiles and tech, that are currently immune to tariffs. Now, to be clear, challenges still remain in Japan. But the potential for sustained economic growth in Japan, coupled with its position as a diversifying outlet to U.S. market uncertainties, makes it a compelling area to watch for hedging.

-

Australia: Riding the Commodity Wave and Regional Stability: Australia's economy is heavily influenced by its vast natural resources as we’ve shared with readers. Its strong trading relationships with Asia, particularly China, also give it a diversified trading group. This makes Australia a potential beneficiary of global demand for commodities. Australia's relatively stable political and economic environment, coupled with its geographic distance from major geopolitical hotspots, provides a great degree of insulation.

Prinsights Pulse Premium readers, be sure to check out this video exclusive from the UK Parliament that details five key companies we’re actively monitoring right now.

The Time to Embrace Strategic Diversification is Now

The investment landscape is constantly evolving. What I learned from my years on Wall Street is that holding on to past strategies and expecting the same results won’t get you very far. It’s key to consider shifting dynamics. Now, with U.S. market volatility, coupled with a potential longer-term slump in the once-dominant Magnificent 7, the need to consider hedging and having new strategies is vital.

By looking beyond the familiar shores of U.S. tech stocks and exploring opportunities in international markets – both for growth and as potential hedges – it’s possible to build a more resilient and diversified portfolio. Don't wait for the storm to fully break before seeking shelter. Now is the time to proactively assess your exposure and take steps to mitigate potential risks – all while simultaneously seeking out new avenues for growth.

More By This Author:

What The Fed's Still Not Telling You

Why Now Is The Time For Uranium

Follow The Central Bank Money Signs, Not The Tariff Whiplash

Disclosure: None.