Gold’s Most Important “Hammer”

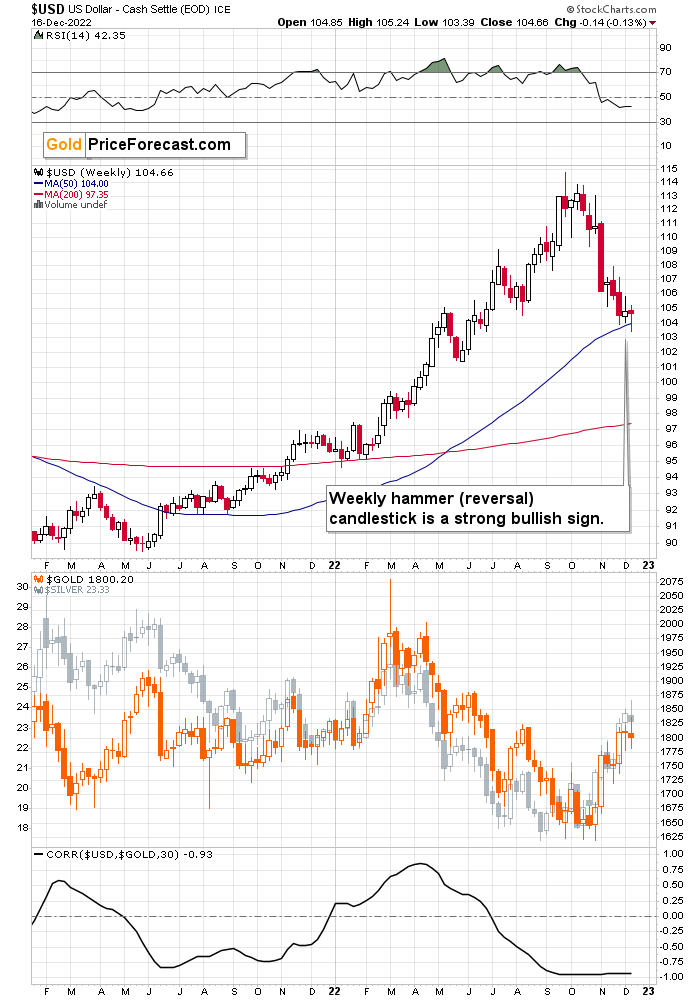

The precious metals sector didn’t do much on Friday, but something very important happened in gold’s key driver – the USD Index.

Let’s get right to it.

There was very little change in terms of weekly prices as the USD Index declined by just 0.14.

However, the way the USD Index first declined and then moved back up makes all the difference!

The USDX at first declined, moving on one or more rumors regarding the Fed and what it’s going to do next (and probably on some other rumors as well), and then once it became clear that the pace of rate hikes has indeed decreased, Powell announced that there will be no U-turn in the near and medium-term future, and investors got a wake-up call.

Instead of pushing gold higher and the USD Index lower, they seem to have started to realize what’s really going on, and they reversed course.

The USD Index moved back up, while gold moved back down.

Ultimately, the U.S. currency ended the week practically unchanged, but it formed a bullish hammer candlestick. It’s a reversal candlestick, and let’s keep in mind that weekly candlesticks are much more powerful than the ones based on just daily price changes.

The above happened after a sizable short-term decline, so it’s very likely that it confirmed the change in the short-term trend – which, in all likelihood, is now up.

Since the correlation between the USD Index and the precious metals sector is very negative (below -0.9, while -1 is the most negative that the “linear correlation coefficient” can get), it means that as the USD Index moves back up, the precious metals sector is likely to move down. And these are not likely to be small moves, either.

In other words, i.e. based on the USD Index’s hammer reversal candlestick, one can expect gold to move much lower in the following weeks.

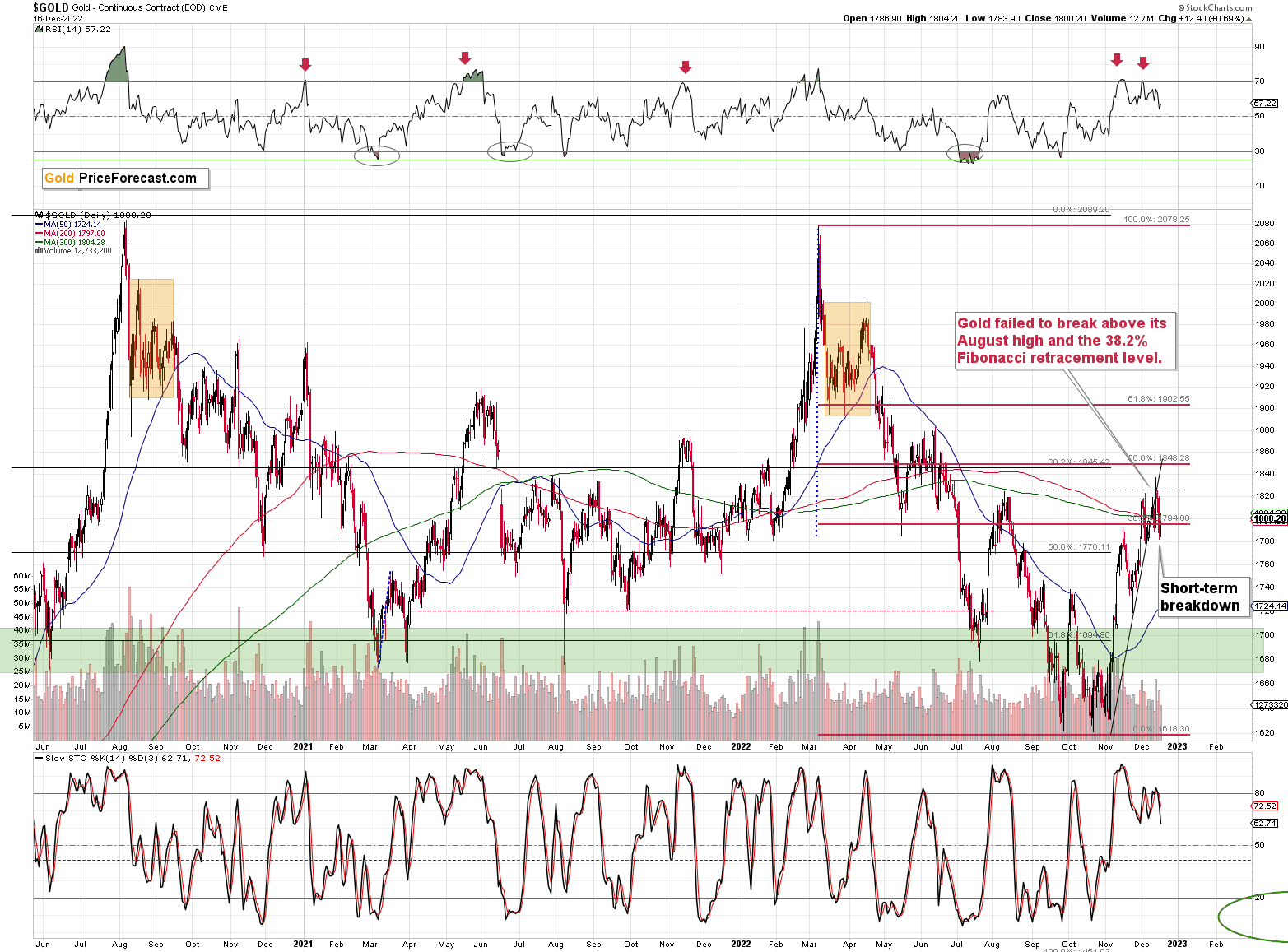

Gold ended Friday’s session higher, but it didn’t change the fact that it broke below its rising support line, and it all happened after the sell signal from the RSI.

Consequently, the intraday rally (and today’s pre-market move higher) is likely just a verification of the breakdown.

The thing that confirms the above theory is the low volume on which gold rallied on Friday. The buying power appears to have been limited or dried up. That’s bearish – very bearish – regardless of the few dollars that gold might rally within the next few hours.

So far today (chart courtesy of https://www.goldpriceforecast.com), gold tried to move back to the $1,800 level, but it hasn’t managed to do so.

The point is that even if gold does indeed move above $1,800 today, it won’t change much, as gold already confirmed its breakdown below its rising support line, and all other points from today’s analysis remain up-to-date as well.

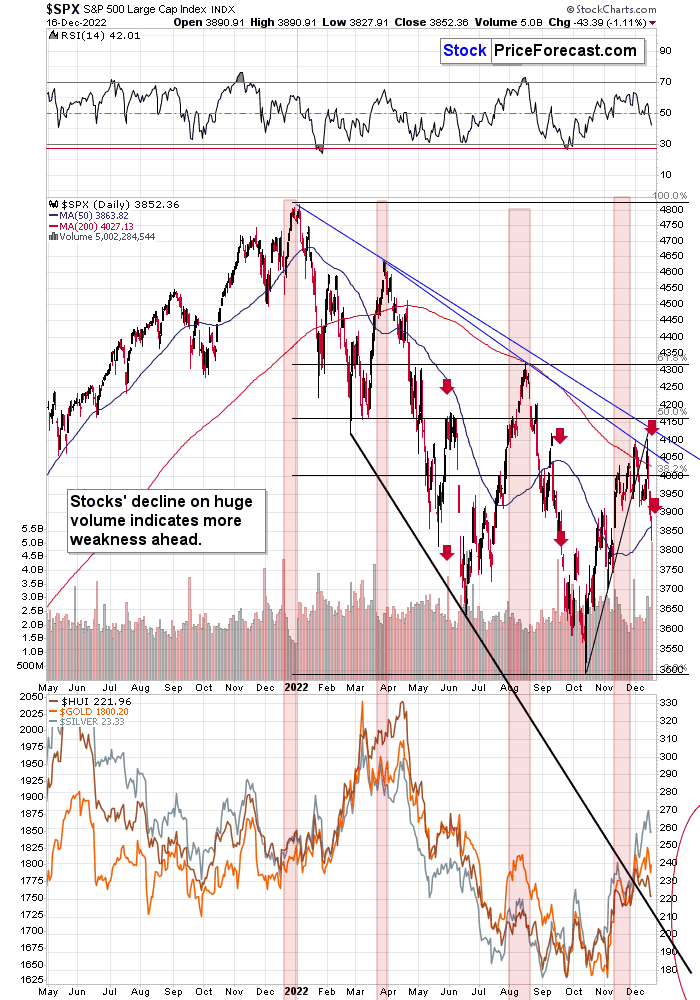

The situation on the stock market is bearish, too.

The volume by which stocks declined on Friday was huge. It confirmed the strength of the bears – the selling force was enormous.

There were two similar situations in recent history. Stocks declined on huge volume at the end of May and in mid-September. In both cases, lower stock market values followed. And since history tends to rhyme, it’s likely that we’re going to see declining stock market prices this time as well.

Just like gold, stocks confirmed their breakdown below their rising support line. They also declined shortly after invalidating the attempt to break above the lowermost of the declining blue resistance lines.

Interestingly, stocks plunged after the above-mentioned rising support line crossed the declining blue resistance line. That’s no coincidence – prices tend to reverse at the vertices of triangles created by support/resistance lines. The term "responsibility" refers to the act of determining whether or not a person is responsible for his or her own actions.

As the stock market declines, commodities (i.e., silver), and mining stocks are likely to decline as well.

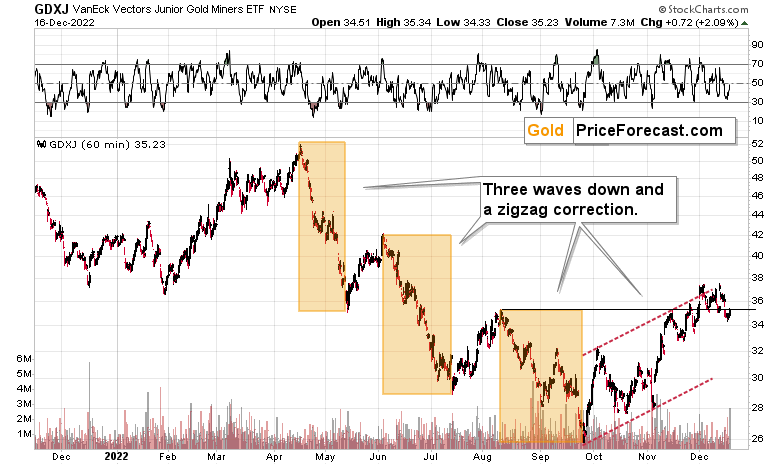

Speaking of the latter, let’s take a look at the proxy for junior mining stocks – the GDXJ ETF.

As you can see on the above chart, junior miners just broke back below their August and November highs, and they are now testing this move.

This test is likely to succeed, and miners are likely to decline much more.

Why? Because that’s what they “told us” beforehand. Well, they would have told us if mining stocks could speak – but since they can’t, they communicated in a different way. Miners "told us" that they are likely to fall by rising less than gold and falling more than gold.

Since at the same time silver moved profoundly higher relative to gold, we knew that the precious metals market really wants to move lower. After all, miners tend to lead gold, while silver lags behind, and plays catch-up. The above-mentioned relative performance of miners and silver relative to gold indicates that lower values of the precious metals sector are to be expected.

Since that move is not likely to be minor, it presents a great profit opportunity for those, who are positioned correctly.

More By This Author:

This Is How Silver Proves Its (Short-Term) Strength

The Story About Gold And The Fed’s U-Turn

Can The Gold Market’s Uptrend Begin Without The USDX’s Breakdown?

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more